Highlights:

- Crypto market drops as trade war fears overshadow strategic reserve announcement.

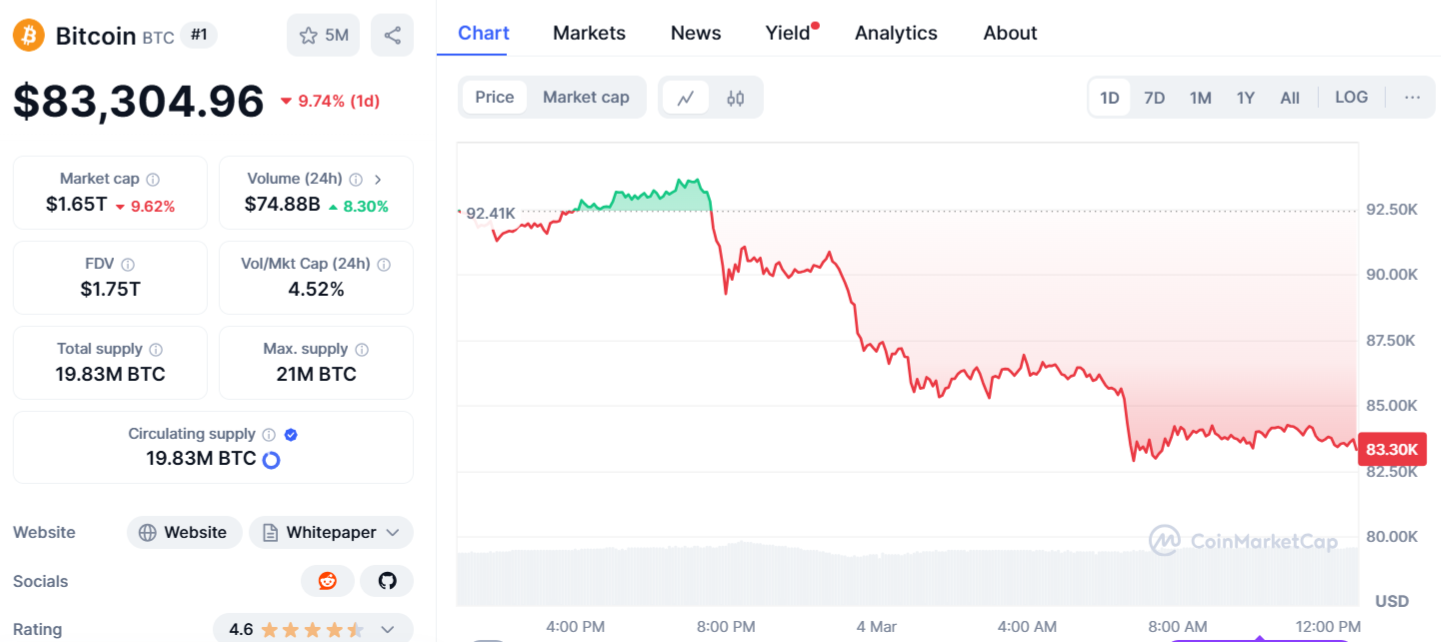

- Bitcoin falls near $83,000 as altcoins see heavier losses.

- Investors eye White House Crypto Summit for market recovery signals.

The cryptocurrency market dropped sharply on Tuesday as investors reacted to macroeconomic data and ongoing tariff uncertainties. It wiped out previous gains driven by President Donald Trump’s weekend proposal for a US strategic crypto reserve.

Crypto Strategic Reserve Sparks Market Surge, But Trump’s Tariffs Lead to Losses

On March 2, Donald Trump announced the plan to create a crypto strategic reserve that will include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA). The announcement, posted on social media, triggered a strong market surge, leading to significant price increases for major digital assets.

However, concerns over a trade war quickly overshadowed the excitement surrounding the US crypto reserve. The market decline worsened after Trump confirmed that 25% tariffs on both Canada and Mexico would be implemented on March 4. “They’re going to have to have a tariff. So, what they have to do is build their car plants — frankly — and other things in the United States, in which case they have no tariffs,” Trump stated.

The White House has also confirmed a 20% tariff on Chinese imports. Initially, a 10% tariff was in place, and as of March 4, an additional 10% had been added. This represents a significant escalation in the U.S.-China trade war. Tariffs are increasing at a much faster pace than during Trump’s first term. The rising tariffs are expected to increase trade costs between the US, Canada, and Mexico. This could negatively impact businesses and may also slow economic growth.

Tariffs can raise market volatility, inflation, and mining costs, affecting crypto liquidity. Investors may shift assets based on economic conditions.

Crypto Market Plunges as Strategic Reserve Coins Suffer Heavy Losses

Amid the broader crypto market downturn, the cryptocurrencies proposed for the Crypto Strategic Reserve have suffered significant losses. The total cryptocurrency market cap has declined by more than 12% in the last 24 hours. After surpassing $94,000 on Sunday, Bitcoin has retreated. At the time of writing, the leading digital asset was trading near $83,304, marking a nearly 9.74% drop.

Ethereum, the second-largest cryptocurrency, has dropped by approximately 12.88% to $2,080.

XRP plunged 13.5% to $2.30, while Solana and Cardano saw even larger declines, each dropping over 15%.

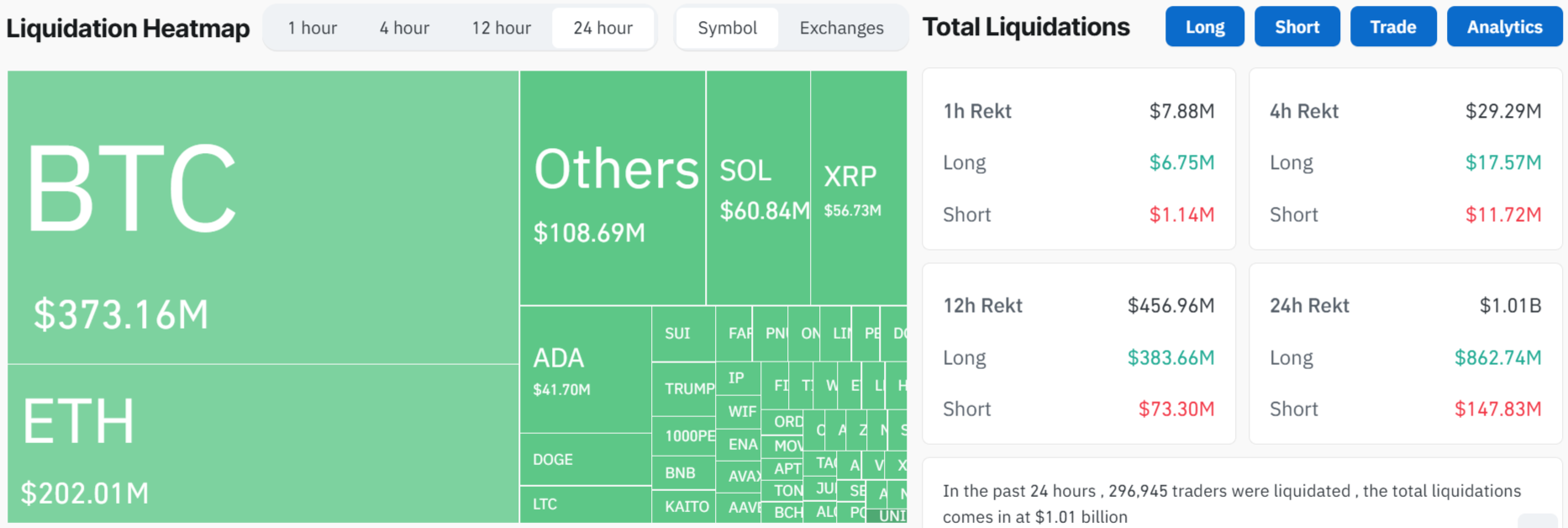

The market sell-off led to liquidations totaling $1.01 billion, impacting more than 296,945 traders within the last 24 hours, according to CoinGlass data. Bitcoin saw $373.16 million in liquidations, while Ethereum recorded $202.01 million. Among altcoins, Solana experienced $60.84 million in liquidations. XRP followed with $56.73 million, while Cardano saw $41.70 million in losses.

Investors Await White House Crypto Summit as Hayes Predicts Bitcoin Recovery

Investors anticipate the first White House Crypto Summit on Friday, March 7, despite the market decline. Trump will host the event, while White House AI and Crypto Czar David Sacks will oversee it. The summit will share insights into the crypto reserve and new regulations.

Arthur Hayes expects Bitcoin to recover before traditional markets. He sees falling U.S. Treasury liquidity as bullish but warns BTC may test $70,000. Hayes believes Bitcoin remains in a long-term bullish cycle and expects it to exceed $1 million eventually.

As promised, "KISS of Death" details how Trump will dominate JAYPOW into printing money once more. In the meantime $70k $BTC is still on the cards.https://t.co/6HKIBp9fJF pic.twitter.com/GlzHKCj4sb

— Arthur Hayes (@CryptoHayes) March 4, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.