Highlights:

- Solana has today rallied through multi-day resistance at $171.03

- Sustaining this rally could push Solana to $200 short term

- Growing institutional demand for Solana is likely to drive momentum

Solana (SOL), like the rest of the cryptocurrency market, is sending strong bullish signals today. In the last 24 hours, Solana has gained by 5.22% to trade at $172.23. Solana’s rising bullish momentum is also supported by its trading volumes. Today, Solana’s trading volumes are up 7.31% to $4.62 billion. This indicates that money is flowing in strongly with the expectation that Solana could likely be headed much higher in the short to medium term. Already, multiple factors are converging that could push Solana higher going into the future.

Institutional Demand for Solana Is On the Rise

One of these factors is the rising institutional demand for Solana. In the recent past, there has been strong growth in the institutional demand for cryptocurrencies. However, most of the money has gone towards Bitcoin and Ethereum. Things are now changing, and Solana too is starting to take a sizeable chunk of this amount. More companies are adding Solana to their balance sheets and increasing their holdings. The latest to make this move is Bit Mining. Bit Mining recently invested in 27,191 Solana. The company also launched a validator node to earn yield from its SOL.

Publicly listed companies are buying Solana in droves to capture the blockchain's staking rewards, with three recently announcing they have purchased more of the token.

Bitcoin mining company Bit Mining said it made its first Solana (SOL) purchase on Tuesday, acquiring 27,191… pic.twitter.com/aQmTrA9TrF

— earnmining (@EarnMiningUK) August 7, 2025

Another company that has been quite aggressive in accumulating Solana is Upexi. Upexi recently announced that it had been buying Solana throughout July and now holds more than 2 million SOL tokens. Such moves point to the growth of institutional adoption of Solana in the chase of yields. Solana’s passive income potential could play a significant role in pushing its price to new highs in the future. The possibility of Solana staking ETFs becoming a reality soon could add to this momentum. That’s because they would pave the way for even more companies to get exposure to Solana and the yield it brings.

With over 2M SOL ($334M+) held and earning $65K+/day in staking rewards, $UPXI is the first Solana treasury stock on NASDAQ. Upexi Inc. gaining attention as crypto and AI narratives accelerate and AI momentum builds.

– Only public company offering direct SOL exposure

– 172%… pic.twitter.com/bBa4aF6wQ4— Mr M Trades (@MrMTrades) August 7, 2025

Solana Reserves on Exchanges In Decline – A Positive Signal for SOL

Solana could also get a boost because the average holder is not keen to sell. In recent weeks, the price of Solana and other major cryptocurrencies has been sluggish. However, this has not incentivized holders to liquidate. This is evident in Solana data showing that between July 23 and August 5, Solana exchange balances dropped by 10%. They went from 33.06 million Solana to 30.78 million. Such metrics mean the increasing demand for Solana is chasing a declining number of tokens. Based on the economic law of supply and demand, this dynamic could trigger a Solana rally to new highs in the foreseeable future.

Possible Upcoming US Rate Cuts Could Send Solana Higher

Solana could also get a boost from events happening in the macro environment. Recently released economic data indicates that the US economy is creating fewer jobs than expected. The result is that the Federal Reserve could be forced to cut rates to keep the economy going. Such a move would unlock liquidity into risk-on assets such as cryptocurrencies. Being one of the best-known altcoins, Solana is likely to benefit the most from such a move. The fact that US stock indices show increasing strength indicates that such a move could play out in the short to medium term.

Technical Analysis – Solana Breaks Out of Multi-Day Consolidation

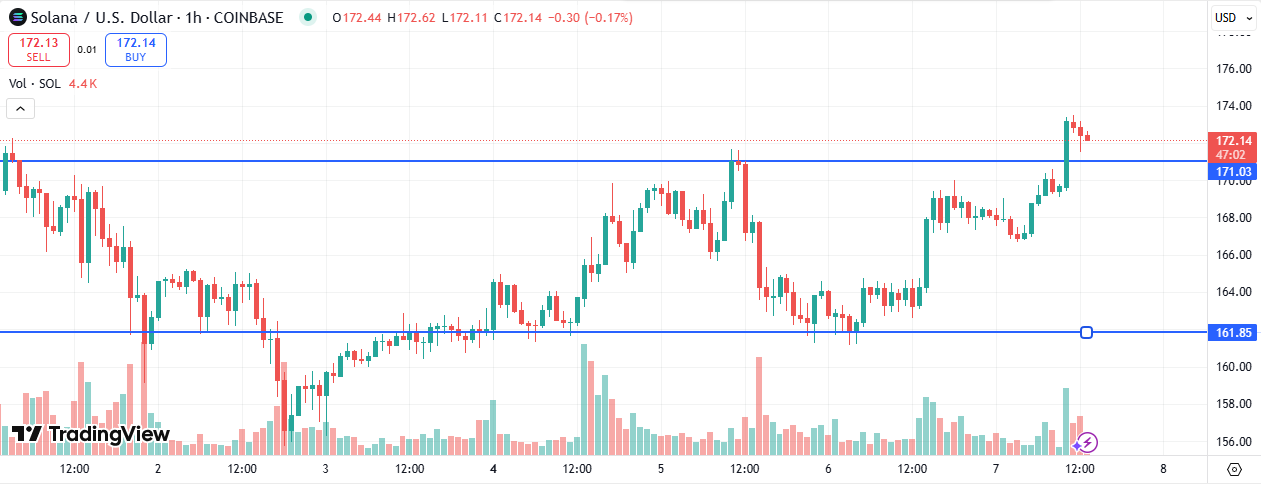

Since August 5, Solana has been consolidating between the $171.03 resistance and $161.85 support. Today, Solana has broken out bullish. If bulls sustain the momentum that Solana has built up in the day, then a rally to $200 could follow in the short term.

On the other hand, if bulls lose momentum, the odds are that it would consolidate above the $171.03 price level, which is now support. Of these two scenarios, the odds are higher for a rally to $200 as bulls increasingly control the broader market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.