Highlights:

- Metaplanet leads other companies in NISA stock rankings between May 19 and 23.

- The company missed out on the total balance ranking, sparking concerns.

- Metaplanet’s Head of IR suggested prioritizing improving long-term investors’ confidence.

On May 25, Shinpei Okuno, Metaplanet’s Head of Investor Relations (IR) and Capital Strategy, shared a tweet displaying Metaplanet’s impressive Japan Nippon Individual Savings Account (NISA) stock rankings. According to the X post, the Japanese crypto investment firm ranked first in purchase rankings among SBI securities customers that traded between May 19 and 23. Launched in 2014, NISA is a Japanese investment initiative that allows retail investors to benefit from tax-free stock. The statistics have undoubtedly positioned Metaplanet as an avenue for investors seeking less risky investment options.

たまたまTLみていて、気づいたのですが、先週SBI証券顧客のNISA買付ランキングでメタプラネットが首位だったようです… pic.twitter.com/mUs2gxsk5b

— 奥野晋平(Shinpei Okuno) (@Shinpei3350) May 25, 2025

Metaplanet Missed out on the Total Balances Ranking

Aside from the weekly metric, the tweet also showed different companies ranking in terms of total balances held. Okuno raised concerns about Metaplanet’s omission in the total balances standings. He said the investment firm can address the challenge by improving long-term investors’ confidence via proper education.

Part of the tweet read:

“On the other hand, our balance of holding is not ranked. We need to further strengthen our education activities to move up the rankings and make people consider Metaplanet as a long-term investment option.”

Gerovich Shares Insight on the Remarkable Feat

In an X post, Simon Gerovich, Metaplanet’s Chief Executive Officer (CEO), explained how investments under NISA have benefited investors. He said investors gain indirect BTC exposure by investing in Metaplanet. In addition, registering under NISA allows investors to earn profits from BTC’s price appreciation without paying capital gains tax. Explaining further, the CEO added, “Bitcoin + zero tax + leverage = Japan’s ultimate Bitcoin proxy.”

Metaplanet was the #1 most bought stock last week via NISA accounts at SBI Securities, Japan’s largest online broker.

Japanese investors are using NISA, a tax free investment scheme, to get exposure to Bitcoin without paying capital gains tax.

Bitcoin + zero tax + leverage =… https://t.co/kAI4ephVM2

— Simon Gerovich (@gerovich) May 25, 2025

In a separate tweet, Gerovich shared Metaplanet’s BTC rating and the implications for the company. In the X post, the CEO said Metaplanet has a 69.24x BTC rating, implying a flexible capital structure. He also stated that even if BTC’s value drops to about $2,000, Metaplanet’s Net Asset Value (NAV) has a significantly high value to offset all the company’s liabilities. This underscores Metaplanet’s robust financial standings and BTC’s role in improving the company’s finances after embracing the asset class in 2024.

BTCレーティング69.24倍を誇るメタプラネットは、極めて強靭かつ柔軟な資本構造を維持しています。ビットコインNAVが負債を大幅に上回ることで、BTC価格が2,000ドルに下落した場合でも、全ての債券のカバーが可能な水準となっています。 https://t.co/yBVH6I3VSH

— Simon Gerovich (@gerovich) May 25, 2025

Metaplanet Edges Closer to Achieving Long-Term Investment Target

In January, Gerovich said Metaplanet must boost its BTC holdings to at least 10,000 by the end of this year. He added that the company must also strive to meet a bigger 21,000 BTC holdings target by the end of next year. So far, the investment firm has already procured 7,800 BTC within five months. Maintaining its current investment strategy implies that Metaplanet could meet its long-term goals sooner than expected.

On May 19, the Japanese crypto investment firm announced its most recent purchase, which involved 1,004 BTC, valued at roughly $104.3 million. The company has maintained a culture of always announcing new purchases on Mondays. Hence, chances are high that Metaplanet will disclose another purchase on May 26.

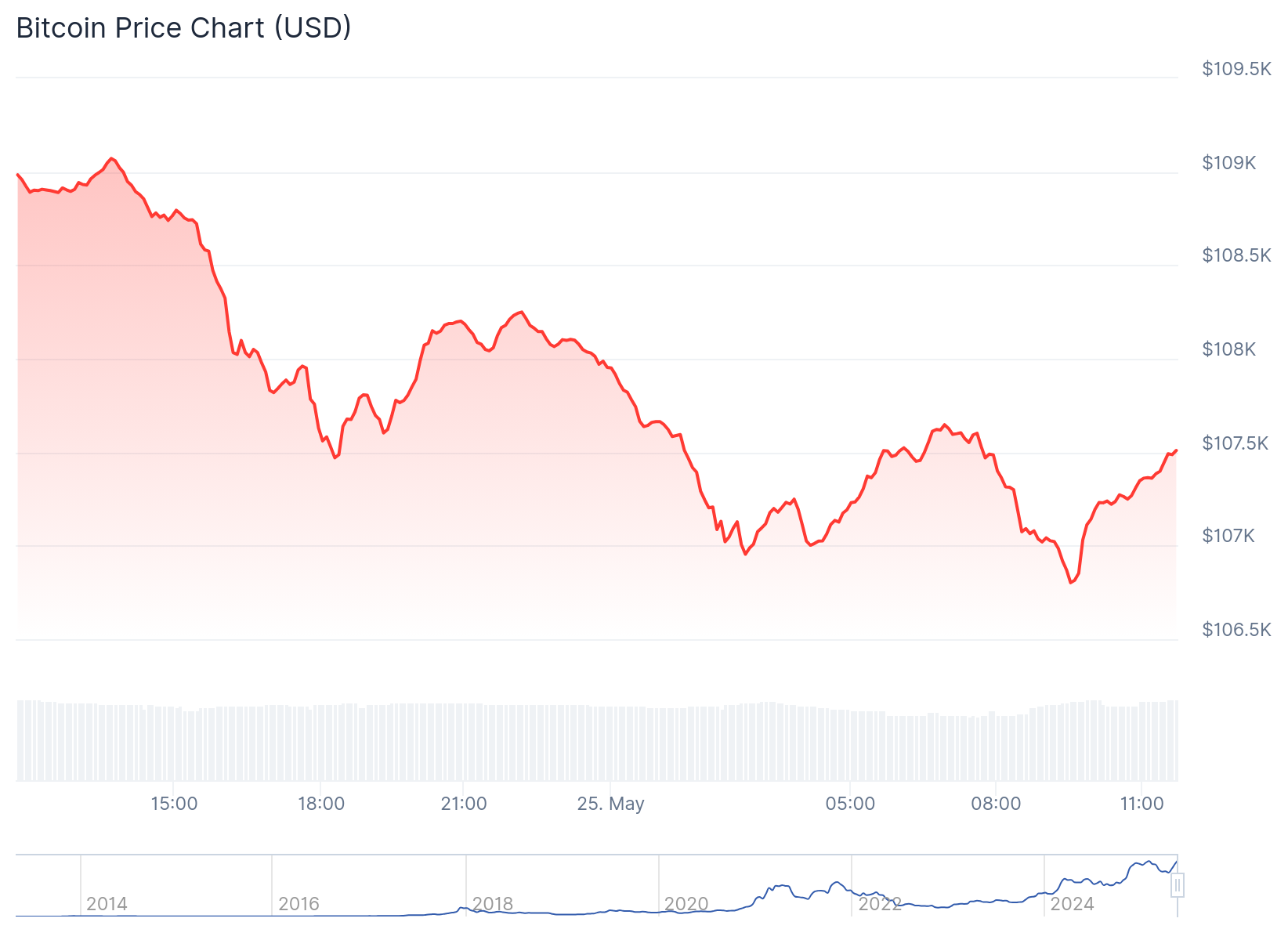

Meanwhile, Bitcoin has dropped 1.5% in the past 24 hours, with price extremes fluctuating between $106,802 and $109,071. At the time of press, the flagship crypto is priced at approximately $107,300, with a market capitalization of $2.1 trillion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.