Highlights:

- Cardano price breaks above a falling triangle at $0.40, as bullish momentum builds.

- The rising geopolitical tension between the US and Venezuela may limit further upside in ADA, calling for traders to be cautious.

- The technical outlook shows rising buying pressure as the Cardano price eyes $0.48 zone.

The Cardano price has broken out of a falling triangle to trade at $0.40, marking a 1% surge. The trading volume has notably spiked 35% to $678 million, suggesting intense market activity. Meanwhile, the derivatives market is lifting the mood, with the Open Interests (OI) of ADA rising. Traders, however, must beware because there is a high possibility of an imminent increase in geopolitical tension between the US and Venezuela. This may limit additional profits in the Cardano market.

This comes as on Saturday, the US launched a massive military attack against Venezuela, taking the Venezuelan leader, President Nicolas Maduro and his wife. The US President Donald Trump later added that Maduro and his wife will face US justice and that the US will take over Venezuela until they can safely, properly, and judicially effect a transition.

🚨 🚨 BRAKING 🚨 🚨

The duly elected dictator of Venezuela, Nicolas Modelo, has been arrestido (Spanish for “arrested”) in his home by US Forces

This action is illegal for a number of reasons:

1. President Modelo has diplomatic immunity

2. They did not have a warrant to… pic.twitter.com/vvREBokE36

— Three Year Letterman (@3YearLetterman) January 3, 2026

Moreover, statements by Trump on Monday, as quoted in the Kobeissi Letter, have also brought geopolitical anxieties. Trump acted, suggesting that the US might intervene in Colombia, saying that the Colombian president is a sick man and that ”the country is run by a sick man.” This has increased the uncertainty and has the potential to burden the risk sentiment.

PRESIDENT TRUMP JUST NOW:

Trump: "Colombia is run by a sick man, he's not going to be doing it for very long."

Reporter: "So there will be an operation by the US in Colombia?"

Trump: "Sounds good to me." pic.twitter.com/66fQM7cEIY

— The Kobeissi Letter (@KobeissiLetter) January 5, 2026

ADA Derivatives Market Outlook

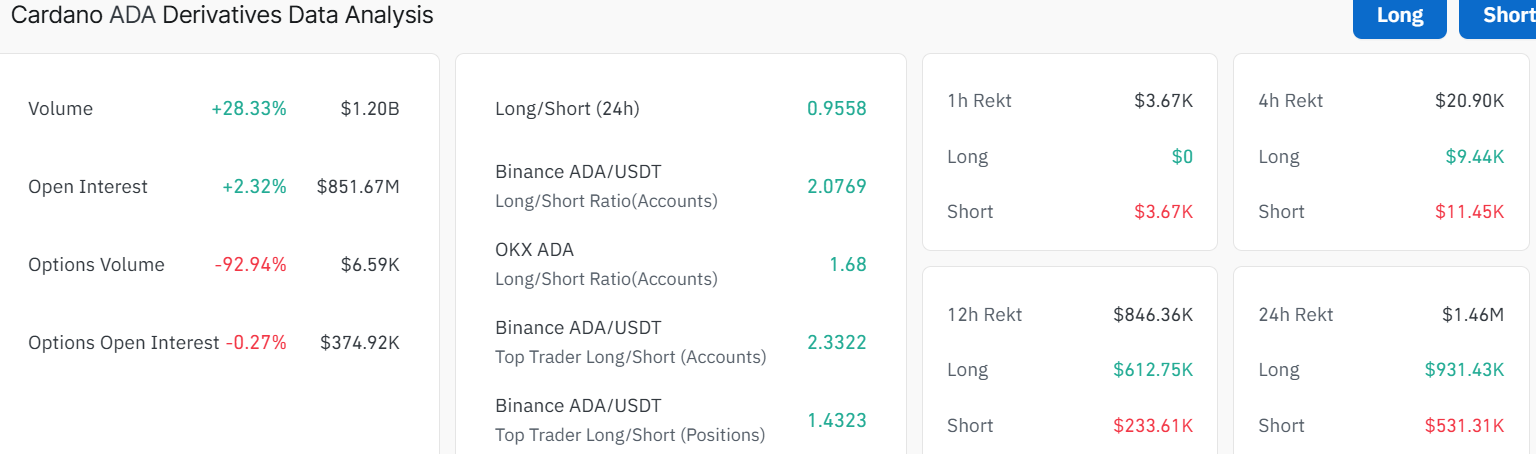

On the other hand, the Cardano derivatives outlook paints a bullish picture, as the open interest and volume spike. The open interest has soared 2.32% to $851.67 million, as the trading volume rises a whopping 28% to $1.20 billion. This recent surge in OI indicates that new money is entering the market, which may trigger more buys in ADA, further causing a rally.

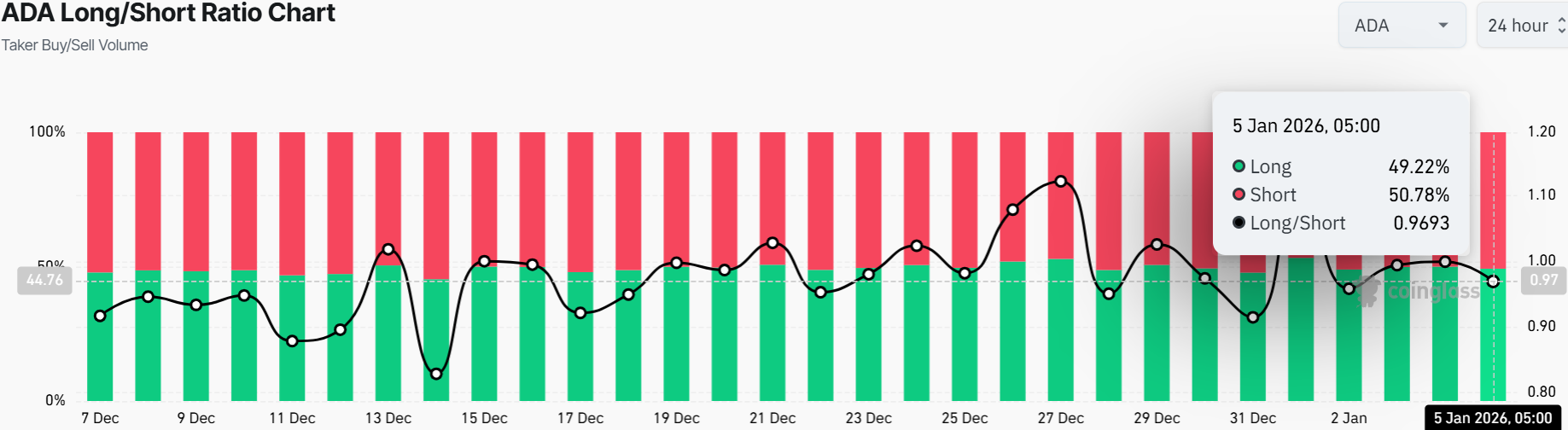

Additionally, the ADA long-to-short ratio is sitting at 0.9693. The shorts are having the lion’s share of 50.78% while the longs take the rest of 49.22%. This signals caution in the Cardano market, as more traders are sidelines, which may cause a slight decrease in ADA.

Cardano Price Eyes $0.48 as Bullish Momentum Builds

Looking at the daily price chart, ADA has broken through the key resistance level at $0.40, flipping it into support. The token is currently trading at $0.4024, up from last week’s low near $0.33. This is a bullish sign, as buyers are showing strength.

The next critical resistance comes at $0.65, which is the 200-day SMA and marks a region where selling pressure could increase. If ADA can break cleanly above this area on strong volume, then traders should expect a run towards $0.75-$0.88 soon.

Conversely, the initial support sits at $0.40 (50-day SMA) with further downside protected by the base near $0.33. Momentum indicators strongly favour the bulls. The Relative Strength Index (RSI) is at 56.82, showing that price is rising rapidly but not yet at extreme overbought levels. The MACD is bullish, signalling that buyers have control. If ADA fails to hold above the immediate resistance at $0.48 zone, the price may retrace towards $0.33, where buyers will watch for renewed support.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.