Highlights:

- The price of Chainlink rises 5%, reaching $14, as trading volume spikes 60% in the past 24 hours.

- GEMx adopts Chainlink’s CCIP and Proof of Reserve to prevent mint attacks.

- Chainlink Technical indicators show a bullish outlook with a potential surge to $18.

The Chainlink price has experienced a notable surge, rising to $14, representing a 5% increase over the past 24 hours. Its daily trading volume has notably accompanied the price movement, rising 60%, indicating intense market activity. This recent increase comes amid GEMx, a platform that aims to onboard the emerald market on-chain, has declared its collaboration with Chainlink. The given strategic partnership implies the implementation of CCIP (Cross-Chain Interoperability Protocol) and Proof of Reserve.

GEMx (@EmGemXofficial)—a platform bringing the emerald market onchain—has adopted Chainlink CCIP and Proof of Reserve.

By leveraging Proof of Reserve Secure Mint and CCIP, GEMx mitigates against infinite mint attacks by preventing the issuance of unbacked tokens and enables… pic.twitter.com/i0yp6Ae76G

— Chainlink (@chainlink) July 8, 2025

The combination of Proof of Reserve, Secure Mint, and CCIP will enable GEMx to counter infinite mint attacks, a potential threat scenario. These attacks occur in cases where unbacked tokens are created, thereby destabilizing the market and exposing investors to significant risk concerns. The Proof of Reserve offered by Chainlink will enable GEMx to ensure that all the produced tokens are collateralized by physical assets.

LINK Derivatives Market Upholds a Bullish Outlook

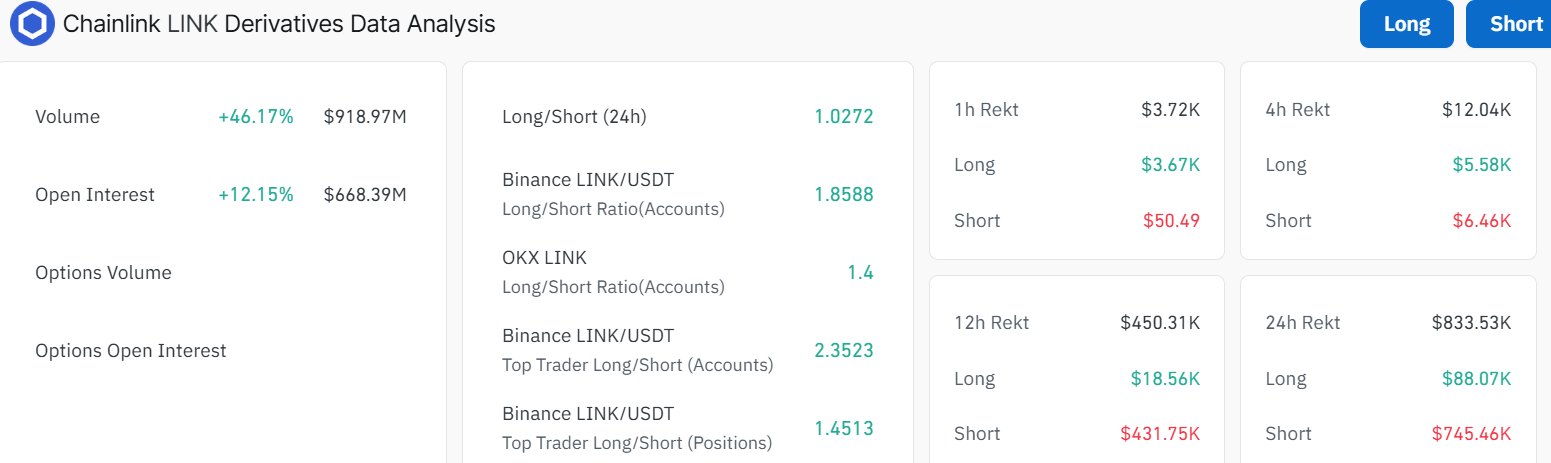

Recently, as shown in the derivatives domain, the analysis of data provided by Chainlink reveals major patterns in the LINK/USD market. The data indicate massive growth in terms of volumes and open interest, with the total volume increasing by 46.17% to 918.97 million.

Such a surge in trading activity suggests a growing interest in the LINK token. Likewise, open interest has increased by 12.15%, reaching a total of $668.39 million. These numbers indicate an increasing trust in LINK’s future performance, and it can be seen that traders and investors are preparing to capitalize on its future growth.

The analysis also reveals interesting details about the prevailing market sentiment, with a 24-hour long/short ratio of 1.0272. The ratio signifies a generally bullish expression of the equity between long and short positions on the market.

Chainlink Price Aims for a Breakout to $18 in the Short Term

The LINK/USD 1-day chart’s outlook timeframe indicates that the altcoin is currently in a descending parallel channel. Furthermore, the bulls have established strong support around the $13.88 level, giving them the strength to attempt a breakout above the $16.51 immediate resistance. If the current conviction holds, the bulls may strike above the governing channel, as the derivatives analysis above supports the bullish grip.

The RSI and MACD suggest that the token is experiencing a moderate bullish movement. Its RSI is at 56.39, indicating that LINK is in a neutral zone, but it may be poised to earn more profits when it breaks through important resistance levels. The MACD also upholds a buy signal, manifested by the blue MACD line crossing above the orange signal line. In the meantime, traders are free to buy more LINK tokens unless market sentiment changes.

With Chainlink quietly dominating the stablecoin space, its price may strike to the upside soon. This is reinforced by the current positive technicals, backing a potential breakout. If the support at $13 holds, the bulls could continue the upside movement, obliterating the key barrier at $16. A break above this level will likely see the bulls target the $18-$20 range in the short term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.