Highlights:

- The Solana price has surged 6.5% to $191, with a 14% weekly gain and a 34% monthly rise.

- Most Solana holders purchased below $189, indicating minimal resistance and potential for further gains.

- The SOL rounding bottom pattern and bullish technicals indicate more upside potential.

The Solana price boasts a splendid bullish momentum, surging about 6.5% to $191 in the past 24 hours. The bulls are showing intense hype, as the trading volume is up 68%, indicating heightened market activity. Moreover, the SOL token is now up 14% over the past week and 34% over the past month. On the other hand, Solana’s market cap has surpassed $100 billion to $103 billion.

JUST IN: Solana $SOL surpasses $100 billion market cap. pic.twitter.com/ZliRJc5ifk

— Watcher.Guru (@WatcherGuru) July 21, 2025

The key technical indicators support the current price rally in Solana, indicating that the rally can continue to higher levels. According to popular analysts, Ali Martinez’s analysis suggests that there may be less resistance on the way to Solana after breaking above the $189 point. The graph shows that the UTXO Realized Price Distribution (URPD) of Solana is highly concentrated below $189, indicating that most holders bought at lower prices. When the price climbs beyond these levels, price discovery becomes possible, followed by the potential for accruing additional gains.

Once Solana $SOL breaks above $189, there’s little standing in the way of a continued rally. pic.twitter.com/IOwvdPMMJ7

— Ali (@ali_charts) July 21, 2025

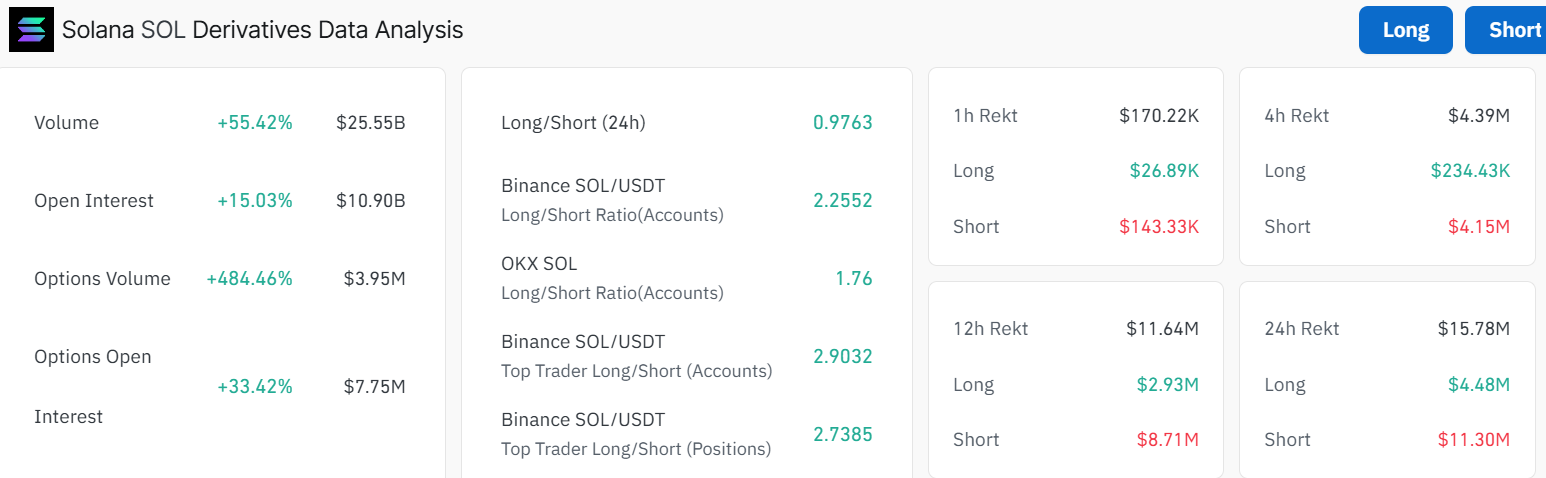

Additionally, the data presented on the derivatives market in the Solana Derivatives Data Analysis shows that the market is highly active. This is evident as the volume increased by 55.42% and open interest rose by 15.03%, which is one of the indicators of growing investor confidence.

Particularly, the volume of options has increased by more than 484%, with increased speculative attention on the price of Solana. Another factor indicating the presence of bullish momentum driving the market trend is the prevalence of long positions over short positions, illustrating a balanced market mood as indicated by the long/short ratio analysis.

Solana Price Poised for Further Upside Above Rounding Bottom Pattern

The Solana price has formed a rounding bottom pattern, often signalling further upside in the market. Moreover, the bulls have put their best foot at the front, showing the bears total dust. The immediate support zones currently align with the 50-day ($154) and the 200-day ($164) moving averages. This tilts the odds in favour of the bulls, signalling further upward movement if the support zones hold.

Other technical indicators, such as the Relative Strength Index (RSI), support a bullish sentiment, currently reading 77.75. Its position above the 70-level cautions traders of a potential retracement, as this position indicates overbought conditions.

On the other hand, the MACD indicator has crossed above the orange signal line, upholding a positive buy signal. Traders are at liberty to buy more SOL tokens, unless the trend changes.

Is It Too Late to Buy SOL?

If the bulls hold the neckline support around $180, solana price could rally toward $246 (a 28% jump) in the next few weeks. However, a drop below the neckline might signal a pullback, potentially testing the $176 level.

Is it too late to buy now? Not quite. The 14% weekly gain shows strong levels of hype, likely fueled by Solana blockchain adoption in various dApps. Meanwhile, with the RSI roaming around the overbought territory, early profiteering may kick in. Traders with a higher risk appetite may consider scaling in near the $163 support level. Cautious traders might want to wait for a dip or confirmation above $200.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.