Highlights:

- Cardano price slips 2% to $0.80, as trading volume plummets 7%.

- The drop comes despite PayPal’s announcement of rolling out over 100 cryptocurrencies for purchases.

- Technical indicators are showing mixed signals, with a potential drop to $0.73.

The Cardano price has dropped 2% to $0.80, as its trading volume slumps 7% to $1.09 billion. The recent drop comes despite Digital payments giant PayPal saying it is rolling out a service that lets US merchants accept over 100 cryptocurrencies in payment for purchases as it aims to cut cross-border fees.

BREAKING: 🇺🇸 PayPal Is Launching, Pay With Crypto, In The Coming Weeks!

Covering 90% of the $3+ trillion Crypto Market Cap, Pay with Crypto offers the ability to pay with 100 cryptocurrencies including BTC, ETH, USDT, $XRP, BNB, Solana, USDC and many others!

Clarity Act Will… https://t.co/Ofyo3d3rNV pic.twitter.com/al2xitsn79

— Good Morning Crypto (@AbsGMCrypto) July 28, 2025

The feature, Pay with Crypto, which will be available in the coming weeks, will enable shoppers to use crypto wallets, such as MetaMask, Phantom, Kraken, and Coinbase, at checkout. Payments can be made with digital assets, including ADA, BTC, SOL, and stablecoins such as USDT and USDC, as well as other cryptocurrencies.

Cardano Price Slips 2% as $5.68M in Longs are Liquidated

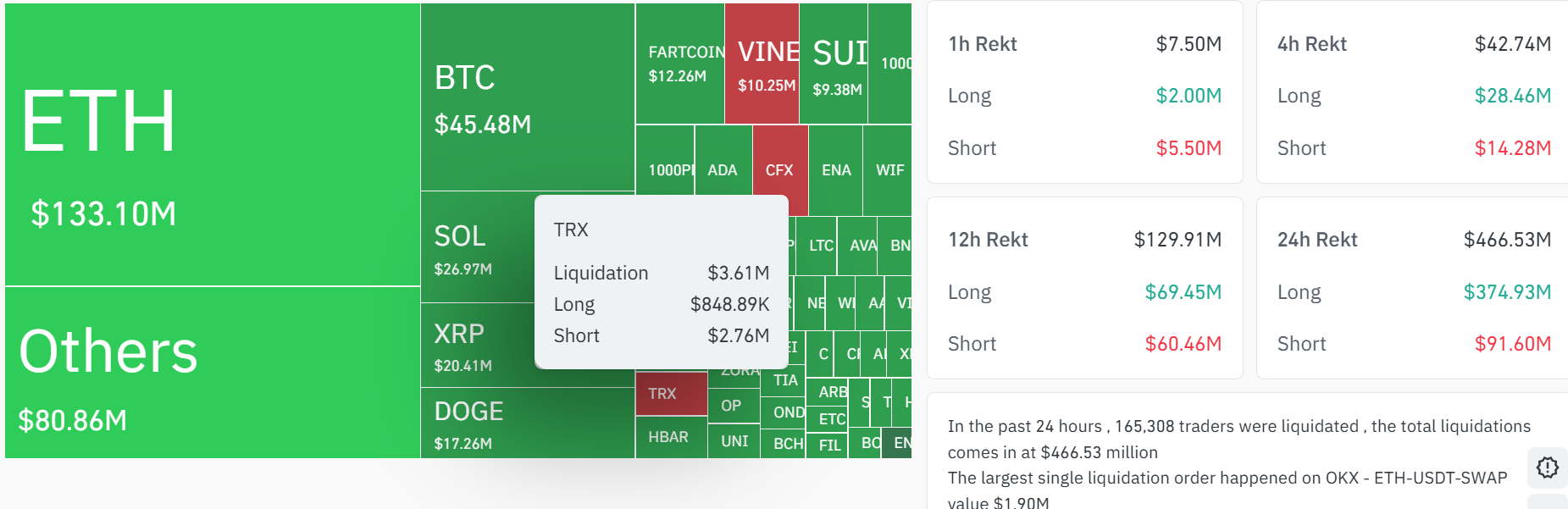

The Cardano price has slipped 2%, reaching an intraday high of $0.84 following recent announcements. The recent drop occurred as many traders using high leverage were forced out of their positions, resulting in $5.99 million in TRX trades being liquidated, primarily long trades.

In total, ADA saw $5.99 million in liquidations, with $5.68 coming from long trades. Across the entire cryptocurrency market, liquidations totaled $428 million in the last 24 hours, with Ethereum leading the wipeout at $133 million.

Cardano price daily chart outlook shows a looming cup and handle pattern. Despite the recent pullback that allowed the bulls to sweep through liquidity, ADA is still maintaining a bullish sentiment. This is reinforced by the 50-day SMA ($0.6756) and the 200-day SMA ($0.7386) acting as the immediate support zone, providing the bulls with a foothold for further upside.

The Relative Strength Index (RSI) currently indicates that ADA is bullish, as it sits above the 50-mean level at 57.53. There is more room for further upside after ADA retraced from the 82.01 overbought zone, sweeping enough liquidity.

Nevertheless, the Moving Average Convergence Divergence (MACD) indicator shows that a sell signal is in play. This is reinforced as the blue MACD line (0.0436) has flipped below the orange signal line (0.0509). In such a scenario, traders should be cautious, as the sell signal indicates that the Cardano price may continue to drop if the bulls fail to regain momentum.

ADA Eyes 28% Gains If Bulls Gain Momentum

Looking at the technical indicators, it seems Cardano price could be gearing up for a massive rally. If the cup and handle pattern comes into play, the ADA bulls could rally towards $1.03, marking 28% gains from current levels. However, the MACD’s blue line dipping below the orange signal line is a red flag, showing momentum is shifting, and fast. If ADA busts below $0.73 with conviction, the next stop could be $0.67, aligning with the 50-SMA support. A worst-case scenario would be a crash toward $0.62-$0.54 if panic sets in.

On the flip side, if bulls step in and push past $0.90, Cardano price might dodge the bullet and aim for $1.13. Meanwhile, the 2% drop is not a lock, but the chart is showing warning signs. Traders might want to keep an eye on the key zones and the RSI dip.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.