Highlights:

- BTC whale transaction counts have spiked to a 10-week high.

- Similarly, the BTC-dominant conversation surged to an 11-week peak.

- Bitcoin holders making money at the token’s current price soared remarkably, hitting 95% as BTC’s valuation stabilized around $67,000.

In one of its most recent tweets, renowned on-chain tracker Santiment reported that Bitcoin (BTC) whale transactions are surging, which invariably depicts strong large investors’ interest in the token. Interestingly, the statistical value of the whale actions revealed a whopping 11,697 transactions worth over $100K occurred in 24 hours. Notedly, the recorded value marked the highest level of BTC whale transactions in over ten weeks.

For context, the last time whale investors actively traded BTC in transactions worth over $100K was on August 4. Contrary to the prevailing bullish outlook, the heightened BTC transfers in August stemmed from BTC slumps that saw the token drop below $50,000. During the declines in August, traders engaged in more sell-offs than accumulations, drawing a stark contrast from current events.

Aside from the spiking whale transactions, Santiment drew over 191K followers’ attention to the increasing Bitcoin social media conversation rates. Like the increased whale market actions, the spiking BTC-dominant conversation also marks increased interest in Bitcoin’s market movements.

Describing Bitcoin’s soaring conversational rate in its X post, the on-chain tracker wrote:

“Conversations across social media have veered heavily toward BTC over altcoins, with crypto’s top asset making up over a quarter of all discussions. Traders are heavily on prices after exceeding $68K for the first time since July.”

The “quarter of all discussions” in the statement above implies that the flagship crypto discussion rate has reached 25.57%. Hence, it marked its first time since July 27, 2024.

🐳 Bitcoin's whale transactions have spiked to their highest level in over 10 weeks, with 11,697 $100K+ transfers on the network Tuesday, and Wednesday on pace for a high mark as well.

🗣️ Additionally, conversations across social media have veered heavily toward BTC over… pic.twitter.com/Izhq6JeaAd

— Santiment (@santimentfeed) October 16, 2024

Santiment Explains Implications of the Spiked Metrics

Contrary to widely shared sentiments, Santiment has warned that the increased transaction counts and discussion rates could cause a transient halt in BTC’s upward trajectory. Per the on-chain tracker, Bitcoin’s existing rally will experience a temporary setback because of key stakeholders taking profits and impacts from retailers’ “Fear of Missing Out” (FOMO) syndrome.

Meanwhile, emphasizing why it envisages a transient momentum drop, Santiment mentioned that Bitcoin’s market variables have remained bullish. In its exact wordings, Santiment remarked: “However, with mid and long-term metrics still looking bullish, any price correction would likely be a short one.”

Holders Making Money Nears 100% as BTC Price Remains Stationed Around $67,000

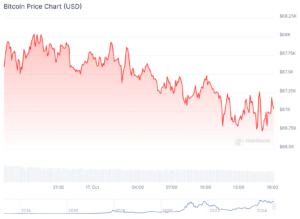

At the time of writing, Bitcoin is changing hands at about $67,000, reflecting a subtle 0.6% decline. Notedly, over the past 24 hours, BTC displayed price extremes ranging between $66,738.86 – $68,038.17. Therefore, it underscores price stabilization around the $67,000 price region.

Following BTC’s remarkable price actions, IntoTheBlock revealed its holders making money data has surged considerably to about 95%. 3% are neither making nor losing money, while 2% are incurring losses. Meanwhile, despite whales soaring transaction counts, Bitcoin concentration by large investors was about 12%, which invariably implies a reduced tendency for whale actions to impact BTC’s price actions.

In other relevant statistics, holders’ composition by time-held variable disclosed that 71% of BTC holders held the token for over a year. 25% are intermediate holders (1 – 12 months), while 5% are short-term holders (less than a month). Interestingly, total exchange netflows for the past seven days reflected a negative $31.19 million, signifying more accumulation over dumping actions.