Highlights:

- ETH ETFs saw a $33.7M inflow on July 30 after four negative days.

- BlackRock’s ETHA led inflows with $118M; ETH dropped 0.60% in the past 24 hours.

- Bitcoin ETFs faced $18.3M outflows; BTC price slid 1.03%.

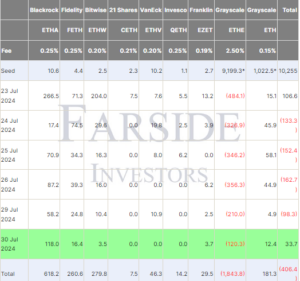

The nine US-based spot Ethereum (ETH) exchange-traded funds (ETFs) saw net inflows of $33.7 million on July 30, ending a four-day streak of negative flows. Although the figure isn’t striking, it marks the first inflow for the funds since their launch. Since July 24, about $547 million has exited spot Ether investment products.

On July 30, BlackRock’s iShares Ethereum ETF (ETHA) saw the largest inflows, totaling $118 million. Fidelity’s Advantage Ether ETF (FETH) attracted $16.4 million, while the Bitwise Ethereum Fund (ETHW) and Franklin Ethereum ETF (EZET) gained $3.5 million and $3.7 million, respectively.

The Grayscale Ethereum Trust (ETHE) was the sole spot Ether ETF to experience negative flows, recording $120.3 million in net outflows. The ETHE has faced outflows daily since its debut on July 23. In contrast, the Grayscale Ethereum Mini Trust (ETH), a spinoff of Grayscale’s ETHE, saw $12.4 million in inflows. Grayscale’s ETH is one of the lowest-cost spot ETH products in the US market.

The three other spot Ether ETFs recorded no flows. On Tuesday, trading volume for spot ETH products dropped to $563.22 million, down from $773.01 million on Monday and $933.86 million on Friday.

Just a day earlier, on July 29, Steno Research senior analyst Mads Eberhardt predicted that the large outflows from Grayscale’s ETHE would decrease this week, and it seems this has already started to happen.

The Ethereum ETF net outflow is yet to subside, but it is likely that it will happen this week. When it does, it's up only from there. pic.twitter.com/mJqbcyUTp5

— Mads Eberhardt (@MadsEberhardt) July 29, 2024

BlackRock’s ETHA Hits New Milestones

Since its launch, BlackRock’s iShares Ether ETF has recorded inflows daily. Consequently, total ETHA inflows have surpassed $618 million in just six trading sessions, according to Farside Investors.

According to ETH Store President Nate Geraci, the iShares Ether ETF has also secured a position among the top 15 ETFs by inflows. With over 330 ETFs launched in 2024, the iShares Ether ETF’s performance stands out. Geraci also noted that spot Bitcoin ETFs have dominated the top four inflows.

In *one* week of trading, iShares Ethereum ETF already in top 15 inflows of *all* ETFs launched this yr…

Top 15 out of approx 330 new ETFs.

Top 4 inflows all spot bitcoin ETFs btw.

— Nate Geraci (@NateGeraci) July 31, 2024

Ethereum Under Pressure Amid Significant ETF Outflows Since Launch

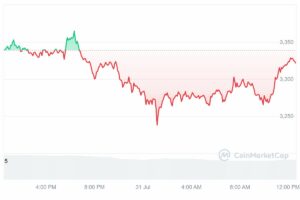

Amid ETF outflows, Ethereum’s price remains under pressure, dropping 4.5% over the past week. At the time of writing, ETH is trading at $3,321, reflecting a 0.60% decrease in the last 24 hours, with a market cap of $399 billion. Market analysts predict that ETH may experience sideways movement through August before potentially breaking out in September. A Fed rate cut in September could be a key catalyst for an ETH price rally.

Spot Bitcoin ETFs Experience Outflows

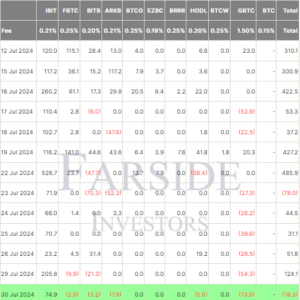

On Tuesday, the 11 spot Bitcoin ETFs in the US saw net outflows of $18.3 million, according to Farside Investors, ending a streak of four consecutive days of positive flows. BlackRock’s IBIT was the sole spot Bitcoin ETF to record net inflows, with $74.9 million flowing into the fund.

In contrast, Grayscale’s GBTC saw the largest outflows, with $73.6 million. It was followed by Ark and 21Shares’ ARKB, which had $7.9 million in outflows, VanEck HODL with $5.58 million, Bitwise BITB with $3.2 million, and Fidelity FBTC with $2.9 million in net outflows.

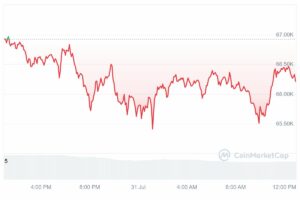

Bitcoin slid 1.03% over the past 24 hours to change hands at around $66,211 at the time of writing, according to CoinMarketCap. The overall crypto market was down 0.79%.

Read More

- Next Cryptocurrency to Explode in August 2024

- Ethena Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Bitcoin Price Prediction: Why BTC Breakout to $71k is Imminent