Highlights:

- Solana’s price soars 2% to $221 as trading volume pumps.

- Demand for Solana is also rising in the derivatives segment as Open Interest soars 1.65% to $5.41 B.

- Crypto analyst predicts that Solana could reach $300 level soon, if the $220 resistance is broken.

The Solana price has skyrocketed 2% to trade at $221, as its daily trading volume shot up 33% to $5.1 billion. The price has experienced a strong rally, gaining approximately 205% over the past year and 2% in the last week, signaling increasing interest and momentum in the Solana ecosystem.

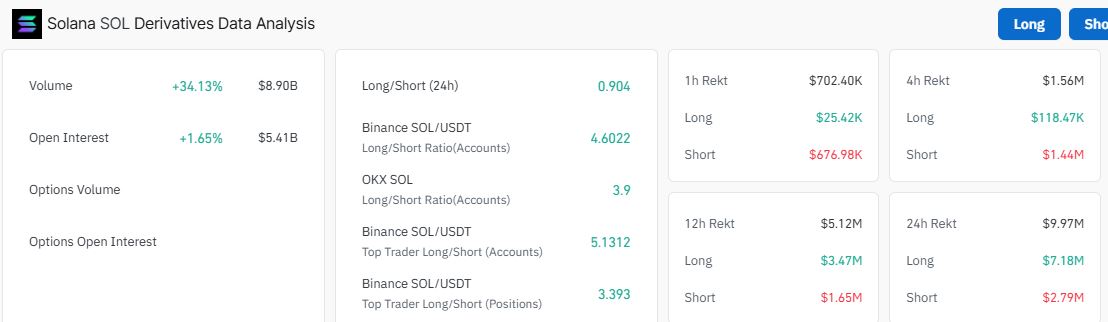

Meanwhile, demand for Solana is also on the rise in the derivatives segment. For context, the level of open interest soared 1.65% to $5.41 billion in the last 24 hours at press time, and its volume has also skyrocketed 34% to $8.90 billion. This shows that new money could be flowing into the Solana market, which could lead to a rally in the coming days.

The above data suggests that more traders have switched to the bullish camp—indicating surging bullish optimism.

Elsewhere, crypto analyst Andrew has noted that Solana this year mirrors ETH back in 2021. This is because the Best Layer-1 Blockchain is Highly Adopted, Fast, Cheap, and easy to use. He predicted that after Solana broke the $220 resistance, it could reach the $300 level soon.

#SOL In my opinion SOLANA this year is the same ETH back in 2021 !

Best Layer-1 Blockchain Highly Adopted , Fast ! Cheap and easy to use and develope !

Technically it is breaking a heavy resistance level at $220 after a break it can reach to $300 sooner than you think !

Wait… pic.twitter.com/tJKpoE9g9Q— Andrew Griffiths (@AndrewGriUK) December 17, 2024

Solana Statistical Data

Based on CoinmarketCap data:

- SOL price now – $221

- Trading volume (24h) – $5.1 billion

- Market cap – $106.32 billion

- Total supply –590.39 million

- Circulating supply – 479.25 million

- SOL ranking – #5

The price of Solana has undergone a significant correction, from $264 to $221, a 16% increase. Meanwhile, the Solana altcoin trades well within a descending triangle.

Looking into the technical outlook, the bulls have flipped the $217 resistance into the support floor, paving the way for further gains. Moreover, the $166 support level, coinciding with the 200-day SMA, tilts the odds in favor of the bulls. This suggests that the bulls are ready to take control, potentially rallying the price to $248.

The RSI has climbed to 47.99, slightly below the 50-mean level. Increased buying appetite at this level will see rising momentum, causing the SOL token to soar. Further, there is still more room for the upside before SOL is considered overbought.

On the other side of the fence, the Moving Average Convergence Divergence (MACD) introduces a new bearish outlook. This is manifested as the MACD hints at a sell signal as it crosses below the orange signal line. Similarly, the MACD histograms are fading, a sign of waning bullish sentiment.

Solana Price Outlook

The Solana price is showing mixed reactions to the daily chart timeframe; however, the odds tend to lean towards the upper side. If the $217 support level holds, bulls could seize the opportunity to push the Solana price to $264. In a highly bullish case, the gains could extrapolate to record a new range high of $300.

Conversely, the MACD also hints at a sell signal, manifested as the blue MACD has crossed below the orange signal line. Similarly, the MACD histograms are fading, a sign of waning bullish sentiment. If the $217 gives way, the Solana price could fall through. Nevertheless, the bullish sentiment for the SOL price would only be invalidated below the $196 support. Such a move would also indicate a change in market structure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.