Highlights:

- Geraci expects several spot ETH ETFs to launch in the US this week.

- Minimal SEC feedback hints at imminent Ethereum ETF approval.

- ETH surges above $3300 following analyst’s prediction.

Nate Geraci, ETF analyst and president of The ETF Store, projected that eight spot ETH ETFs would be launched by the end of this week. Geraci’s forecast follows extensive discussions and regulatory filings surrounding the Ethereum ETFs.

In a July 14 X post, Geraci wrote:

“Welcome to spot ETH ETF approval week. Don’t know anything specific, just can’t come up [with] good reason for any further delay at this point.”

Welcome to spot eth ETF approval week…

I’m calling it.

Don’t know anything specific, just can’t come up w/ good reason for any further delay at this point.

Issuers ready for launch.

— Nate Geraci (@NateGeraci) July 14, 2024

Optimism Around SEC’s Ethereum ETF Approval

Bloomberg ETF analysts Eric Balchunas and James Seyffart had earlier forecasted that spot Ethereum ETFs could gain approval and commence trading as early as mid-July. According to Geraci, several issuers, including 21Shares and VanEck, filed amended registrations last week, hoping to receive the SEC’s final approval to list spot Ether ETFs. He said the SEC’s minimal feedback on these latest filings suggests they are close to being satisfied with the requests.

Matt Hougan, the Chief Investment Officer at Bitwise, stated that minimal amendments suggest imminent approval. The approval of a spot ETH ETF is anticipated to have a major impact on the ETH market and the broader crypto industry. This could drive significant inflows of institutional and retail capital into Ethereum. The move has the potential to mirror the success of spot Bitcoin ETFs. Hougan estimates that spot Ethereum ETFs could attract $15 billion in net inflows by the end of 2025.

Tom Dunleavy, managing partner at MV Global, reported he expects the funds to attract up to $10 billion in new inflows after their launch. This could drive Ether prices to new all-time highs by the end of the year. Dunleavy also mentioned that contrary to popular opinion among other ETF experts, Ether ETFs would be an “easier sell” to Wall Street compared to BTC ETFs.

Dunleavy stated:

“ETH has cashflows. It can be described as a tech stock, the app store of crypto, or an internet bond […] This is a much easier sell for financial advisors than ‘digital gold.”

Happy ETH ETF S-1 approval week to those who celebrate

— sassal.eth/acc 🦇🔊 (@sassal0x) July 14, 2024

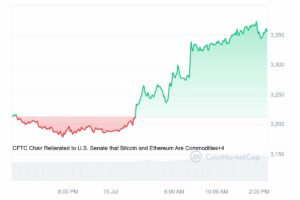

ETH Surges Above $3300 Following Analyst’s Prediction

The news has boosted Ethereum’s price. At the time of writing, ETH is trading at $3,355, marking a 4.34% increase in the past 24 hours. If Ethereum breaks through these resistance levels, it could surge past $3,500. However, if it fails to clear $3,340, it might correct downward, with support at $3,220 and $3,150.

Ethereum ETFs Launch Could Boost ETH Over BTC

Analyst Michael Van de Poppe predicts ETH will outperform BTC, especially with the launch of spot Ethereum ETFs. The analyst believes ETH/BTC prices are favorable for patient traders. The upcoming launch of the Ethereum ETF is expected to strengthen ETH’s position and increase its value with institutional investor participation.

The $BTC dominance has likely peaked. Ethereum has been outperforming Bitcoin for two months straight.

The upcoming Ethereum ETF will likely push it even further, through which the potential bearish divergence on the weekly timeframe seems inevitable to be valid. pic.twitter.com/gauZeQKYNf

— Michaël van de Poppe (@CryptoMichNL) July 13, 2024

Learn More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- ETH Surges Above $3300 as Analyst Tip Ethereum ETF Approvals This Week

- Will Solana Claim 50% of Ethereum’s Market Cap Following a Strong Week, as Envisioned by a Market Expert?