Highlights:

- GSR Markets predicts a potential 9x increase in Solana’s price if a spot Solana ETF is approved in the U.S.

- VanEck’s new filing for a spot Solana ETF coincides with optimistic growth projections from GSR Markets.

- GSR’s analysis highlights Solana’s advanced technology and market demand as key factors for its strong ETF candidate status.

Solana might be on the verge of a significant price increase if the approval of spot exchange-traded funds (ETFs) materializes in the United States. According to a recent report by crypto market maker GSR Markets, the price of Solana could surge by up to nine times its current value under favorable conditions.

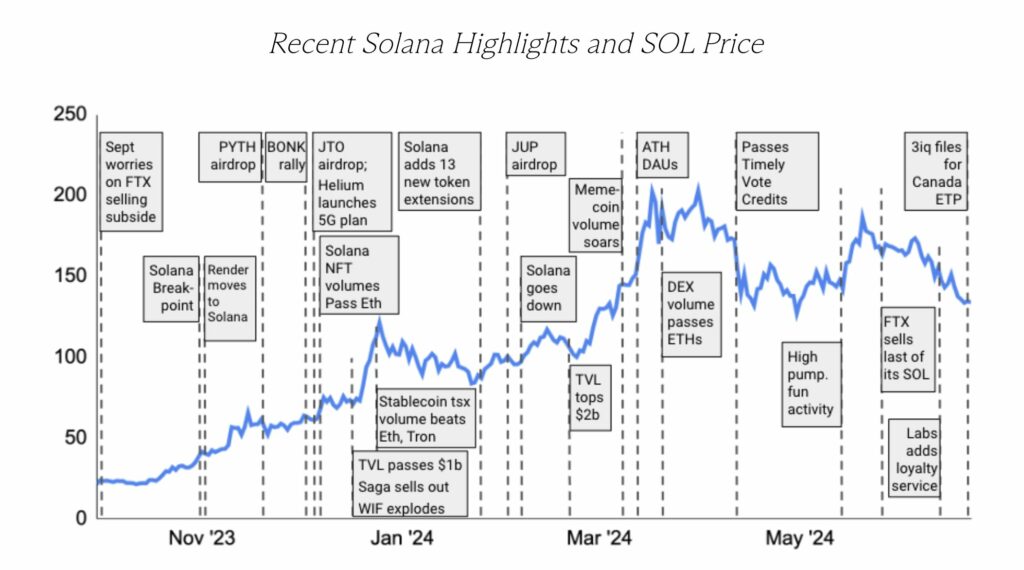

GSR Markets released this analysis on June 27, the same day that fund manager VanEck submitted a filing for a spot Solana ETF. This move surprised many and highlighted the growing interest in Solana within the financial sector.

GSR’s Optimistic Forecast for Solana

GSR’s “blue sky” scenario projects that Solana’s price could increase from its current $149 to over $1,320. This projection assumes that spot Solana ETFs could capture 14% of the capital inflows observed by spot Bitcoin ETFs since their launch in January. Considering its current supply, this scenario envisions Solana’s market capitalization reaching approximately $614 billion.

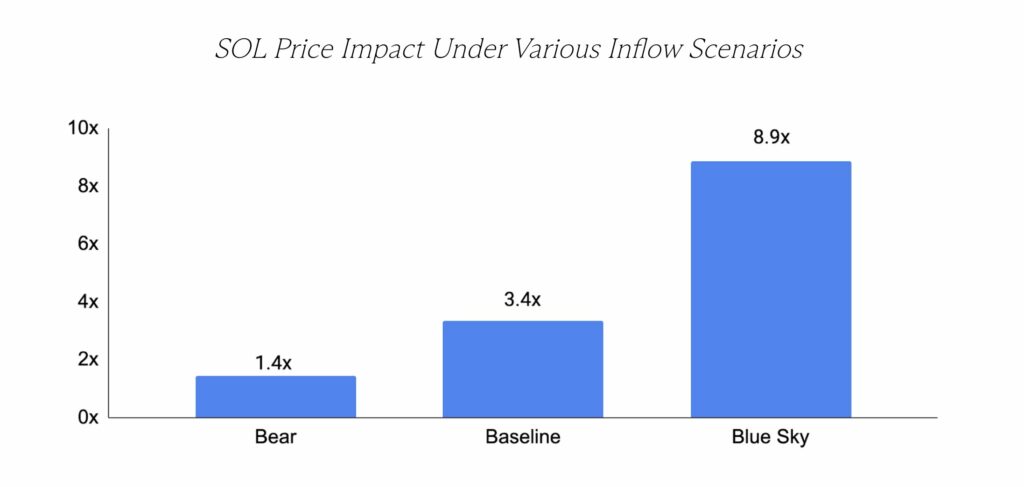

However, GSR’s analysis does not only rely on this optimistic outlook. The firm also presented more conservative scenarios, predicting a 1.4x increase in a “bear” scenario and a 3.4x rise under baseline conditions. These estimates could be even higher if the spot Solana ETFs incorporate staking rewards, although staking was not permitted in the approved spot Ether ETFs.

Technological Edge and Market Demand

Solana’s potential to benefit from a spot ETF approval stems from its unique technological advantages and market demand. GSR Markets highlighted Solana’s proof-of-history consensus mechanism, which enables validators to produce blocks efficiently, resulting in significant speed and scalability benefits. Additionally, Solana’s ability to process parallel transactions boosts throughput, leveraging modern computing advancements.

GSR also emphasized Solana’s high hardware and bandwidth requirements, which optimize speed and security, albeit at the expense of decentralization. However, as costs decrease, Solana might be the first to solve the blockchain trilemma and achieve its vision of synchronizing global state at unprecedented speeds.

Regulatory Challenges and Market Outlook

Despite the optimistic outlook, regulatory approval remains a critical hurdle. Market experts, including Bloomberg ETF analyst Eric Balchunas, believe that a change in the U.S. presidency and the leadership of the Securities and Exchange Commission (SEC) might be necessary for a spot Solana ETF to be seriously considered.

Looks like VanEck just filed for a Solana ETF h/t @btcNLNico pic.twitter.com/fB5luuS1uQ

— Eric Balchunas (@EricBalchunas) June 27, 2024

The U.S. Securities and Exchange Commission, led by Chair Gary Gensler, has classified SOL as a security in lawsuits against major exchanges Binance and Coinbase. This classification could complicate the approval process for a spot Solana ETF compared to Bitcoin and Ether ETFs.

GSR’s report suggests that a change in the U.S. presidency and the leadership of the SEC could pave the way for a spot Solana ETF. The report noted that former President Donald Trump’s recent support for the crypto industry has influenced Democrats to adopt a more favorable stance on digital assets. A potential Trump administration and a liberal SEC Commissioner could enable the launch of multiple spot digital asset ETFs.

Growing Interest in Solana ETFs

The report coincided with VanEck’s filing for a spot Solana ETF on the same day. This filing followed a similar application by cryptocurrency asset manager 3iQ in Canada, marking a North American first. The growing interest in Solana ETFs indicates a strong demand for exposure to the SOL token and the Solana network.

Furthermore, major asset managers like Franklin Templeton have praised the Solana ecosystem. However, the firm has not confirmed plans to launch a spot Solana ETF. Over $1 billion worth of Solana exchange-traded products are available worldwide, indicating robust demand for exposure to the SOL token and the Solana network. A U.S.-based spot Solana ETF could significantly impact Solana’s price and adoption if approved.

As of this writing, Solana is trading at $145, up 6% in the past 24 hours. Solana’s market cap is $67 billion, while the trading volume has seen a significant surge of 120%, with a value of $3.15 billion.

Read More

- Crypto Losses From Hacks and Scams Soar 112% in Q2 2024, Reaching Over $572M

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins

- Best Metaverse Coins to Invest – Next Metaverse Coins