Highlights

- Solana’s price surged 43% in a week, hitting a two-year high of $225, boosted by Bitcoin’s record rally.

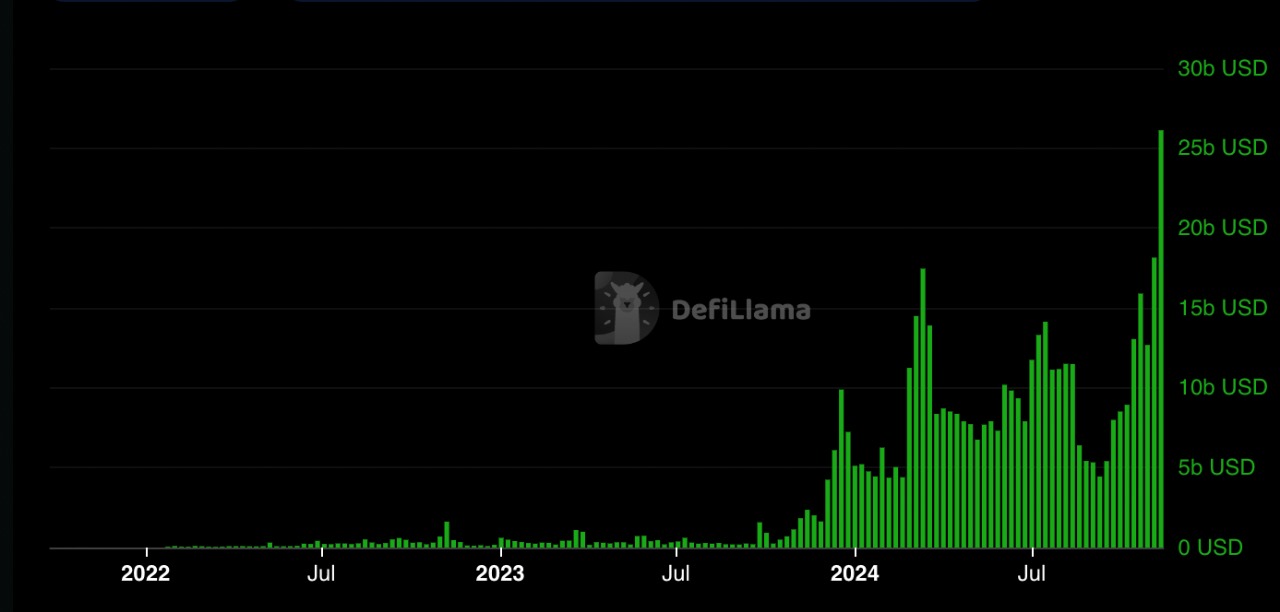

- Solana’s DEX volumes hit $26.1 billion, surpassing Ethereum, while its TVL rose 460% to $7.9 billion this year.

- Open interest in SOL futures reached $4.54 billion, reflecting strong institutional confidence but higher liquidation risks.

The Solana price has surged 5% in the last 24 hours to trade at $207 as of 1:30 a.m. EST on a 30% drop in trading volume to $9 billion. The market capitalization now stands at $87 billion.

The price of Solana rallied from $156 on Nov. 5 to a two-year high of $225 on Nov. 12-a 43% gain that has sent traders optimistic about reaching its all-time high of $260. This rally has happened in correlation with the general cryptocurrency market after Bitcoin surged to a new peak of $93,434.

Strong on-chain metrics underpin Solana’s trend, such as an uptick in DEXs and a rising Total Value Locked within its ecosystem. Solana’s total DEX volumes reached an ATH of $26.1 billion on November 11 for the week, capturing 37% market share above Ethereum.

Further, the total value locked in smart contracts that functionally execute instructions on Solana increased to $7.9 billion by Nov. 13. This is a whopping growth of 460% year-to-date, boosted by leading DApps such as Jito, Raydium, and Marinade.

With the rise in Solana price, open interest in SOL futures reached an all-time high of $4.54 billion on Nov. 12, reflecting deep institutional interest. Adding leverage may fuel SOL’s upward spree, but it also carries the risk of forced liquidations if prices drop. Overall, these metrics indicate solid backing that is probable for SOL’s upward trajectory. This is because larger on-chain activity and rising interest in derivatives are a sign of further upside, even as this growth comes with increased risks.

Solana Statistics

- Solana price: $207

- Market capitalization: $97 billion

- Trading volume: $9 billion

- Circulating supply: 471 million

- Total supply: 588 million

Solana Price Signals a Bullish Reversal Above the Bullish Channel

The price of Solana (SOL) shows a strong uptrend with key technical indicators supporting a bullish outlook. Currently, the price is around $208.72, down slightly by 0.41%. The price has been moving within an ascending channel, indicating steady upward momentum. A support level around the $200 mark has been identified, which may serve as a foundation if the price sees a pullback.

As long as SOL maintains this support, the bullish trend remains intact. Additionally, SOL’s price is well above the 50-day Moving Average (around $167.16) and the 200-day Moving Average (around $154.47), which supports the upward trend. The 50-day MA crossing above the 200-day MA, known as a “golden cross,” further strengthens this outlook.

Bullish Technicals Indicate a Slight Pullback

The MACD indicator also supports a bullish scenario. The MACD line is above the signal line, with a current reading of 2.11, indicating increasing buying momentum. Positive histogram bars suggest that this momentum is still strengthening, though the levels are not yet excessive, meaning there could still be more room for growth.

Meanwhile, the RSI sits at 65.12, approaching the overbought threshold of 70. This implies the potential for further price increases, though caution may be needed if the RSI edges closer to 70, as that would suggest overbought conditions. Given these indicators and the channel’s trend, the Solana price has more room for upside, potentially targeting the $240 level or higher as long as it holds above $200.

If SOL can maintain support above $200, the next upside target would likely be around $240, as indicated by the channel’s upper boundary and recent price momentum. Should this resistance be broken, SOL could aim for higher levels, potentially reaching $260 or even $280 if the buying pressure continues.

However, the RSI at 65.12 suggests that the asset is nearing overbought conditions, meaning that while the price has room to grow, traders should watch for any signs of exhaustion near the $240 level.