Highlights:

- Jersey City Pension Fund plans to invest in Bitcoin ETFs following SEC approval.

- Mayor Steven Fulop advocates for blockchain and crypto technologies.

- Investment mirrors Wisconsin Pension Fund’s Bitcoin ETF move.

In a July 25 X Post, Steven Fulop, the mayor of Jersey City since 2013, has revealed plans to invest a portion of the city’s pension fund in Bitcoin (BTC) exchange-traded funds (ETFs). This move mirrors the Wisconsin Pension Fund’s decision, which allocated 2% of its $156 billion assets to Bitcoin ETFs in Q2.

Not my normal subject matter in a post but I’ll share anyway – the question on whether Crypto/Bitcoin is here to stay is largely over + crypto/Bitcoin won. The #JerseyCity pension fund is in process of updating paperwork to the SEC to allocate % of the fund to Bitcoin ETFs… https://t.co/5iNEqRqHGM

— Steven Fulop (@StevenFulop) July 25, 2024

Fulop said Jersey City, the second-largest city in New Jersey, is updating its paperwork with the United States Securities and Exchange Commission (SEC) to include Bitcoin ETFs in its pension fund investments. The mayor estimates the process will be completed by the end of the summer.

He emphasized his long-standing belief in blockchain technology and cryptocurrency. Fulop said, “The question on whether Crypto/Bitcoin is here to stay is largely over, and Crypto/Bitcoin won.” He further highlighted the potential of blockchain technology, calling it one of “the most important technological innovations since the internet.”

Jersey City Pension Fund Mirrors Wisconsin’s Bitcoin ETF Investment

Fulop drew parallels to the State of Wisconsin Investment Board, which invests in pension and other trust funds. In a mid-May 13F filing with the SEC, the State of Wisconsin Investment Board disclosed holding $100 million in BlackRock’s iShares Bitcoin Trust and nearly $64 million in the Grayscale Bitcoin Trust. The filing also included shares in Coinbase, Block, Marathon Digital, Riot Platforms, and other crypto companies.

JUST IN: 🇺🇸 State of Wisconsin Investment Board discloses it holds almost $100 million of BlackRock's spot #Bitcoin ETF. pic.twitter.com/Jdv4uKSi9J

— Bitcoin Magazine (@BitcoinMagazine) May 14, 2024

“Normally you don’t get these big fish institutions in the 13Fs for a year or so (when the ETF gets more liquidity) but as we’ve seen these are no ordinary launches. Good sign, expect more, as institutions tend to move in herds,“ Bloomberg Senior ETF analyst Eric Balchunas stated at the time.

Bitcoin ETFs Expansion and Growing Institutional Interest

Since their launch earlier this year, Bitcoin ETFs have performed remarkably well. BlackRock’s IBIT has recently surpassed Nasdaq’s QQQ in year-to-date inflows. The SEC’s approval of spot Bitcoin ETFs on US exchanges has opened the door for public pension funds to explore these investments, though only Jersey City and Wisconsin are currently among the few public entities doing so.

Although major financial institutions like Wells Fargo and JPMorgan Chase have invested less than $1 million combined in Bitcoin ETFs, Fulop’s decision indicates a growing acceptance of digital assets in institutional portfolios.

In May, Michael Saylor, Chairman of MicroStrategy, predicted Bitcoin would soon be part of US pension fund portfolios. Saylor’s advocacy for Bitcoin in pension funds is gaining attention as institutional investors increasingly see cryptocurrencies as valuable components of diversified investment strategies. Moreover, Investor Robert Kiyosaki has endorsed Bitcoin and suggested that Trump administration policies could boost cryptocurrency values.

Bitcoin Rises 4.18% Amid Increased Market Activity

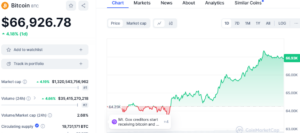

Amid these developments, Bitcoin (BTC) has shown bullish momentum over the last 24 hours. At the time of writing, BTC was trading at $66,926, marking a 4.18% increase from the previous day. Concurrently, BTC’s market capitalization increased by 4.18% to $1.32 trillion, while the 24-hour trading volume surged by 4.66% to $35.41 billion. This increase in trading volume suggests an increase in investor interest as they buy the dip in the hope of a bullish recovery to $71,000.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- Michigan Pension Fund Invests $6.6M in ARK Bitcoin ETF

- Notcoin Eyes Bullish Rebound as Technical Indicators Favor Upside

- BitFlyer Finalizes FTX Japan Purchase, Eyes Crypto ETF Expansion

- HSBC Australia Blocks Crypto Payments, Citing Scam Concerns