Highlights:

- Solana price is making headlines, as it soars 5%, with the crypto market showing signs of life.

- Solana signals a bullish Q4 as 98% of validators approve the Alpenglow upgrade.

- Bullish technical indicators signal a rally above $250 if SOL overcomes $220 key zone.

The crypto market is showing signs of life, with Solana price surging 5% to $211. The daily trading volume has spiked 47% to $9.16 billion, showing growing investor confidence. Over the past few years, Solana has taken a series of headline-making choices that are transforming the blockchain landscape. Recently, the introduction of a new protocol, the Alpenglow Consensus Protocol, is a plus that will have a positive effect on the overall performance of Solana in terms of latency, scalability, and rewards.

SOLANA JUST WENT GOD MODE 🔥

98%+ of validators approved Alpenglow, the biggest upgrade in $SOL history.

Latency: 12s → 100ms

100x scalability boost

Cleaner consensus, bigger rewardsThis isn’t an update… it’s a whole new chain. pic.twitter.com/ti7qyhNpAF

— Kyledoops (@kyledoops) September 3, 2025

In conjunction with this, the liquid staking ecosystem and market activity of Solana have been gaining traction.

Alpenglow Upgrade: A Brand New Chain on Solana

Solana has just signed the Alpenglow Consensus Protocol, which is one of the most significant updates in its history. The upgrade is sure to improve the performance of the Solana blockchain by a large margin, with 98% of the validators supporting this protocol. The previous 12 seconds of latency have been reduced to just 100 milliseconds, making transaction speeds quicker.

Solana is also experiencing incredible growth in its liquid staking ecosystem. Currently, it reflects the all-time high of 57 million SOL staked in Liquid Staking Tokens (LSTs). This figure is a significant 13.65% of the total SOL bonded to the network. The liquid staking market is growing rapidly, which is also part of a larger trend of making staking easier and more flexible.

📊Report: @Solana’s liquid staking ecosystem continues to expand as $SOL staked in LSTs hit a new all-time high of 57M $SOL, which is 13.65% of the total 418M SOL staked on the network. pic.twitter.com/ZS7YdEleDF

— SolanaFloor (@SolanaFloor) September 3, 2025

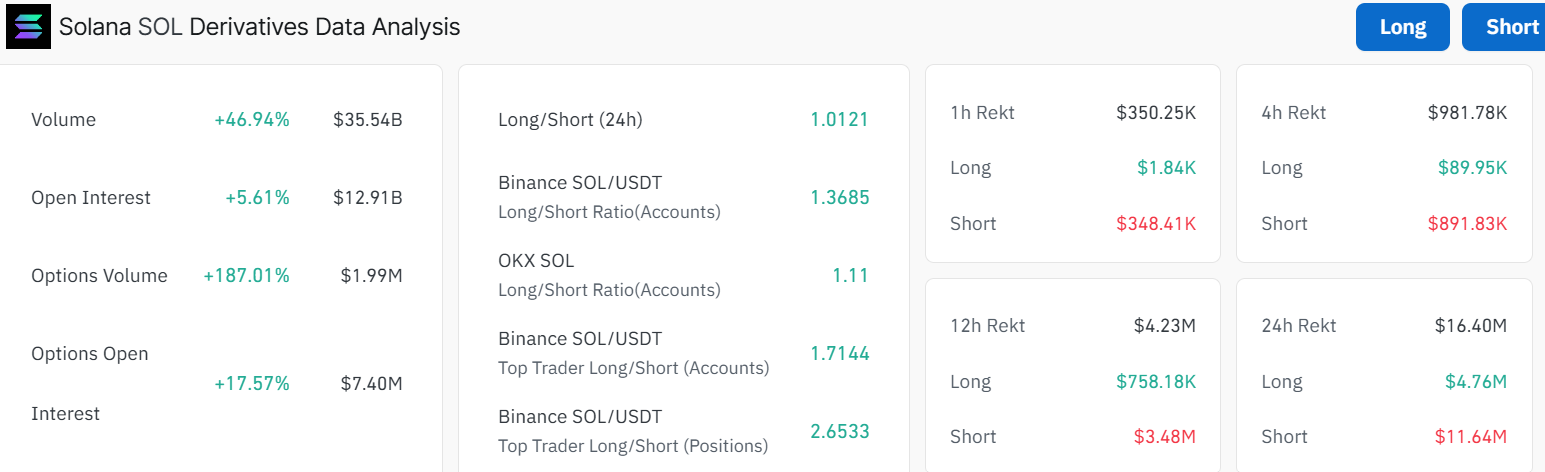

With the LST market cap almost doubling, this increase is a positive indication that more people are becoming confident in using the Solana staking. Along with liquid staking, the Solana derivatives market is also exploding, as its volume has increased by 46.94%, and the open interest has grown by 5.61%The Solana options market has also risen by more than 187%, meaning that more traders are coming into the market with high exposure to the price volatility of SOL. The large volume and increasing open interest signal that traders are gaining greater confidence in the future potential of the asset.

Notably, the long/short ratio of Solana has surpassed 1 to 1.0121, painting a bold bullish picture. The alt is positioning itself as an attractive asset to both traders and investors as the market grows deeper and more liquid.

Solana Price Suggests Potential Upside

Solana price has shown a steady upward trend in the daily chart, as bulls have the upper hand. According to the most recent data, the price of SOL is around $210, floating above key moving averages, which further strengthens the bullish outlook.

The technical indicators further show bullish strength, as the RSI stands at 58.98. This tells us that the SOL price is in a strong buying zone and may surge further. If bullish momentum continues and Solana price breaks above $220, a rally towards $250 could be imminent this September. A close above this level will open the doors for further upside, potentially $300. On the downside, if the $196 support fails, SOL may face selling pressure that could send it back toward the $186 (50-day SMA), which has acted as a longer-term base of support.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.