Highlights:

- SOL has plunged 8% in the past week to a multi-month low of $124.

- Solana’s revenue has dropped 93% from its January peak due to declining memecoin activity.

- DeFi TVL on Solana has plunged nearly 50%, reflecting lower on-chain engagement.

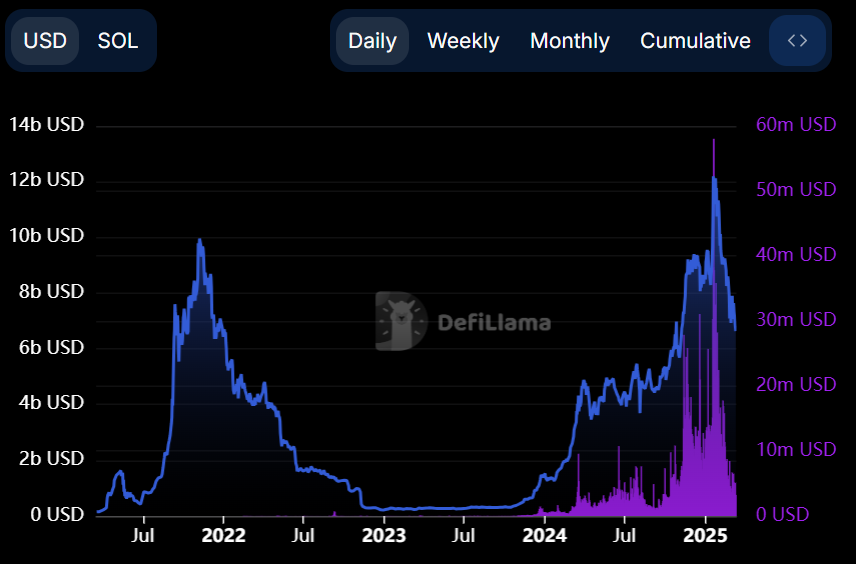

The Solana price has plunged 8% in the past 7 days to a multi-month low of $124, struggling amid bearish market sentiment. The weekly Solana network’s revenue shows it saw its highest-ever record in January, with $55 million. This, however, has been lowered by almost 93% since then, as Solana blockchain’s past week’s revenue plunged to $4 million.

This trend is in relation to Solana’s revenue statistics, as Solana’s decentralized application revenue has fallen, reaching $32 million in the past week. This marks an 86% decrease, with $238 million in revenue in January.

The Total Value Locked (TVL) on Solana currently stands at $6.4 billion. Solana’s total value locked (TVL) has dropped by half from its January all-time high of approximately $12 billion. The total memecoin interest drop during the past two months resulted in this general market downturn.

According to a VanEck report, Solana generates 80% of its revenue through the Pump.fun meme coins. In the last days of January, the Pump.fun platform’s revenue hit $15 million daily. The remittance industry saw its value decrease by 95% to $800,000 following the decline in the popularity of memecoin.

Solana Price Outlook

The Solana price 3-hour chart shows a downtrend channel, with the price currently trading near the lower boundary of the descending channel. The 50-day MA shows a looming sell signal below the 200-day MA. Meanwhile, the price attempts to recover but remains below both moving averages, suggesting that sellers still have control.

At the current level of $124.34, SOL is showing signs of a potential short-term rebound, but the structure remains bearish. If the price successfully breaks above the 200-day MA at $183.83 and holds, it could signal a bullish reversal, with the next resistance sitting at $186.22, aligning with the 50-day MA. However, failure to reclaim this moving average may result in a continued downward movement, possibly retesting the lower channel boundary near $117 before reaching the key supports at $113, $110, and $99.

Can SOL Rebound Above Moving Averages?

Solana’s price shows encouraging signs of recovery, with technical indicators hinting at a potential move toward the $150 barrier. The bearish momentum on the RSI, coupled with a slight price increase, suggests that sellers could be losing control.

However, with the broader crypto market lacking a strong uptrend, Solana will need sustained buying pressure to break through resistance levels. A steady climb with increasing volume could set the stage for Solana’s price to the $186 mark, though a lack of momentum may lead to consolidation before any significant move.

On the other hand, if $117 fails to hold as support, SOL could experience further downside pressure, potentially leading to a broader downtrend. This would invalidate the current upward trajectory and open the door for more bearish movement toward the critical supports at $109. Traders should watch for volume spikes and price action signals around the support zone to confirm a potential reversal or breakdown.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.