Highlights:

- Ethereum ETFs established a new weekly profit record after concluding the week with over $800 million in net inflows.

- Bitcoin ETFs’ remarkable run saw the entities amass over $2 billion in weekly gains.

- Bitcoin price slightly stabilizes above $100K as Ethereum continues to trade below $4,000.

On September 13, Bitcoin (BTC) and Ethereum (ETH) Exchange-Traded Funds (ETFs) witnessed their last trading of the week. As expected, both recorded net inflows to conclude the week profitably. Ethereum ETFs are on a fifteen-day gainful streak, while Bitcoin ETFs extended theirs to the twelfth consecutive day.

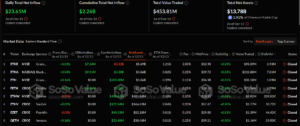

According to the renowned on-chain ETF tracker, Ethereum ETFs attracted roughly $23.61 million in gains following their most recent market outing. This profitable contribution raised ETH ETFs’ weekly profits to about $854. 85 million. The latest weekly gains imply that the token broke the previous $836.69 million high attained on December 6.

Ethereum spot ETF had a total net inflow of $23.6072 million yesterday, continuing its net inflow for 15 consecutive days. BlackRock ETF ETHA had a single-day net inflow of $9.5069 million. The total net asset value of Ethereum spot ETF is $13.783 billion. https://t.co/Tvs2oCSxTg pic.twitter.com/eqxwY3vdII

— Wu Blockchain (@WuBlockchain) December 14, 2024

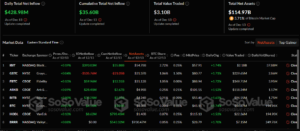

On the other hand, Bitcoin ETFs recorded $428.98 million in gains on December 13, soaring their weekly gains to approximately $2.17 billion. With growing institutional interests in Bitcoin, Ethereum, and other digital assets, chances abound that BTC and ETH ETFs’ remarkable run will persist for a more extended period.

Bitcoin spot ETF had a total net inflow of $429 million on December 13, continuing its net inflow for 12 consecutive days. BlackRock ETF IBIT had a net inflow of $393 million per day. The total net asset value of Bitcoin spot ETF is $114.969 billion. https://t.co/59u0BnEqLG pic.twitter.com/dkQIYxF4Y8

— Wu Blockchain (@WuBlockchain) December 14, 2024

Ethereum ETFs Record Reduced Market Activeness

According to the latest flow data, only three ETH commodities were active yesterday, as the remaining six entities recorded zero activities. Notably, all the active ETFs attracted only profits, which invariably implies that none incurred losses. BlackRock Ethereum ETF (ETHA) topped the profits chart with its $9.51 million input.

Other profitable entities include Grayscale Ethereum ETF (ETHE), with approximately $7.24 million contribution, and Fidelity Ethereum ETF (FETH), with about $6.86 million cash inflows. With the new inputs, Ethereum ETF cumulative net inflows soared to about $2.26 billion. The total value traded was roughly $453.81 million, while the total net assets reflected $13.78 billion.

BlackRock Leads the Bitcoin ETFs Profitable Pack

Unlike Ethereum, Bitcoin ETFs witnessed heightened activeness. Eight entities were active on December 13, and three registered zero flows. Grayscale Bitcoin ETF (GBTC) was the only entity that attracted cash outflows valued at approximately $105.76 million. In profitable entities, BlackRock Bitcoin ETF (IBIT) recorded gains of about $393.03 million to stand out as the only commodity with over $100 million in profitable input.

In the remaining BTC ETFs that attracted cash inflows, three registered profits valued above $10 million. They include Fidelity Bitcoin ETF (FBTC) ($59.96 million), Bitwise Bitcoin ETF (BITB) ($33.21 million), and ARK 21Shares Bitcoin ETF (ARKB) ($28.41 million). Three other commodities witnessed profits below $10 million. They are VanEck Bitcoin ETF (HODL) ($8.62 million), WisdomTree Bitcoin ETF (BTCW) ($7.01 million), and Grayscale Mini Bitcoin ETF (BTC) ($4.51 million).

Following yesterday’s gainful contributions, Bitcoin ETF cumulative net inflows surged to about $35.6 billion. The total value traded was approximately $3.10 billion, while the total net assets reflected $114.79 billion. Meanwhile, the total net assets valuation represents 5.71% of Bitcoin’s $2 billion market capitalization.

Bitcoin Remains Steady Above $100K as Ethereum Continues to Trade Below $4,000

At the time of writing, Bitcoin is changing hands at about $101,300, reflecting a 1.2% upswing in the past 24 hours. Despite its remarkable price actions, the flagship cryptocurrency’s 24-hour trading volume is down by approximately 18.17% and boasts roughly $55.67 billion in valuation.

On the other hand, Ethereum is up by a slight 0.4% in the past 24 hours, reflecting approximately $3,890 in selling price. The world’s most valuable cryptocurrency has struggled to reclaim $4,000 after visiting the level at some points this month.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.