Highlights:

- DeFi Development aims to raise $1 billion, mainly for purchasing Solana tokens.

- The company has already secured $42 million to boost its Solana holdings.

- Solana’s price shows bullish momentum, with analysts targeting $200 for a breakout.

DeFi Development Corporation, now often called the “MicroStrategy of Solana,” has filed a $1 billion shelf offering with the U.S. Securities and Exchange Commission (SEC), as per a filing released on Friday. The company plans to use the money from the offering for general business needs. A big part of this plan is to buy Solana (SOL) tokens as part of its new treasury strategy.

This type of offering lets a company sell its securities step by step over time, instead of selling everything at once. The filing outlines a variety of securities, including preferred stock, warrants, common stock, and debt instruments. It also noted that any mix of these could be sold, with the total value not exceeding $1 billion.

The company stated:

“We may sell any combination of these securities in one or more offerings, at prices and on terms to be determined prior to the time of the offering, with an aggregate offering price of up to $1,000,000,000.”

The exact timeline for the shelf offering hasn’t been disclosed yet, and it still requires approval from the SEC. DeFi Development Corp is among a growing list of publicly listed firms showing interest in Solana. Similar to companies like Sol Strategies, Upexi, and Galaxy Digital, DDC is acquiring SOL to give its investors a new way to access digital assets.

The approach mirrors Michael Saylor’s method of building a large Bitcoin treasury. However, DDC and Sol Strategies are also running validator nodes and staking their Solana tokens, allowing them to earn rewards and make their holdings more useful.

Solana MSTR ramping up pic.twitter.com/65jkXjZafe

— db (@tier10k) April 25, 2025

DeFi Development Expands SOL Holdings Amid Growing Market Interest

DeFi Development Corporation, previously known as Janover, offers software for commercial property debt financing. Last year, they started accepting Bitcoin, Ethereum, and Solana as payment. Earlier this year, they hired former Kraken executives to help with their shift toward crypto.

Currently, DeFi Development owns about $48.2 million in Solana, including rewards from staking, and aims to increase this amount even more. A report from Coinbase shared that the company has already secured $42 million through convertible debt to help with its first Solana purchases. Coinbase also noted that the company could become the first big corporate SOL holder.

In the wider Solana world, some new events have brought more excitement. Big amounts of SOL have recently been sent to exchanges, showing strong activity in the market. Lookonchain shared that Kraken got a large deposit of 117,913 SOL (worth about $18.26 million) from Pumpfun. This could mean more price movements ahead. It also hints that interest in Solana is growing, especially among big investors.

Pumpfun(@pumpdotfun) deposited 117,913 $SOL($18.26M) to #Kraken again in the past 2 hours.

So far, #Pumpfun has deposited 3,097,265 $SOL($575M) to #Kraken at $186 and sold 264,373 $SOL for 41.64M $USDC at $158.https://t.co/LwqXbrs7oc pic.twitter.com/gVUgW9E5T3

— Lookonchain (@lookonchain) April 25, 2025

Solana Gains Momentum as Big Players Join In, Eyes Set on $200 Breakout

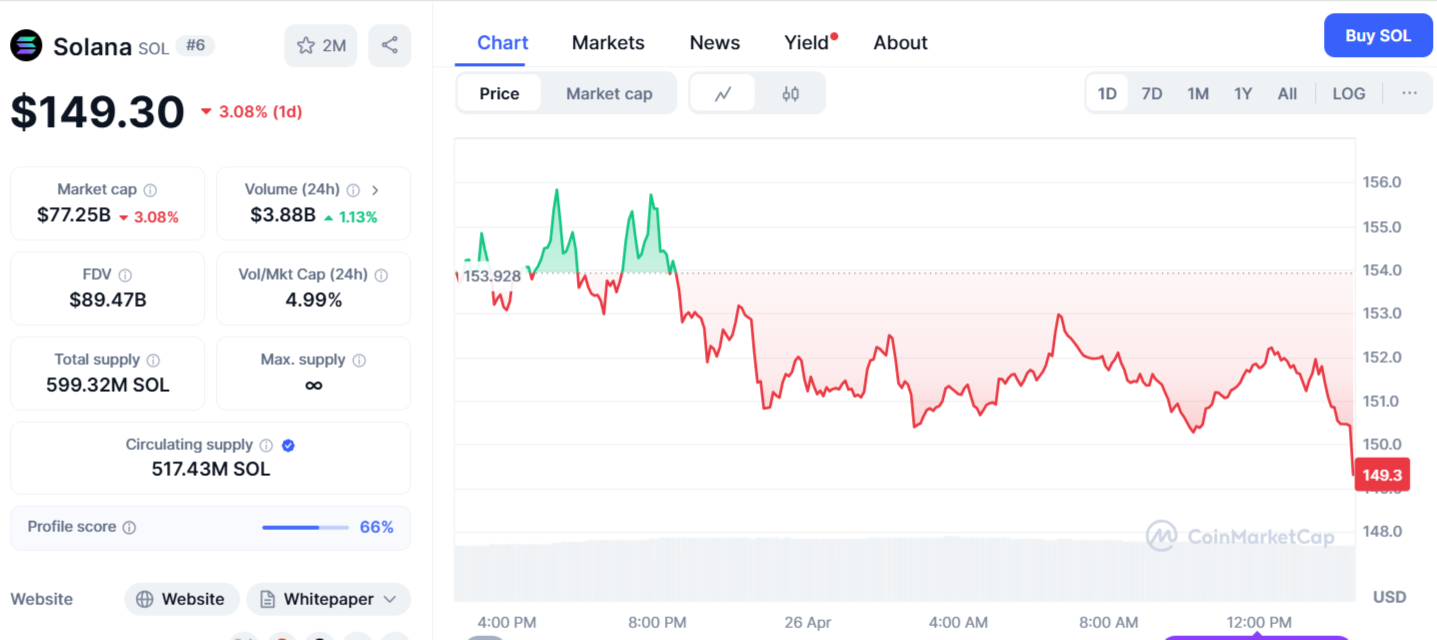

With big investors like DDC joining, Solana is getting more attention. Charts now suggest Solana’s price could go up soon. At the time of writing SOL was trading at $149, reflecting a 3.08% decrease in the past 24 hours.

Solana was trading between $126 and $200 for almost a year. Recently, the price jumped from $146.74 to over $153.88, reclaiming the $155 level. Crypto analyst The Birb Nest called the move above $155 a fakeout recovery, meaning the drop below was temporary. He believes Solana is now back in a strong uptrend, with targets set at $180 and $200. A break above $200 could start a bigger rally.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.