Highlights:

- Spot Ethereum ETFs saw positive inflows on Wednesday, led by BlackRock’s ETHA.

- Grayscale’s Ethereum Trust saw $78 million in outflows, crossing $2 billion total.

- The 12 US Bitcoin ETFs started August with $50.64 million in inflows.

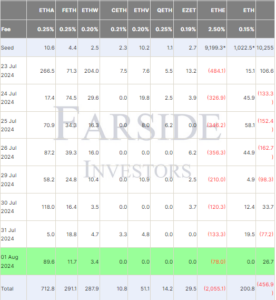

On August 1, the United States spot Ethereum (ETH) exchange-traded funds (ETFs) saw positive inflows despite five of nine ETFs showing neutral flows. According to Faride Investors data, ETH ETFs posted a net inflow of $26.7 million.

BlackRock’s iShares Ethereum ETF (ETHA) saw the largest inflows, totaling $89.9 million. Fidelity’s Advantage Ether ETF (FETH) attracted $11.7 million, while the Bitwise Ethereum Fund (ETHW) gained $3.4 million. The Grayscale Ethereum Trust (ETHE) was the only spot Ether ETF to see negative flows, with $78.0 million in net outflows. ETHE has faced daily outflows since its July 23 debut. On Thursday, Ethereum funds had a total trading volume of $331.11 million, down from $1.11 billion traded at their launch on July 23.

The day before, on 31 July, spot Ethe ETFs net flow turned negative following the Federal Reserve’s decision to keep interest rates unchanged, hinting at a possible rate cut in September. However, at the start of August, flows shifted back to positive territory.

Grayscale Ethereum ETF Outflows Cross $2B

On August 1, Grayscale’s Ethereum Trust recorded $78 million in outflows, pushing the total outflows to just over $2 billion since its conversion to a spot ETF. Unlike the other eight spot ETH ETFs launched as “newborn” funds, ETHE is a trust that provides institutional investors exposure to ETH. Before its conversion, ETHE held $9 billion in Ether. As of August 1, outflows have exceeded 22% of the initial fund.

Steno Research senior analyst Mads Eberhardt said the large outflows from Grayscale’s ETHE might ease by week’s end, which could be positive for ETH’s price. In a July 30 post, Eberhardt said, “When it does, it’s up only from there.”

The Ethereum ETF net outflow is yet to subside, but it is likely that it will happen this week. When it does, it's up only from there. pic.twitter.com/mJqbcyUTp5

— Mads Eberhardt (@MadsEberhardt) July 29, 2024

Ethereum Whale Activity Surges Amid ETH Volatility

Recently, the Ethereum blockchain experienced significant whale activity as the ETH price hovered around $3,144. Lookonchain attributed the recent ETH price drop to three wallets linked to Elwood, which deposited a combined 19,500 ETH worth $64 million on Binance over the past two days. As per Lookonchain, these wallets have a history of making such deposits before price declines.

Who dumped $ETH causing the price to drop?

We noticed 3 wallets related to #Elwood deposited 19,500 $ETH($63.66M) to #Binance in the past 2 days!

Coincidentally, these wallets deposited $ETH to #Binance every time before the price crashed!https://t.co/ME12Up3BIL pic.twitter.com/9dEbivNWrZ

— Lookonchain (@lookonchain) August 1, 2024

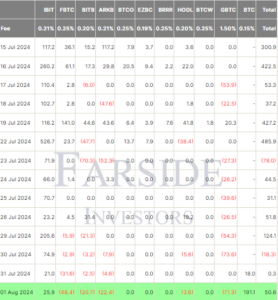

Bitcoin ETFs Log $50M in Inflows

The 12 US-listed spot Bitcoin ETFs also kicked off August with a reported daily net inflow of $50.6 million. Grayscale’s Bitcoin Mini Trust, which started trading on Wednesday, led net inflows with $191.13 million on Thursday, according to Farside Investors. It was followed by BlackRock’s IBIT, which experienced inflows of $25.9 million.

The inflows were offset by net outflows from five US funds. Grayscale’s GBTC experienced $71.3 million in outflows on Thursday, while Fidelity’s FBTC saw $48.4 million leave the fund. Ark Invest and 21Shares’ ARKB had $22.4 million in outflows. VanEck and Bitwise also reported net outflows, while the other five funds from issuers like Valkyrie had no flows yesterday.

The total daily trading volume for the 12 Bitcoin ETFs reached about $2.91 billion on Thursday, up from $1.37 billion on Wednesday. Since January, spot Bitcoin products have garnered a total net inflow of $17.74 billion.

Read More

- Next Cryptocurrency to Explode in August 2024

- Ethena Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Bybit Exits France Citing Regulatory Developments in EU