Highlights:

- The Solana price is trading above $195, showing a glimmer of hope for further upside.

- SOL on-chain activity shows a drop, cautioning traders in the market.

- SOL bulls target to break above $216 resistance to ignite a rally to $250.

The Solana price is trading above $195, despite a slight 2% drop, which shows that the sentiment may be shifting to positive. Its daily trading volume has notably dropped 14%, indicating a slight plunge in trading activity. Meanwhile, other major altcoins such as Bitcoin (BTC) and Ethereum(ETH) have steadied above $111,000 and $4000. This shows that the crypto market may gain strength, pushing the market to a positive outlook.

After an intraday setback that put Solana’s price at $189, the altcoin is trying to break above $200. The bullish grip needs a stronger support at the immediate level of $195 to strengthen the chances of the expected movement.

Solana and It Treasury Company Adds Over 86,000 Tokens

On the other hand, Solana and its treasury company, DeFi Dev Corp, have acquired more than 86,000 SOL tokens, worth 9.57 million. The company is now holding a total of 2.19 million SOL, which is worth $426 million due to this recent acquisition. Such a massive acquisition is also a pointer to increased confidence in the Solana ecosystem, which can be seen in the overall market trends.

🚨UPDATE: Solana treasury company @defidevcorp has acquired an additional ~86,307 $SOL, at an average price of $110.91, bringing its total holdings to ~2.19 million $SOL. pic.twitter.com/TNZ2HN4g55

— SolanaFloor (@SolanaFloor) October 16, 2025

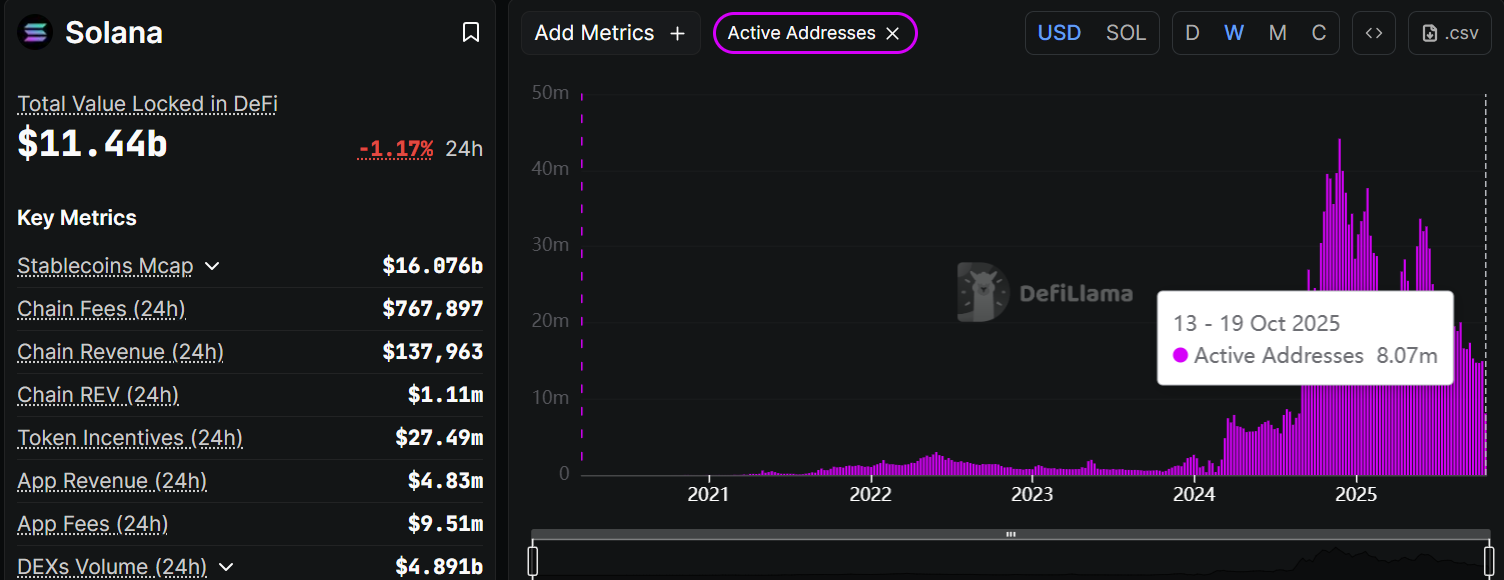

Nevertheless, DefiLlama attracts the attention of investors. Currently, the number of addresses that actively operate on the Solana blockchain has significantly reduced. The chart below indicates that the number of active addresses is 8.04 million during the week between October 13 and 19. This is significantly lower compared to 33.63 million between May 19 and 25.

The Active Addresses measure the count of wallets communicating with the protocol by either sending or receiving SOL. This has been the case over time, indicating low user engagement, and this translates into a low demand for Solana. The Solana price might also be held down. This is because the bulls will find it difficult to keep the recovery, with low on-chain activity.

Solana Price Targets $250 If the $216 Resistance is Broken

The SOL/USD 1-day chart shows the price is trading at $195, and the 50 SMA sits at $216, cushioning against further upside. Meanwhile, the 200 SMA clocks in at $173.76, which is a strong support zone, suggesting some stability. Currently, the Solana price is roaming within the falling wedge pattern, as the bulls aim for a breakout above $200 soon.

Zooming into the indicators, the RSI at 43.72 is hovering in the neutral territory, leaving room for the crypto to run. Looking ahead, if the $216 resistance holds firm, there might be a dip toward the $189-$173 support zone, right where the SMA aligns.

The worst case would be the Solana price breaking below $173. It could send SOL crashing to $158, especially if the broader market undergoes a correction. However, if bulls push past $200 with volume, SOL could eye $216 resistance. A break above this level will send the Solana price towards $238-$250 zone. Meanwhile, the plummeting active addresses suggest caution, despite the RSI giving a glimmer of hope. Investors should keep their eyes peeled, awaiting a clearer signal.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.