Highlights:

- The Solana price is eyeing new levels, having soared to $234, a 2% increase.

- SOL DeFi TVL and derivatives market indicate a positive sentiment.

- Its technical outlook suggests that a break above $250 could trigger a rally to $303.

The Solana price is showing strength as it eyes new levels, currently up $2% to $235. Solana’s growth and expansions have continued to strengthen its position in the blockchain space. One of the main highlights is Solana’s subsidiary, Helius, announcing its major purchase of additional SOL tokens. The company’s digital asset treasury strategy now has more than 2.2 million SOL in its treasury. After acquiring the new stake, the total holdings of SOL and cash have reached $525 million.

🚨NEW: Solana Company (NASDAQ:HSDT) has bought additional $SOL and now holds over 2.2M $SOL as part of its digital asset treasury strategy. The company also holds over $15M in cash, bringing combined $SOL and cash holdings to $525M. pic.twitter.com/ZvUDF2X9ho

— SolanaFloor (@SolanaFloor) October 6, 2025

The strategic move comes when Solana’s blockchain is witnessing a consistent surge in activity, thanks to an increasing number of users. Solana’s recent purchase of SOL reinforces its long-term commitment to its native token and the ecosystem built on the Solana blockchain. Helius’ ongoing investment in Solana demonstrates the company’s continued confidence in the network.

Solana DeFi TVL and Derivatives Market Outlook

Solana’s market performance has been showing strong signs of growth. The total value locked (TVL) of DeFi projects on the Solana blockchain has steadily increased in the last data update. It stands at $12.896 billion, representing a 2.35% increase over the last 24 hours. The jump in TVL indicates Solana’s growth in the decentralized finance space, as Solana’s blockchain underpins numerous DeFi applications.

Moreover, Solana’s daily chain revenue of $158,188 is increasing as demand for these network services grows, lifting SOL’s price. Solana’s ecosystem with token incentives and app revenue is on a solid footing for further developer and user adoption.

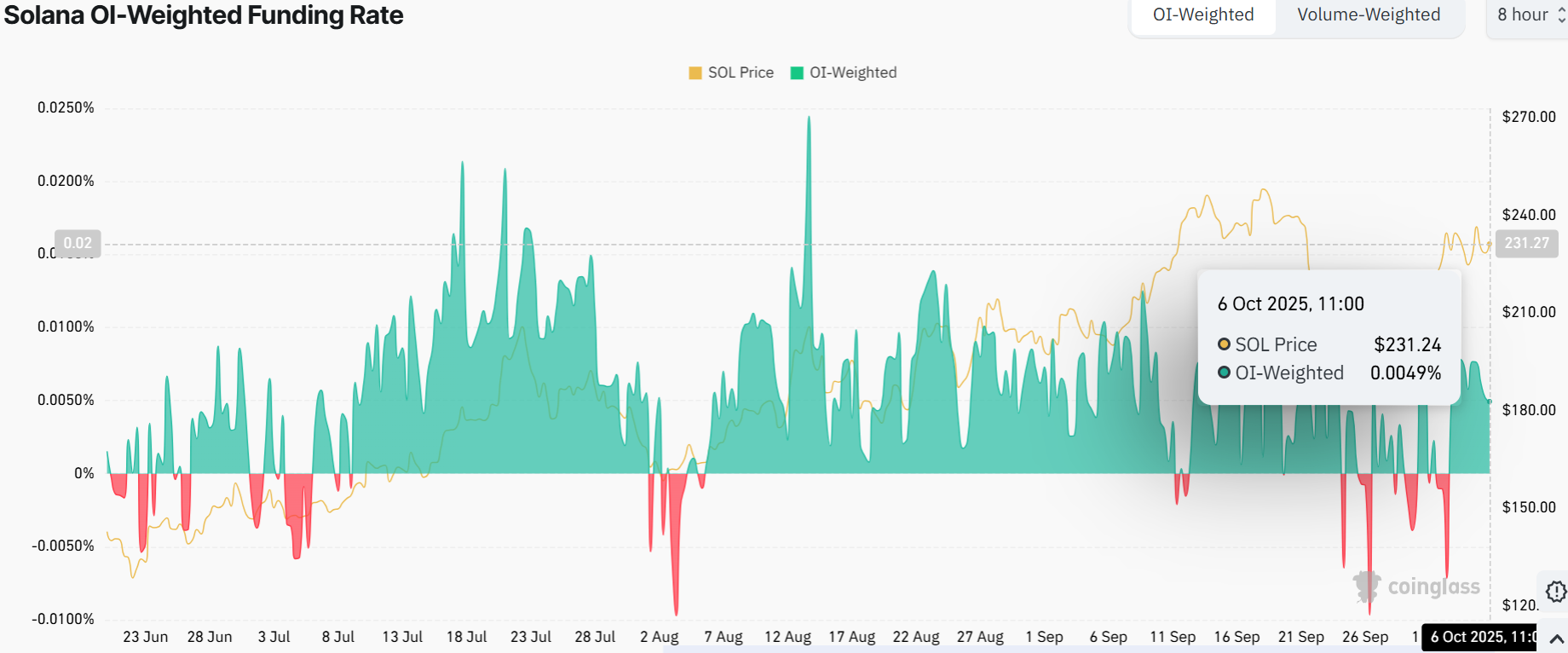

Notably, the SOL OI-Weighted fund rose to a positive rate recorded 0.0049% on Monday, indicating that longs are paying shorts. According to the chart below, Solana’s price has rallied sharply whenever the funding rates have flipped from negative to positive in the past.

Solana Price Outlook: A Break Above $250 Could Stir a Rally to $303

The SOL/USD chart shows the asset trading at $234, up 2% over the 24 hours, despite a notable 0.78% decrease in volume. The 50 Simple Moving Average (SMA) on the 1-day chart sits at $214, and the 200-day SMA at $170, both acting as solid support levels. Solana’s price is riding above those two SMAs, which signals bullish momentum. Moreover, the rising channel indicates growing bullish momentum in the SOL market.

The Relative Strength Index (RSI) at 58.06 is hovering just below overbought territory, indicating room to run before a potential pullback. The Moving Average Convergence Divergence (MACD) is also looking bullish, as the MACD line (blue) is surging above the signal line, indicating further upside potential.

Looking ahead, the Solana price action shows a classic rising channel forming, with firm support zones. Meanwhile, a break above $250 is a green light for further gains. If SOL bulls continue their campaign, the price may surge to $303. However, if bears crash the party, the Solana price could retrace back to $226 or $214.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.