Highlights:

- After two consecutive outflows, BTC ETFs have finally recovered with over $200 million in net inflows.

- Ethereum ETFs recorded another net outflow as their loss streak extended into a third consecutive day.

- Bitcoin’s price continues to trade comfortably above $90,000 as Ethereum struggles to break above $3,500.

According to the most recent Exchange Traded Funds (ETFs) statistics, Bitcoin (BTC) ETFs have finally bounced back after recording losses in their two previous outings. On the other hand, the Ethereum (ETH) ETFs’ outflow spree persisted, extending into a third consecutive day.

Bitcoin ETF cash inflow stemmed from purchasing 2,830 BTC. The over 2,500 procured BTC cost about $254.8 million. For Ethereum, its ETF commodities witnessed sales of about 12,700 ETH. The sold tokens amounted to about $39.1 million in net cash outflows.

#ETF Flows Update | 18.Nov#Bitcoin (BTC):

Bought from ETFs: 2,830 $BTC

Net Inflows: $254.8M#Ethereum (ETH):

Sold from ETFs: 12,700 $ETH

Net Outflows: $39.1MStay tuned for the latest ETF trends in the #crypto market. pic.twitter.com/9m7hJnSduZ

— Cryptocurrency Inside (@Crypto_Inside_) November 19, 2024

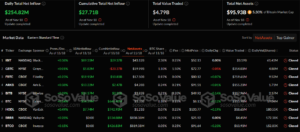

IBIT Nears $30 Billion in Cumulative Net Inflows

On November 18, seven of eleven Bitcoin ETFs were active. Remarkably, all seven entities welcomed gains, with the remaining four commodities displaying zero flows. As usual, BlackRock Bitcoin ETF (IBIT) topped the inflows chart with its most recent profitable contribution of $89.33 million.

With over $80 million in gainful input, IBIT’s cumulative net inflows soared to $29.37 billion. Net assets reflected approximately $43.12 billion, while the total value traded was roughly $3.19 billion. Meanwhile, aside from IBIT, four other commodities welcomed gains above $10 million.

They include Fidelity Bitcoin ETF (FBTC) ($59.95 million), Grayscale Mini Bitcoin ETF (BTC) ($54.39 million), Bitwise Bitcoin ETF (BITB) ($24.37 million), and ARK 21Shares Bitcoin ETF (ARKB) ($13.22 million). Two other commodities witnessed profits of less than $10 million – VanEck Bitcoin ETF (HODL) ($7.74 million) and Grayscale Bitcoin ETF (GBTC) ($5.82 million).

With the latest inflow inputs, Bitcoin ETF cumulative net inflows soared to about $27.71 billion. Similarly, the total value traded and net assets spiked significantly to approximately $4.78 billion and $95.93 billion, respectively.

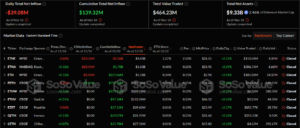

ETHA Tops Ethereum ETFs Losses Chart

Unlike Bitcoin, BlackRock Ethereum ETF (ETHA) witnessed the highest outflows among ETH’s nine ETF commodities. Notedly, ETHA recorded losses of about $23.91 million. Despite the outflow, ETHA remains the Ethereum ETF with the highest cumulative net inflows at about $1.7 billion.

Aside from ETHA, three other entities were active on November 18, with two commodities registering outflows. Fidelity Ethereum ETF (FETH) was the only profitable entity, contributing a meager $3.17 million. Grayscale Ethereum ETF (ETHE) and Grayscale Mini Ethereum ETF (ETH) recorded losses of about $13.28 million and $5.06 million, respectively.

Following the most recent flow contributions, Ethereum ETF cumulative net inflows dropped from about $178.40 million to roughly $139.32 million. The total value traded was $464.23 million, while total net assets reflected $9.33 billion.

BTC’s Price Recovers Slightly as ETH’s Price Continues to Thread in Losses

At the time of writing, Bitcoin is changing hands at about $91,800, reflecting a subtle 0.1% upswing in the past 24 hours. BTC’s other extended periods’ price change variables also reflected profits.

Its 7-day-to-date and month-to-date data reflected gains of about 2.9% and 34.4%, respectively. Additionally, Bitcoin’s market capitalization has soared to about $1.8 trillion, bringing its dominance to about 60.04%.

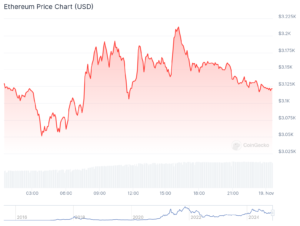

On the contrary, Ethereum is down by about 0.2% in its 24-hour-to-date data, with a selling price of about $3,120. ETH’s 7-day-to-date statistics reflected a 7.2% decline, with minimum and maximum prices ranging between $3,018.52 and $3,396.24.

Despite the slight declines, Ethereum remains the most valuable altcoin, with roughly $376 billion in market capitalization. Its 24-hour trading volume is up by 42.42% and boasts a $36.35 billion valuation.