Highlights:

- Golem transferred $115 million in Ethereum to major exchanges over the past 37 days.

- The project retains 231,400 ETH, valued at approximately $656 million.

- Golem has started Ethereum staking tests to support future growth and network decentralization.

Golem, one of the earliest Ethereum-based projects, has been making headlines with its recent large-scale transfers of ether (ETH) to major cryptocurrency exchanges. Over the past 37 days, Golem has moved approximately $115 million worth of 36,000 ETH to platforms such as Binance, Coinbase, and Bitfinex. Given the potential impact on the market, these transfers have raised eyebrows in the crypto community.

Golem, a project that raised 820,000 ETH in ICO in 2016, has transferred 36,000 ETH to Binance, Coinbase, Bitfinex, etc. in the past 37 days, worth about $115 million. Currently, Golem still has 231,400 ETH, worth about $656 million. https://t.co/EjLTyeEAmz

— Wu Blockchain (@WuBlockchain) July 8, 2024

Major ETH Transfers and Staking Tests

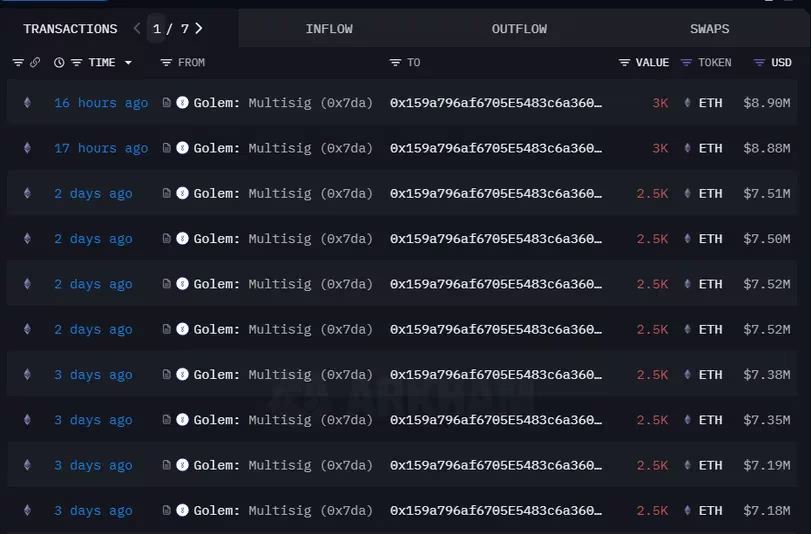

According to data from Arkham Intelligence, Golem’s main wallet has been actively transferring ETH to various exchanges. These transactions, typically under $10 million each, occur daily. Despite these significant transfers, Golem still retains a substantial reserve of 231,400 ETH, valued at around $656 million. This suggests a strategic approach to liquidity management and asset diversification.

Golem’s decision to move large amounts of ETH to exchanges is seen as a potential move to sell holdings, as cryptocurrencies held on exchanges are more readily available for trading. Given the substantial volume involved, this could influence market dynamics.

Early ICO Success and Current Developments

Golem was one of the pioneers of the initial coin offering (ICO) era, raising $8.6 million in ether within 29 minutes during its 2016 ICO. The project aimed to create a decentralized marketplace for computational power, where users could rent out their unused resources in exchange for Golem’s GLM tokens. This concept garnered significant interest and set a precedent for future ICOs.

Despite the large transfers, Golem remains committed to its development goals. Recently, Golem Network announced the start of Ethereum staking tests. Golem aims to support the Ethereum network’s growth and decentralization efforts by allocating a portion of its reserves to staking. The returns from staking will be reinvested into the network’s development, enhancing the ecosystem’s sustainability.

Strategic Moves for Future Growth

Golem’s staking initiative is part of a broader strategy to support the Ethereum ecosystem. Solo staking, which Golem plans to engage in, aims to reduce the dominance of large staking entities and promote a more decentralized network. This move is expected to contribute to Ethereum’s overall health and resilience.

Staking also allows Golem to diversify its assets and generate additional revenue. The staking income will fund ongoing projects and initiatives within the Golem Network, fostering innovation and development.

Golem’s recent activities underscore its strategic approach to asset management and network support. By transferring significant amounts of ETH to exchanges and initiating staking tests, Golem is positioning itself for future growth while contributing to the broader Ethereum ecosystem.

Learn More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- Solana Price Prediction: SOL Bulls Eye $153.71 as Bitcoin Uplifts the Market