Highlights:

- NYSE American proposes rule change for options on Bitwise and Grayscale spot Ethereum ETFs.

- Options-linked crypto funds are viewed as high-risk by regulators.

- Ether ETFs face $23M in outflows, with Grayscale’s ETHE leading losses.

On August 7, the New York Stock Exchange (NYSE) American LLC, in partnership with Grayscale and Bitwise, submitted a filing to the United States Securities and Exchange Commission (SEC). They proposed a rule change to list and trade options on three products: the Bitwise Ethereum ETF (ETHW), the Grayscale Ethereum Trust (ETHE), and the Grayscale Ethereum Mini Trust (ETH).

NYSE American stated that permitting options trading on the three Ether ETFs would benefit investors by offering a cost-effective tool. This tool would allow investors to gain exposure to spot Ethereum while also providing a “hedging vehicle to meet their investment needs in connection with ether products and positions.” Comments on the proposal are anticipated to be submitted within 21 days.

Rising Demand for Spot Ethereum ETF Options

The request for a rule change to list options on the spot Ethereum ETF follows the market regulator’s approval of the base product. Institutional investors are seeking more than just the original ETF offering, driving increased demand. This has prompted Ethereum ETF issuers like BlackRock and now Grayscale to advance their products.

Options on crypto ETFs are still uncertain under Gary Gensler’s SEC. While Bitcoin and ETH ETFs were approved with many concessions, the idea of an options-linked crypto fund seems far-fetched due to its risky nature. NYSE American’s request came just one day after the Nasdaq options exchange sought SEC approval to allow options trading on BlackRock’s spot Ethereum ETF.

Besides Ether ETF issuers, several firms are seeking to trade options on spot Bitcoin ETFs but have not yet received SEC approval. The agency approved 11 spot Bitcoin ETFs in January.

Nasdaq Seeks SEC Approval for Options Trading on BlackRock’s ETHA

On August 6, the Nasdaq International Securities Exchange submitted a proposal to the SEC to introduce the options trading for BlackRock’s iShares Ethereum Trust (ETHA). BlackRock’s fund is currently the only Ether ETF listed on Nasdaq. The filling affirmed that it would not engage in Ethereum staking for additional income. According to Nasdaq, the initiative aims to expand investment options for Ethereum and enhance its accessibility in traditional markets.

James Seyffart of Bloomberg Intelligence says the SEC has 21 days to comment, with a final decision expected around April 9, 2025. The CFTC and OCC also need to approve Nasdaq and BlackRock’s move.

Nasdaq and BlackRock's filing to add options on Ethereum ETFs has hit the SEC site. Final SEC decision on this from SEC likely to be around April 9th, 2025.

(SEC is not the only decision maker on adding options here. Also need signoff from OCC & CFTC) https://t.co/K4HunUPp7S pic.twitter.com/5kQH0mljTz

— James Seyffart (@JSeyff) August 6, 2024

Spot Ether ETFs See $23M in Outflows, Lead By Grayscale’s ETHE

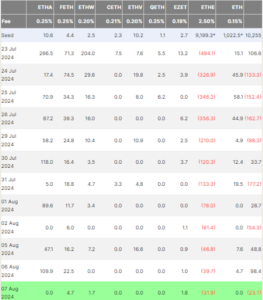

Spot Ethereum ETFs experienced net outflows, losing $23.7 million on July 7. Grayscale’s ETHE drove the negative flows, with $31.9 million in net outflows. Fidelity’s FETH saw net inflows of $4.7 million, and Bitwise and Franklin Templeton’s Ether funds also reported net inflows.

Yesterday, the total daily trading volume for ETH ETFs reached $322.85 million. Since the July 23 listing, these funds have experienced $387.7 million in net outflows. At the time of writing, ETH was trading at $2,422, showing a 3.85% decline over the past 24 hours.

Learn More

- Next Cryptocurrency to Explode in August 2024

- Toncoin Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Ponk Price Prediction 2024 – 2040

- Is It Too Late to Buy ONDO? Ondo Price Falls 21% in a Week, as Analyst Predicts a Rise to $6