Highlights:

- Cardano price aims to find support at $0.82 mark, as analysts eye a rally towards $1.20.

- ADA derivatives data ignite a recovery phase with a positive funding rate.

- ADA bearish indicators suggest a potential downtrend if the bulls fail to regain momentum.

The ADA token has decreased 0.35% to trade at $0.81 in the past 24 hours. However, the trading volume has risen 99% to $1.3 billion, indicating intense investor confidence in the market. Meanwhile, Charles Hoskinson, the CEO of IOHK and founder of Cardano, is making some aggressive statements about the future of blockchain.

BREAKING NEWS:

CARDANO WILL WIN, MY ENTIRE LEGACY DEPENDS ON IT— CHARLES 🙀🙀🙀@IOHK_Charles says his life, brand, and reputation are tied to Cardano’s success, so he has no incentive to see it fail.

He stresses that Cardano must win against competitors like #Ethereum.

He… pic.twitter.com/HYAwOwIpRU

— Mintern (@MinswapIntern) August 31, 2025

He also expressed his expectations that Cardano would have to outperform Ethereum in order to establish itself as a formidable blockchain network. This has already become the standard of decentralized applications and Smart contracts.

Cardano Derivatives Data and Market Movements

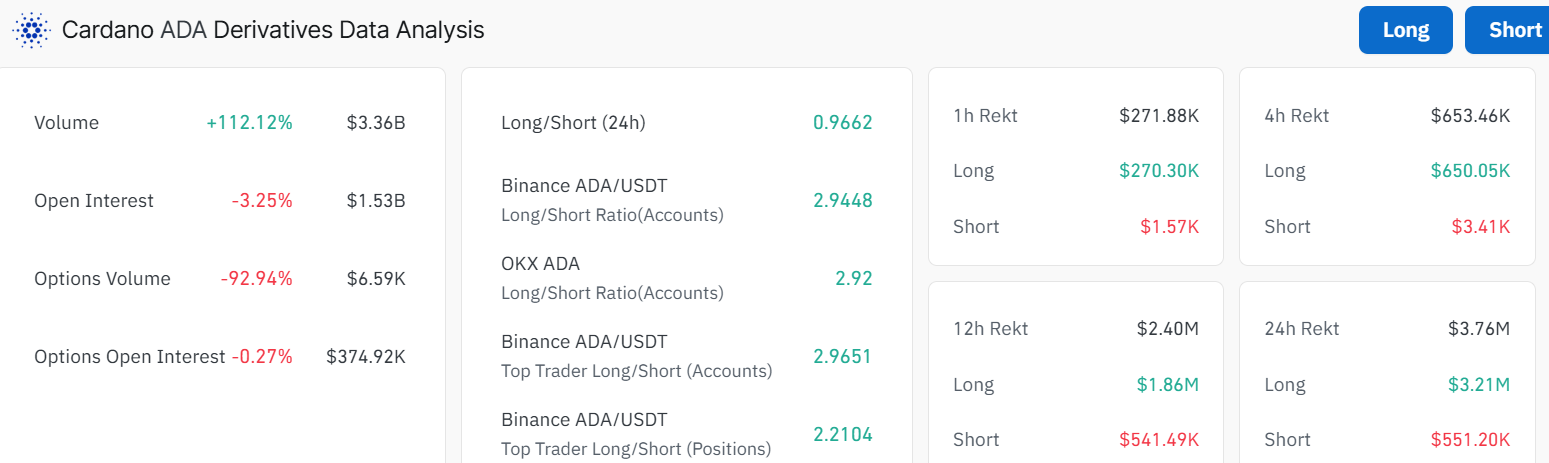

The Cardano derivatives volume has increased by 112.12% in the past 24 hours to $3.36 billion. The network is exhibiting high investor activity, although the open interest has decreased slightly by 3.25% to $1.53 billion. This may be an indication that investors remain hopeful about Cardano’s long-term price potential, despite the short-term volatility.

Notably, the data indicate that the mood is neutral, with a long-to-short ratio of 0.96. This means that the traders are equally split regarding their bullish and bearish positions. The existence of a favorable market environment can be viewed as a positive indicator of future price action.

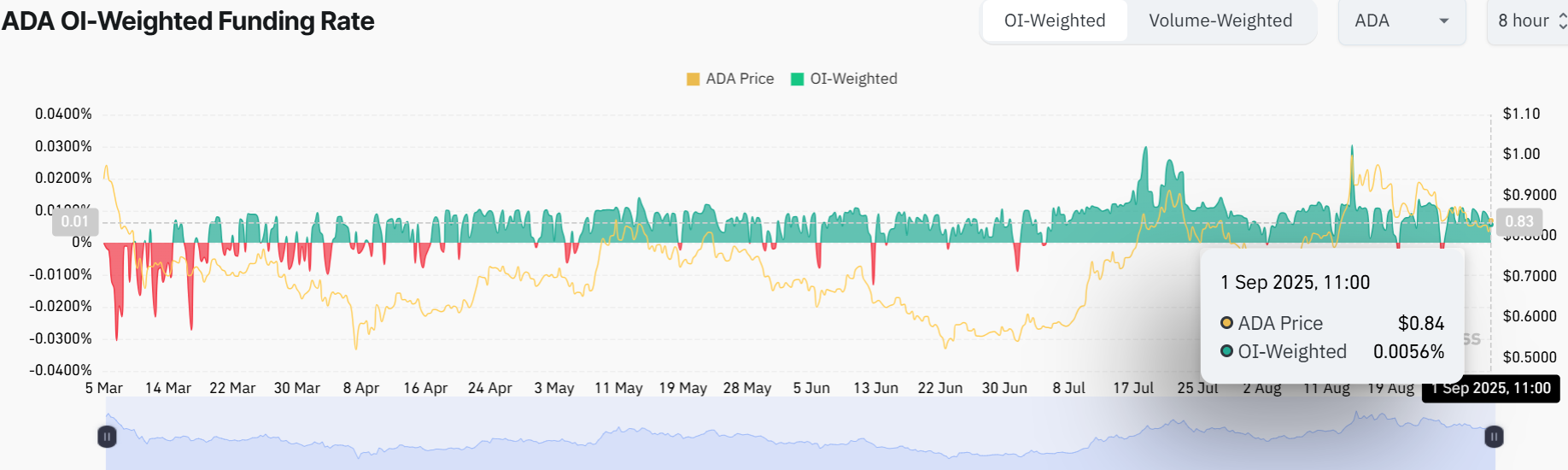

The following interesting data provided regarding the market behavior of Cardano is its OI-weighted funding rate, which indicates the overall health of the market. As of September 1, 2025, the funding rate is 0.00556%, indicating that the Cardano funding market is relatively stable.

This aligns with its price movement, which has remained stable with only slight variations over the past few months. It can be understood as a sign that the market around Cardano is not overheating or in a state of panic, which is usually a positive indicator of long-term growth.

Cardano Price Technical Outlook

On the daily price chart of Cardano, we observe that the price of Cardano is trading within a parallel rising channel. This pattern indicates that the token continues to maintain a positive outlook. The key zone at $0.72 is providing immediate support, as the bulls must overcome the $0.82 resistance to sustain the upward movement.

Notably, the MACD has crossed below the orange signal line, indicating growing selling pressure in the ADA market. In other words, ADA could face more downside if the bulls fail to gain momentum in the market. The RSI also indicates decreasing buyer momentum, suggesting the need for buyer action.

If the $0.82 barrier is broken, with $0.72 support intact, further upside is imminent in the Cardano price. Meanwhile, crypto analyst Ali Martinez has noted that ADA must break above $0.88 mark to rally towards $1.20. However, if the $0.82 resistance proves too strong, a drop towards $0.72 could occur.

Cardano $ADA must break $0.88 to confirm a rally toward $1.20! pic.twitter.com/BpCLzSor4B

— Ali (@ali_charts) September 1, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.