Highlights:

- Cardano price has plummeted 10% to $0.41, as trading volume slips 19%.

- The ADA derivatives market indicates a drop in open interest as long positions decrease, suggesting some bearish outlook.

- The technical outlook indicates an intense bearish grip as ADA attempts recovery.

Cardano (ADA) price has extended its losses by 10% to $0.41 in the past 24 hours. The derivatives data show a bearish turn, with the Open Interest and the amount of open long positions decreasing. Nevertheless, on-chain data show that network activity has increased recently, and that can support long-term demand.

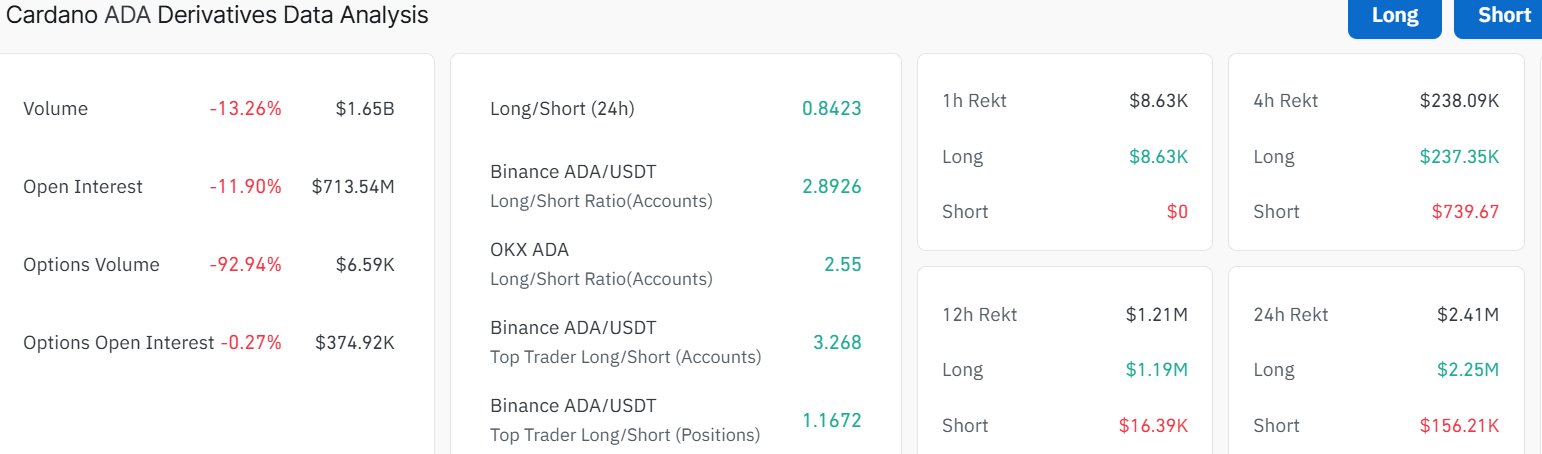

According to CoinGlass, there was an 11% decrease in the Cardano futures Open Interest (OI) in the past 24 hours, to $713.54 million. This means that active positions such as longs and shorts have decreased drastically, implying that the risk appetite of the traders has gone down.

With the risk-off sentiment, the funding rate has decreased to 0.0019% as compared to 0.0047% at the beginning of the day, indicating reduced bullish sentiment.

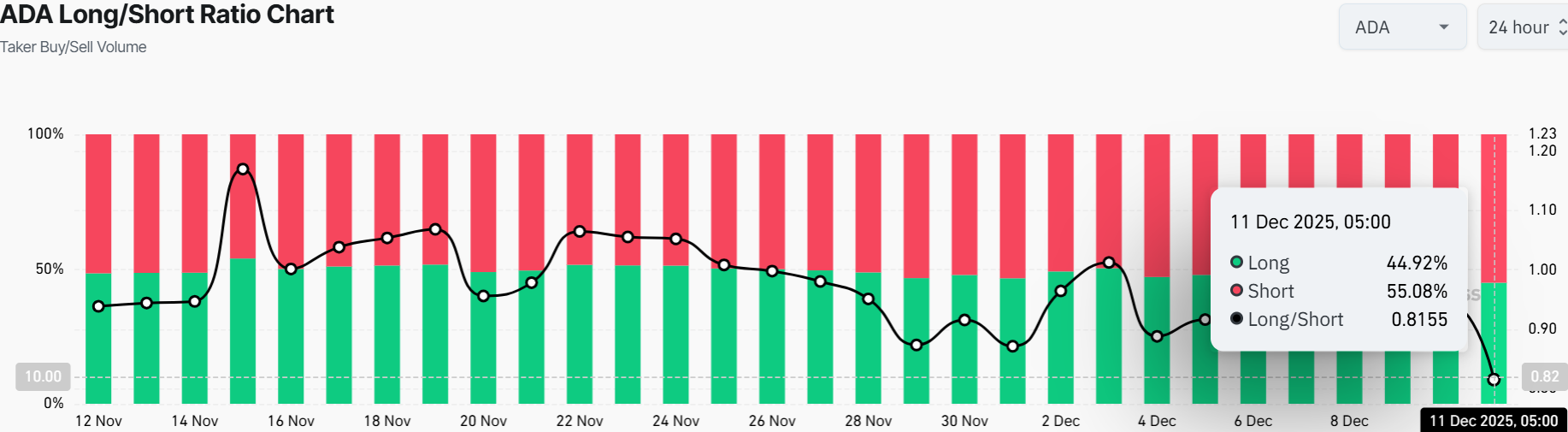

Similarly, the long-to-short ratio chart shows an increase in bearish bets, which shows bearish expectations of traders. At the time of press, 55.08% all active positions comprise short positions. Further, the ratio sits below one at 0.81, suggesting an intense bearish stance in Cardano price.

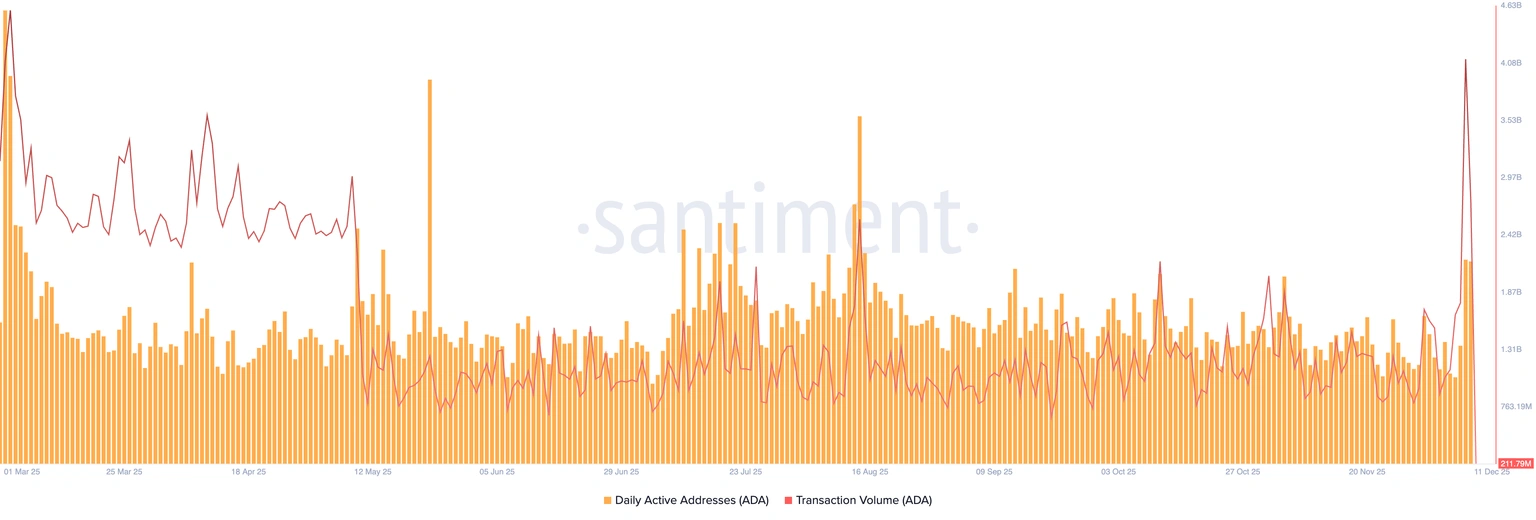

The santiment data on the ADA network indicates that the volume of transactions hit the highest in nine months on Tuesday, with 4.11 billion ADA in transactions. This indicates the action of the network is increasing, which could favour the demand for ADA.

Also, the number of daily active addresses reached its highest level in close to four months on Tuesday, with 34,229 addresses being hit. This means that the network users are interested again.

Cardano Price Moves Into Consolidation

Since early October 2025, the Cardano price has been steadily declining, currently exchanging hands at $0.41. The current price is below the two moving averages, and the 50-day SMA is at ($0.50), and the 200-day SMA is at ($0.69), which is a confirmation of the bearish movement. But the ADA token appears to have entered the consolidation phase that could serve as the accumulation phase prior to a rebound. The RSI is at 41.69, which is slightly less than neutral, indicating neutral conditions.

A break below the current levels could push the Cardano price toward the next major support at $0.37. On the upside, a successful bounce above $0.48 could attract buyers toward the next resistance zone at $0.50 or even $0.69.

Notably, the volume has dwindled 19% to around $1.17 billion, showing a decline in market activity. Traders should remain cautious, as ADA is trading in a bearish consolidation zone where false breakouts are possible.

Swing traders can seek confirmation of a reversal by a break above $0.48 or above the 50-day SMA at $0.50. On the other hand, the inability to hold at 0.41 may speed up the movement to $0.37 and even the support at $0.31. Meanwhile, the price of Cardano is bearish in the short term. The main areas of concern are resistance at $0.48-$0.50 and support at $0.37-$0.31.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.