Highlights:

- The German government transferred 700 BTC amid recent sales.

- The recipient’s address is still unknown, leading to speculation.

- Bitcoin’s price has dropped by over 1.29% following the news.

According to on-chain data from Arkham Intelligence, the German government transferred 700 Bitcoin (BTC), worth about $40 million, to an unknown wallet early Sunday. This move triggered another wave of initial bearish sentiment on social media. However, crypto users believe that market recovery might overshadow this development.

According to Arkham, the German Government transferred 700 BTC to the unmarked address: 139PoP…H7ybVu at 1:07 UTC+8 today, worth about $40.55 million. This may be a deposit address of an institution or OTC service. The German Government currently holds 39.826k BTC, worth about…

— Wu Blockchain (@WuBlockchain) July 7, 2024

The recipient address’s identity is currently unknown, sparking speculation within the cryptocurrency community. Some experts suggest it might belong to an institutional entity or an over-the-counter (OTC) service. Institutions and OTC services often use such addresses for large transactions to avoid impacting market prices significantly. This method also offers anonymity, which could explain why the address is unmarked.

German Government’s Bitcoin Transfers Spark Market Downturn

The German government has transferred over 3,000 Bitcoin to various crypto exchanges and unknown wallets. On July 4, 1,300 BTC, worth approximately $76 million, was moved to exchanges, causing the market trajectory to trend downward. Following this initial transaction, the government sent 500 Bitcoin, worth approximately $29 million, to the crypto exchange Bitstamp, while 400 BTC was sent to Coinbase and Kraken.

These transactions, along with the announcement of the repayment to Mt. Gox creditors caused a market downturn, pushing assets to lows not seen in months. Data shows that the German government currently holds over $2.3 billion worth of Bitcoin. The German government confiscated these Bitcoins during criminal investigations involving film piracy sites, darknet marketplaces, and other illicit activities.

Cotar Urges German Government to Stop Bitcoin Sales

This ongoing selling activity has drawn criticism from Joana Cotar, a member of the German Bundestag. She urged the government to develop a comprehensive Bitcoin strategy instead of hastily selling its holdings.

Statt #Bitcoin als strategische Reservewährung zu halten, wie es in den USA bereits debattiert wird, verkauft unsere Regierung im großen Stil. Ich habe @MPKretschmer, @c_lindner & @Bundeskanzler @OlafScholz darüber informiert, warum dies nicht nur nicht sinnvoll, sondern… pic.twitter.com/v9FpzmfLbp

— Joana Cotar (@JoanaCotar) July 4, 2024

Cotar further argues that Bitcoin provides an opportunity to diversify the state’s assets and reduce the risks of traditional investments. She also highlighted that Bitcoin’s scarcity and deflationary nature make it a hedge against inflation and currency devaluation.

Cotar stated:

“Instead of holding Bitcoin as a strategic reserve currency, as is already being debated in the USA, our government is selling on a large scale.”

Bitcoin Price Faces More Volatility

Bitcoin hit a two-month low due to uncertainty around the US presidential election, German and US government Bitcoin sales, ongoing Mt. Gox fund repayments, and selling pressure from struggling miners.

Mt. Gox, which was a leading cryptocurrency exchange before its collapse in 2014, has begun repaying its creditors. There are concerns that this influx of Bitcoin into the market could further depress prices if lenders immediately sell their received funds.

Cryptocurrency miners face financial pressure, with daily revenue dropping 75% since the April halving event. To cover costs, miners are selling their Bitcoin holdings, adding to selling pressure. Despite the recent decline, some experts remain optimistic about BTC’s long-term prospects. Market analyst Tony Sycamore sees this as a consolidation phase, suggesting Bitcoin could revisit its March highs and potentially reach $80,000. However, the short-term outlook is uncertain.

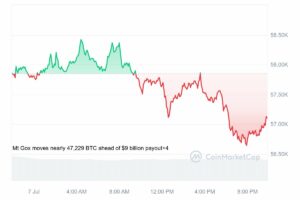

Bitcoin bounced back from its low of $53,550 on Friday, recovering most of its losses by the day’s end. The upward momentum continued on Saturday, with Bitcoin reaching a high of $58,488, indicating a bullish resurgence. However, Bitcoin experienced a slight pullback and closed at $58,251.

The struggle between bulls and bears continued on Sunday, showing early signs of bearish pressure resuming. At the time of writing BTC was trading at $57,106 currently down 1.29% on the daily chart. However, a recent rebound pushed the price above the key resistance level at $56,500, now acting as support.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Crypto Exchanges in 2024

- LayerZero Price Prediction: Can ZRO Rebound and Hit the $5 Mark this Summer?

- Justin Sun Plans Gas-Free Stablecoin Transfers on Tron