Highlights:

- Solana’s price has dropped 4% to $139 as selling pressure intensifies.

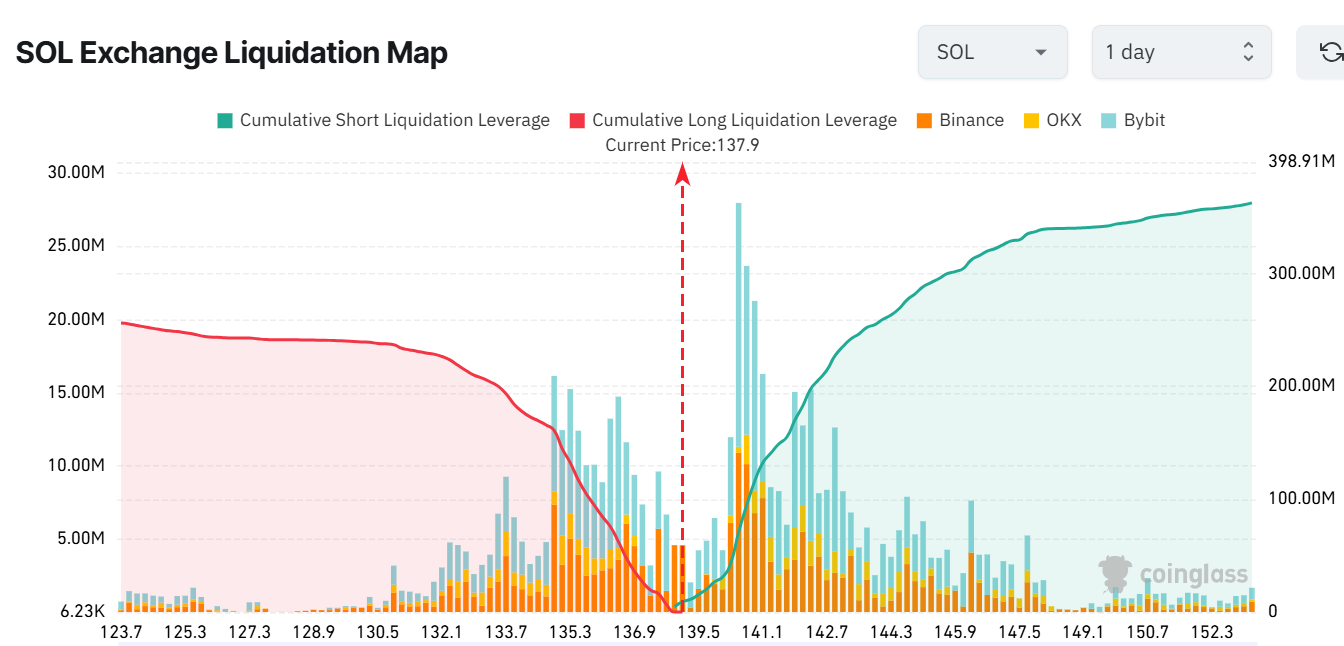

- On-chain metrics show fewer long liquidations than shorts, indicating bolstered bearish momentum.

- Solana technical indicators show a mixed reaction, but can SOL rebound above $200?

The Solana price holds higher lows as the upward momentum looks slightly shaky. SOL is down 4% to $139 as of press time, with the bears having the upper hand. However, the whole crypto market has notably seen a fall in momentum, dropping 0.85% to $2.86 trillion. Other top cryptocurrencies, including Bitcoin, Ethereum, and XRP, have plummeted 0.57%, 1.73%, and 4.08%, respectively. This shows a slight fall in market activity across the crypto world.

Further, data from the Coinglass Liquidation Map shows fewer cumulative long liquidation leverage positions ($256.12 million) compared to shorts ($362.65 million). This imbalance shows that a bearish sentiment dominates the market.

Meanwhile, memecoins, including JELLY JELLY and GHIBLI, are pumping hard on the Solana blockchain. Solana-based memecoins have gained popularity due to the network’s low transaction fees and high speed. Can this trigger a rebound in the SOL price to $200?

GOLD RUSH Mode Activated! 🚀

Meet Ghiblification ( #Ghibli ) @ghiblifi

PRICE: $0.02 | MC: $17.52M | LIQ: $661.10K

Pair: $Ghibli/SOL

CA: H9d3XHfvMGfoohydEpqh4w3mopnvjCRzE9VqaiHKdqs7#Newlisting #Altcoin #Memecoin #FourtisNewlisting pic.twitter.com/6QOQ9DsDns

— StevenLNG (@StvnLngXclusive) March 27, 2025

Solana Price Outlook

The Solana price shows signs of rebounding from the horizontal demand zone, targeting the immediate resistance key at $154, which aligns with the 200-day MA. The altcoin is trading at $139, showing a 4% plunge in the past 24 hours. Moreover, the sellers are still in control, as the price trades below both the 50-day and 200-day MAs. For a potential shift in momentum, Solana’s price needs to break above resistance levels to validate the bullish thesis.

Looking at the daily chart timeframe, Solana’s price still struggles below moving averages, which may call for consolidation. If the bulls fail to reach the immediate resistance keys at $154 and $183, the Solana price could pull back or consolidate between the $126 and $137 range. Further, if the sellers keep dominating at current price levels, SOL could drop to $126 support. A breakout below this level could see Solana drop to the $116 and $110 levels before the bulls gather for a potential upside.

What Next for Solana: Can SOL Breakout or Consolidate?

A quick look at the RSI indicator shows an equilibrium state. The bulls and bears are in a tight tug-of-war, neither giving in. A breakout in either direction in the RSI could determine the next direction in the Solana price.

On the other side of the fence, the MACD indicator has made a bullish convergence, with the green histograms increasing in size. This indicates that the traders and investors can buy more SOL unless the MACD changes. Moreover, the MACD is climbing towards the neutral level to positive territory. A confirmed outlook over the same could validate the bullish momentum.

If the buyers step in and the buying momentum spikes, the SOL price could rebound above the $200 mark. If the $154 barrier is flipped into resistance, the next hurdle would be $183. For a bullish reversal to be validated in the market, the Solana price must breach this level, tilting the odds toward the bulls. In the meantime, traders and investors should closely monitor price action in the coming sessions to determine whether Solana can establish a recovery or continue its downward trajectory.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.