Highlights:

- Cardano’s price is down 4% to exchange hands at $0.36, as bearish sentiment builds.

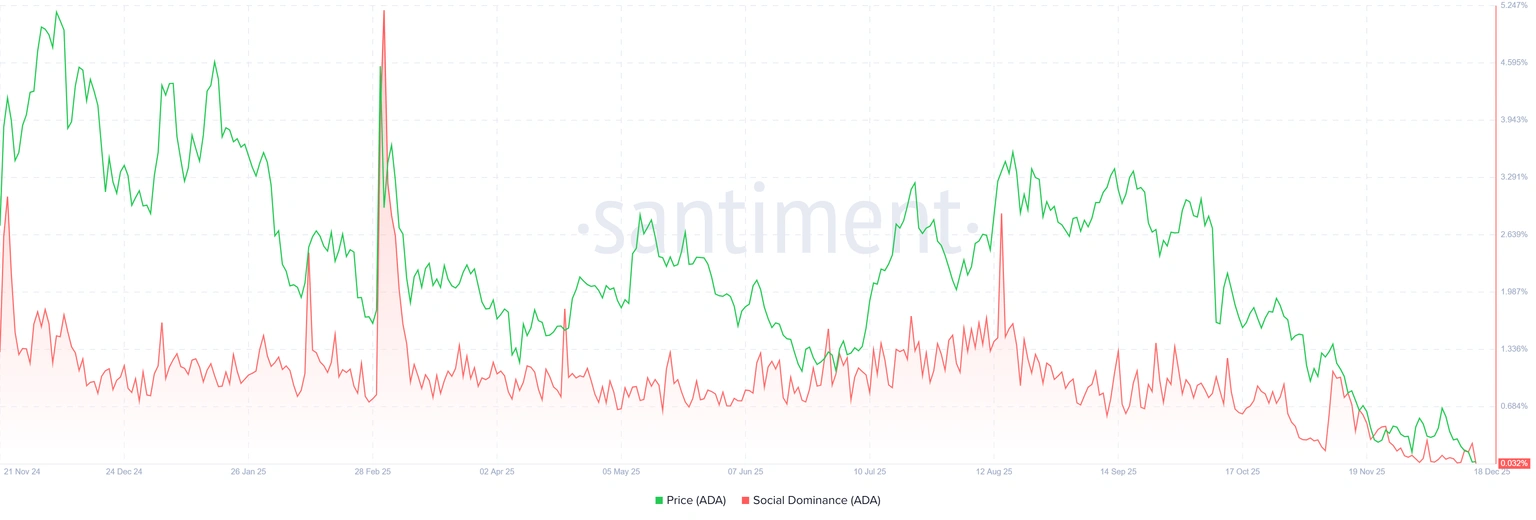

- ADA on-chain activity shows a drop in social dominance, suggesting a bearish grip.

- The technical outlook shows further downside towards $0.29, as momentum indicators flip negative.

The price of Cardano (ADA) is red, falling to $0.3636, marking a 4% decline in the past 24 hours. This further pullback may intensify as the social dominance of ADA declines, implying that traders are bearish. Technically, weakening momentum indicators also point to further downside as ADA risks further drop to $0.29.

The Social Dominance Cardano indicator by Santiment shows a negative perspective. The index is used to estimate the proportion of ADA-related coverage in the cryptocurrency realm. It has been declining since mid-November to an annual low of 0.032% on Thursday. Such a decline is a sign that the market is losing interest in the project and that Cardano investors are losing their confidence.

The index of Age Consumed, as presented by Santiment, also points to bearishness. The volatiles in this index indicate that dormant tokens (tokens that are kept in wallets over an extended period) are on their way and can be utilized to identify short-term local tops or bottoms.

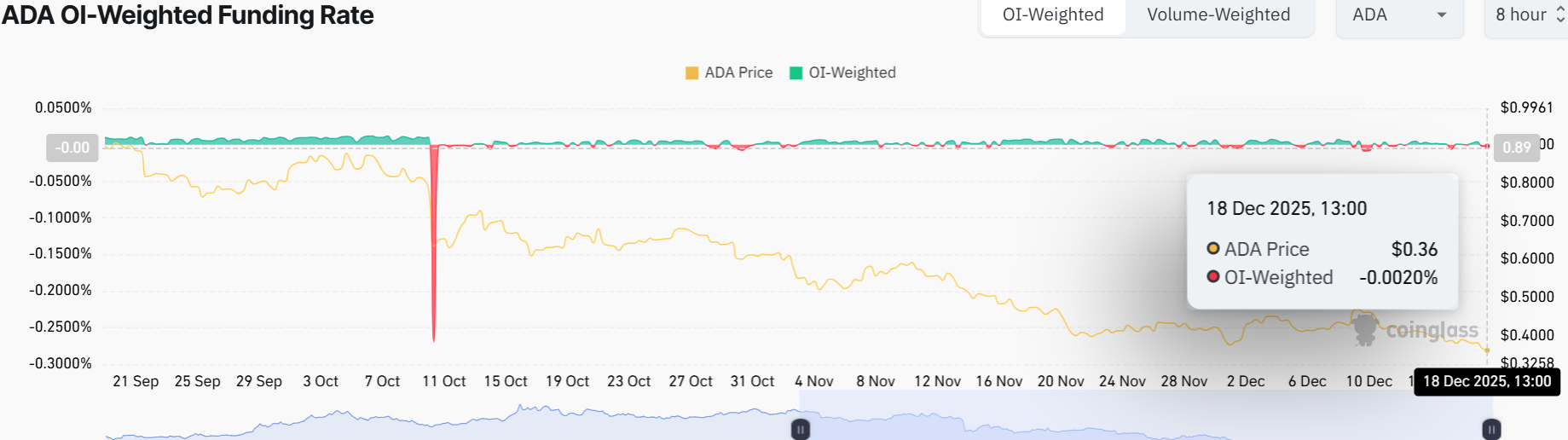

Additionally, more data support the negative forecast regarding Cardano on the derivatives market. According to Coinglass, the OI-Weighted Funding Rate, there are a lot more traders who are trading on the view that the price of ADA will continue to fall, as compared to traders who are betting that the price will rise.

The measure has flipped negative on Thursday to -0.0020%, implying that shorts are paying longs. Traditionally, the ADA prices dropped drastically when the funding rates flipped to the negative.

ADA Could Drop to $0.29 as Selling Pressure Stays Strong

Technically, Cardano’s price action has been very choppy, as the crypto market awaits the upcoming Bank of Japan (BoJ) hike rate decision. The daily chart shows the price currently at $0.36, down nearly 13% over the past seven days.

The altcoin is notably sitting under both the 50-day Simple Moving Average (SMA) at $0.47 and the 200-day SMA at $0.68, both crucial reference points for long-term traders. If price remains below the key moving averages, the next likely support sits at $0.29, which is a previous strong demand zone.

A quick look at momentum indicators is still bearish. The RSI is under 50 (currently 32.95), showing that bears hold the edge. The MACD is negative as a bearish divergence has manifested, backed by the red histograms.

On the upside, recovering above the $0.45 immediate resistance zone would be the first sign of strength, while any break above $0.47 opens the door for a move back to the $0.68.

In summary, Cardano price could stay volatile while whales decide their next move. If buyers hold the $0.45 zone and push past resistance at $0.47, the price may recover quickly. But further heavy selling pressure risks driving the price to $0.29, as predicted by Ali Martinez.

Channel breakout on Cardano $ADA puts $0.29 into focus. pic.twitter.com/cOTYX71cOl

— Ali Charts (@alicharts) December 17, 2025

For traders and investors, the coming days will likely bring a key test for ADA’s longer-term bullish narrative. In the meantime, the next move could decide whether the altcoin rebounds or ADA risks further downside to $0.29.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.