Highlights:

- A U.S. appeals court has revived a lawsuit alleging Binance.US manipulated the HEX token price.

- The Ninth Circuit Court ruled that the district court has personal jurisdiction over Binance.US and CoinMarketCap.

- The case, initially dismissed in 2023, now returns to the district court for further proceedings.

A recent ruling by the U.S. Court of Appeals for the Ninth Circuit has revived a class-action lawsuit against Binance.US. The lawsuit, which had been previously dismissed, alleges that the cryptocurrency exchange manipulated the price of the HEX token. The case, initially filed by plaintiff Ryan Cox in 2021, accuses Binance.US and its affiliate CoinMarketCap of unlawfully suppressing the HEX token’s ranking on the CoinMarketCap platform, causing it to trade at lower prices.

U.S. court reopens HEX manipulation case against https://t.co/ryPvR1aYUC

A U.S. appeals court has rebooted a class-action lawsuit against https://t.co/ryPvR1aYUC regarding the HEX token manipulation case, Cointelegraph reported. https://t.co/ryPvR1aYUC was previously accused of…

— CoinNess Global (@CoinnessGL) August 13, 2024

In February 2023, a district court dismissed the lawsuit, citing a lack of sufficient connections between Binance.US’s activities and the state of Arizona, where the case was filed. The court ruled that Cox had failed to establish a direct link between the exchange’s operations and the alleged manipulation of the HEX token’s price.

Court Overturns Dismissal

However, the Ninth Circuit Court of Appeals disagreed with the district court’s findings. On August 12, a panel of three judges ruled that the district court had personal jurisdiction over the U.S.-based defendants, including Binance.US and CoinMarketCap. The appeals court noted that both entities have substantial ties to the United States, which satisfies the due process requirements for personal jurisdiction.

The panel found that Cox’s claims of price manipulation were valid and warranted further legal proceedings. This decision allows the lawsuit to move forward, adding to the ongoing legal challenges faced by Binance.US. The case is now set to return to the district court for further examination.

HEX Token Under Scrutiny

The HEX token, launched in December 2019 by Richard Heart, has been a subject of controversy and legal scrutiny. On July 31, 2023, the U.S. Securities and Exchange Commission (SEC) filed a separate lawsuit against Heart, accusing him of violating federal securities laws and defrauding investors of over $12.1 million. The SEC alleges that Heart used investor funds for personal luxury purchases, including a 555-carat diamond, expensive watches, and high-end cars.

Today we charged Richard Heart (aka Richard Schueler) and three unincorporated entities that he controls, Hex, PulseChain, and PulseX, with conducting unregistered offerings of crypto asset securities that raised more than $1 billion in crypto assets from investors.

— U.S. Securities and Exchange Commission (@SECGov) July 31, 2023

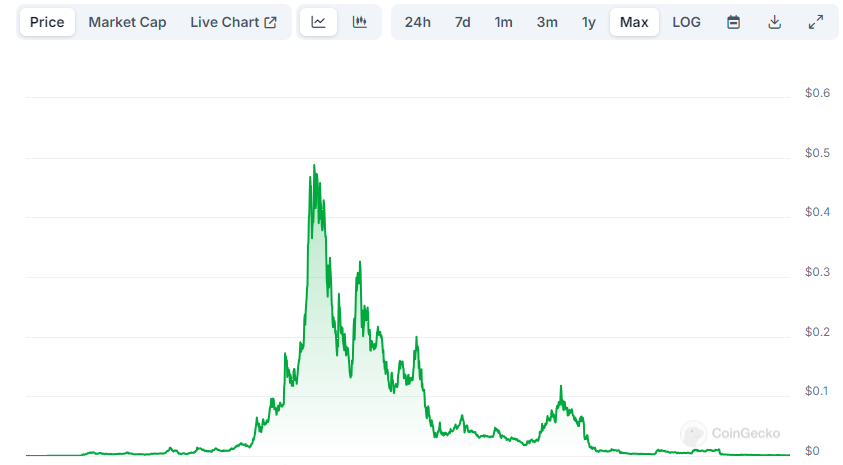

The HEX token, launched in December 2019, has been controversial since its inception. It is currently trading at $0.001, a dramatic decline from its all-time high of $0.51 in September 2021. The ongoing legal battles surrounding HEX, Binance.US, and Richard Heart have further clouded the token’s future in the cryptocurrency market.

Binance.US Granted Approval to Invest in Treasury Bills

Recently, Binance.US received court approval to invest customer assets in U.S. Treasury bills, enhancing transparency within its operations. The decision, issued by Judge Amy Berman Jackson of the U.S. District Court for the District of Columbia, allows the exchange to invest in these safe assets and mandates the transfer of crypto holdings to third-party custodians not affiliated with Binance.

Judge Jackson’s ruling permits BAM Trading Services and BAM Management US Holdings (BAM) to invest customer assets in U.S. Treasury bills backed by the U.S. Treasury Department. Binance.US must also transfer crypto assets to independent custodians, aligning with last year’s consent order to improve asset security.

Following the court order, Binance.US must collaborate with third-party investment advisers to manage BAM’s assets. These advisers will ensure the proper execution of investments in U.S. Treasury bills, maintaining liquidity for customer withdrawals. Investments will mature on a rolling four-week basis in compliance with the court’s directives.