Highlights:

- The price of Solana has increased by 1%, trading at $173.

- A popular analyst has highlighted that Solana’s move above $200 will indicate an instant buy.

- SOL technical indicators show a potential upside to $200 if the bulls sustain the momentum.

The Solana price has increased 1.99% to the $173 mark, as the bulls are building momentum in the market. The 24-hour trading volume has also soared by 8% to $4.27B, as Solana’s market cap rises 1% to $90.36B. The recent increase shows that SOL market activity is soaring, hence intense investor confidence.

Solana Price Outlook

When we look at the Solana daily chart, it has formed a cup-and-handle technical pattern. Often, this pattern suggests a bullish breakout. Moreover, the bulls have flipped the $140 mark, which is in line with the 50-day MA, into support. They are currently targeting the next resistance level at $181, which is in line with the 200-day MA. If the support level holds and the bulls sustain the positive momentum, the Solana price could rise to $200.

Meanwhile, Ali Martinez, a popular analyst, has highlighted that Solana’s price above the $200 level is an instant buy. His analysis is linked to the prevailing cup and handle pattern.

#Solana $SOL above $200 is an instant buy, as it could be breaking out of this massive cup-and-handle pattern! pic.twitter.com/cE2XUSTGLJ

— Ali (@ali_charts) May 15, 2025

Further, the Solana price is showing further upside as the crypto market regains strength. Meanwhile, if the bulls keep dominating, the SOL token could head to $181. A break above this mark will allow for further upside to the $200 mark, validating the bullish grip.

On the other side of the fence, the Relative Strength Index is sitting at 62. After correcting from the 76-overbought territory, the bulls have gained stamina and are poised for a substantial leg up.

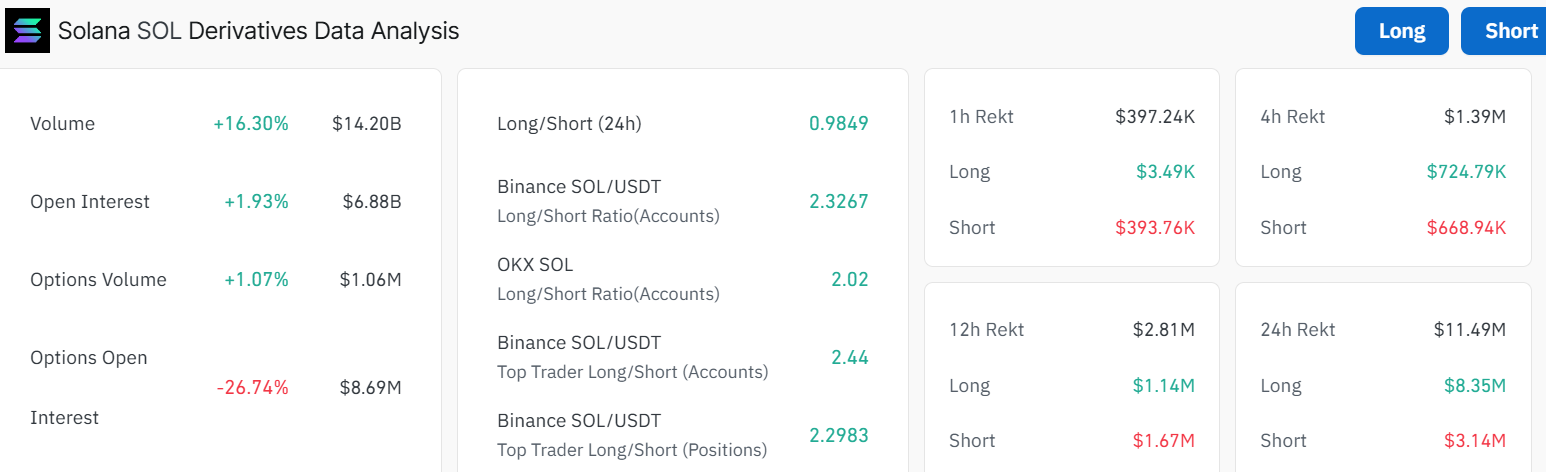

SOL Derivatives Data

The Solana derivatives analysis shows a bullish outlook, according to Coinglass data. Its volume has increased by 16% to 14B, showing intense market captivity. On the other hand, the open interest has soared 1.93% to $6.88B. This shows that traders are now opening their positions in the Solana market; hence, new money is flowing into the market. If this bullish outlook holds, the Solana price will definitely reclaim the $200 mark in the short term. Moreover, the long-to-short ratio has hit 0.98, slightly below 1. The bulls need to push through to 1 in order to affirm the bullish sentiment in the market.

Meanwhile, the Solana liquidations have hit $11.49 million over the past day. The lion’s share has been garnered by the longs, which have accumulated about $8.35M, surpassing the shorts. This is a clear indication that more traders who are betting on a price increase are being forced to close their positions. If the bulls do not gain stamina, the Solana price may flip bearish.

On that note, if the $181 resistance key proves too strong, the bulls may lose momentum. This will cause a slight downside towards the $168 mark. If the bears increase their potential at this level, the Solana price may dwindle further to the $165 and $160 support zones. Traders should, however, keep a close eye on the major support and key resistance zones to determine Solana’s future direction.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.