Highlights:

- Metaplanet plans to expand Bitcoin holdings with a fresh ¥3.6 billion issuance.

- The investment firm will allocate the bonds exclusively to EVO FUND.

- The bonds are redeemable at 100% face value with no interest rate.

Japanese investment firm Metaplanet announced the issuance of its 12th series of ordinary bonds, raising ¥3.6 billion ($24,845,760) to fund more Bitcoin (BTC) purchases. Metaplanet announced the latest issuance earlier today after its board of directors meeting. As expected, the bonds will be allocated exclusively to EVO FUND (“the Bondholder), underscoring Metaplanet’s consistent strategy of acquiring Bitcoin via conventional financial instruments.

Having procured 5,000 BTC, Metaplanet must accumulate an additional 5,000 BTC to meet its long-term target for 2025. Moreover, the company’s extended target entails procuring 21,000 BTC by the end of next year. Metaplanet’s commitment in the first few months of this year implies that it could exceed these targets.

*Metaplanet Issues 3.6 Billion JPY in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/e3UIEP7csr

— Metaplanet Inc. (@Metaplanet_JP) May 2, 2025

Details About the New Bond Structure

The bond will carry a zero interest rate at a face value of ¥90 million ($621,144) per issuance, redeemable at 100% face value on October 31, 2025. However, there are options for early redemption under specific conditions.

Metaplanet stated:

“The Bondholder may request full or partial early redemption by submitting written notice to the company at least one business day prior to the desired early redemption date.”

Apart from the conditions above, bond redemption depends on the proceeds realized from the issuance of Metaplanet’s 15th to 17th series of stock acquisition rights. According to Metaplanet, realizing multiples of ¥90 million after deducting expenditures from prior early redemptions might push it to redeem the bond on the business day after the written notice. The Bondholder and the company could also agree on a mutual redemption date.

Bonds’ Impact on the Company’s Financial Results

Beyond the zero interest rates, the bonds will be unsecured, with no collateral or administrator under Article 702 of the company’s act and Article 169 of the enforcement ordinance of Metaplanet’s act.

The statement added:

“The issuance of these bonds is expected to have a minimal impact on the company’s consolidated financial results for the fiscal year ending December 2025.”

The company, however, noted that it would keep the public updated on any material impact on Metaplanet’s financial performance. The investment firm has always sought to attract more shareholders by upholding transparency.

Metaplanet Record Massive Gains from BTC Investments

Simon Gerovic, Metaplanet’s Chief Executive Officer (CEO), recently shared a chart displaying the company’s unrealized BTC gains. According to the tweet, Metaplanet has exceeded ¥6 billion in unrealized Bitcoin gains. The CEO said the profit was more than four times the company’s market cap before it adopted the Bitcoin standard.

ビットコインの未実現利益がついに60億円を突破。これはビットコインスタンダード導入前の時価総額の4倍以上。

Our unrealized gains on Bitcoin now exceed 6 billion yen which is more than 4x our market cap before we adopted the Bitcoin standard. pic.twitter.com/ySkVIChrzI

— Simon Gerovich (@gerovich) May 1, 2025

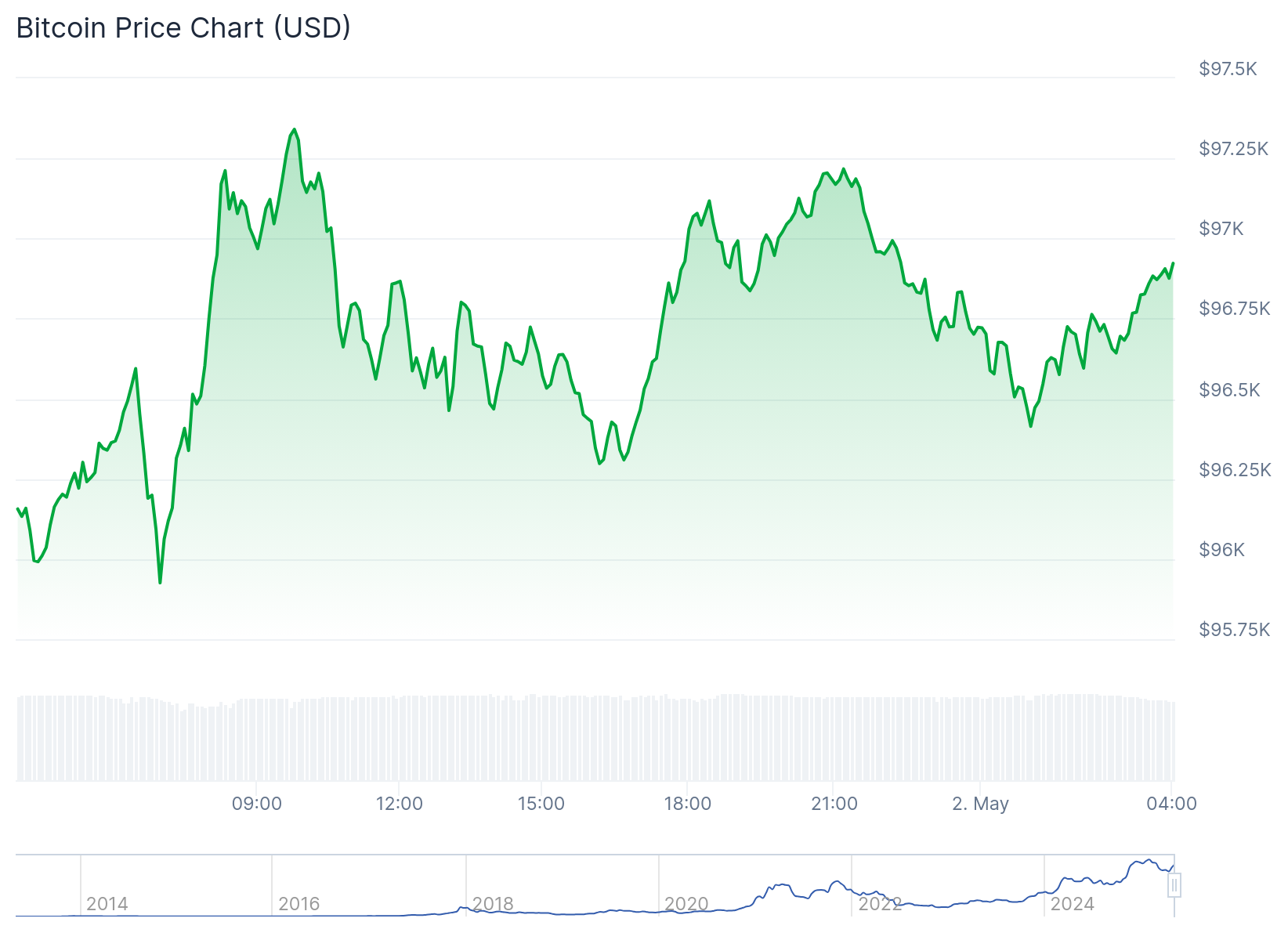

Meanwhile, Bitcoin is changing hands at approximately $96,800, following a 0.6% upswing in the past 24 hours. In its 7-day-to-date price change variable, BTC soared 14.5%, fluctuating between $92,972.12 and $97,183.43. In contrast, BTC’s 24-hour trading volume dropped 1.51% to about $31.53 billion.

Metaplanet Plans to Launch a Subsidiary in Florida

On May 1, Crypto2Community reported that Metaplanet will be expanding with a new Florida branch. The investment firm aims to raise $250 million from the subsidiary to fund its Bitcoin acquisitions. Beyond procuring BTC, the capital will boost investors’ liquidity access and strengthen the investment firm’s operational capacity.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.