Highlights:

- Cardano’s price has decreased about 15% in the past week, to trade at $0.29 today.

- The Santiment outlook shows increased whale offloading, indicating intense selling pressure.

- The technical outlook sends mixed signals as ADA bulls eye a rebound to the $0.36 zone.

Cardano (ADA) price is trading in the red, currently at $0.29 at the time of writing on Monday, after a correction of over 15% last week. The general crypto market is currently wobbling, as on Monday, Bitcoin (BTC) dropped to less than 75,000. On-chain, there is evidence that ADA whales are dumping tokens, whereas technically the outlook is bearish with Cardano very near its last price point of $0.27 lows.

The data of Supply Distribution provided by Santiment suggests a bearish outlook of a more significant decrease in the number of large-wallet holders (whales) exposed to Cardano. The measure shows that whales that are 100,000 to 1 million (red line), 1 million and 10 million (yellow line), and 10 million and 100 million ADA tokens have lost 160 million tokens since Thursday.

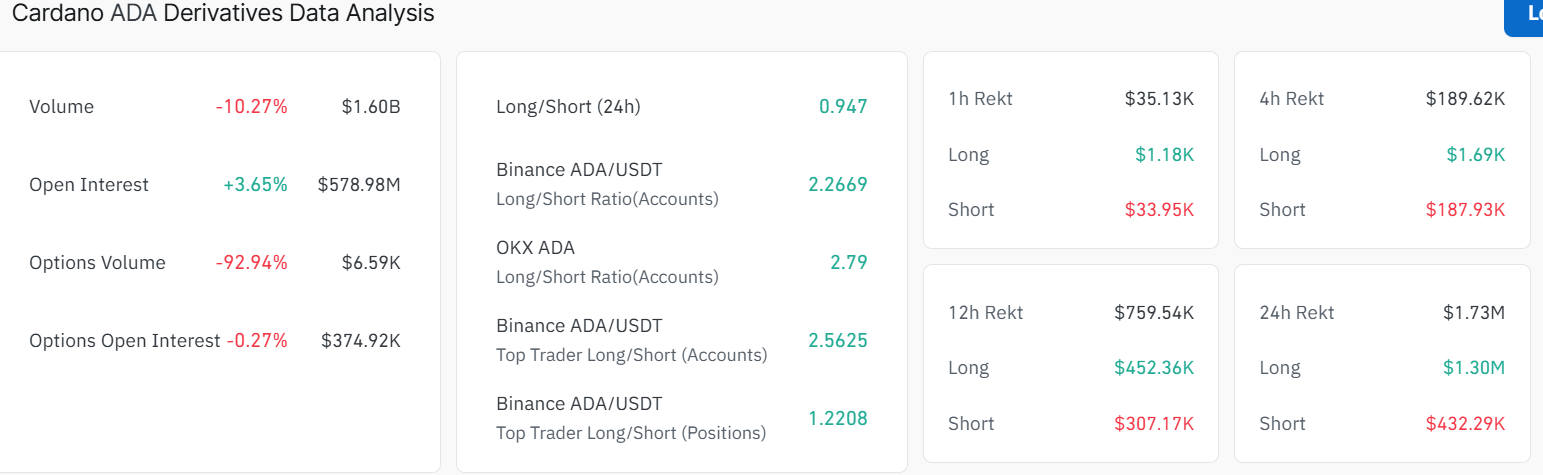

On the other hand, the derivatives market is showing mixed signals. According to Coinglass data, the ADA open interest has soared 3.65% to $578 million, indicating renewed confidence, as new money is flowing into the ADA market. This recent surge in OI may cause ADA bull’s eye a rebound to $0.36 in Cardano price if they show momentum.

ADA Bulls Eye a Rebound to $0.36 Zone

The Cardano price has been in a prolonged downtrend within a triangle pattern, hitting a low near $0.29 in the last 24 hours. The coin is still below both its important 50-day simple moving average (SMA) at $0.36, which acts as an immediate resistance zone, and the 200-day SMA at $0.61.

The $0.36 serves as resistance, meaning ADA needs to clear this to regain upward momentum. Looking at the chart, the Cardano price is trading between key retracement levels near $0.36 to around $0.28. The price currently sits close to the lower boundary of the triangle at $0.29, as bulls attempt a recovery.

Technical indicators reflect bearish market conditions. The Relative Strength Index (RSI) is near 31.99, suggesting no strong momentum, as the token is almost oversold. The MACD is slightly below the signal line but close to neutrality, signalling possible price consolidation. Meanwhile, the bears are still upholding the upper hand, cautioning traders of intense selling momentum.

Looking at the bigger picture, if ADA breaks above the 50-day SMA at $0.36, the next resistance zone lies between $0.42-$0.47. Surpassing this could trigger renewed buying appetite, causing a spike towards $0.61, major resistance, which aligns with the 200-day SMA.

However, if the price falls below the support zone around $0.28, ADA might revisit lower supports near $0.27 and $0.26, risking further short-term selling. However, overall market sentiment is cautious, and most technical indicators show that a break below $0.28 would likely trigger a move to $0.27. Meanwhile, with the rising OI, ADA bulls eye a rebound to $0.36.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.