Highlights:

- Brown University discloses $4.9 million BTC stores from 105,000 shares acquisitions.

- The university has joined a few other educational institutions that disclosed their Bitcoin holdings.

- Macroscope noted that Brown University acquired the new shares between January and March.

A May 2 Securities and Exchange Commission (SEC) filing has revealed that Brown University, a US-based private university, owns significant Bitcoin (BTC) stores. MacroScope, a digital asset analysis-based handle, reported the findings in a tweet that has gained massive traction.

Macroscope Stated:

“Brown University reported owning 105,000 shares of the BlackRock (IBIT) Bitcoin ETF as of March 31, valued at $4.9 million. This is a new position, which means it was acquired in January, February or March. The total value of all 14 positions in the filing is $216 million.”

🇺🇸 $7.2 BILLION BROWN UNIVERSITY JUST BOUGHT $4,900,000 WORTH OF #BITCOIN ETF

ENDOWMENTS ARE BUYING BTC!!! 🚀 pic.twitter.com/sNIEG0BUVk

— Vivek⚡️ (@Vivek4real_) May 2, 2025

Universities Interests in Owning BTC Record Exponential Growth

Brown University became the third university to disclose Bitcoin holdings to the public. In October last year, Crypto2Community reported that Emory University secured 2,678,906 shares after investing over $15 million in Grayscale Bitcoin (BTC) Mini Trust. University of Austin (UTAX) also publicized a similar report in the past.

Aside from universities, other educational institutions have adopted Bitcoin for purposes other than investment. Last month, Scottish school Lomond School became the first institution to announce cryptocurrency as a tuition fee payment option in the UK. The school based in Helensburgh said it will start accepting Bitcoin payments from this year’s Autumn. It added that the decision stemmed from increased demands for more flexible payment options.

In addition, parents from other regions face currency conversion issues. Over the past few years, Bitcoin has shown tendencies to evade these limitations, making it an ideal payment option.

Lomond School will employ two Bitcoin providers, Musquet and CoinCorner. Having secured the UK Financial Conduct Authority Approval (FCA), both platforms will partner to handle the school’s Bitcoin transactions, which entails direct conversion to Great Britain Pound (GBP). This will help eliminate price variation concerns while aligning with regulatory requirements.

JUST IN: 🇬🇧 Lomond School became the first UK school to accept #Bitcoin for payments.

They will “look to build a Bitcoin reserve.” pic.twitter.com/xnBoDBJuip

— Bitcoin Magazine (@BitcoinMagazine) April 11, 2025

Meanwhile, Argentina incorporated Ethereum and blockchain education into its high school curriculums in August 2024. The program aims to expose students to Blockchain at early stages, which invariably drives Bitcoin’s long-term adoption.

Bitcoin ETFs Bounce Back with Remarkable Profit Surge

Since April 17, Bitcoin ETFs have recorded only net inflows. The eighth consecutive gain ended on April 30 when the funds succumbed to a $56.23 million net outflow. However, the funds have bounced back with back-to-back profits. On May 1, Bitcoin ETFs gained $422.45 million.

On May 2, the funds also attracted cash inflows worth $674.91 million. BlackRock was the only active ETF yesterday, as the remaining funds saw neither gains nor losses. Overall, Bitcoin ETFs had a weekly net inflow worth $1.81 billion, marking their third consecutive weekly gain.

On May 2, Bitcoin spot ETFs recorded a total net inflow of $675 million, with none of the twelve ETFs seeing net outflows. Ethereum spot ETFs saw a total net inflow of $20.1032 million, with all nine ETFs reporting no net outflows.https://t.co/Hj2Gs49bWa

— Wu Blockchain (@WuBlockchain) May 3, 2025

Bitcoin Drops Slightly Despite Revolving Positive Sentiments

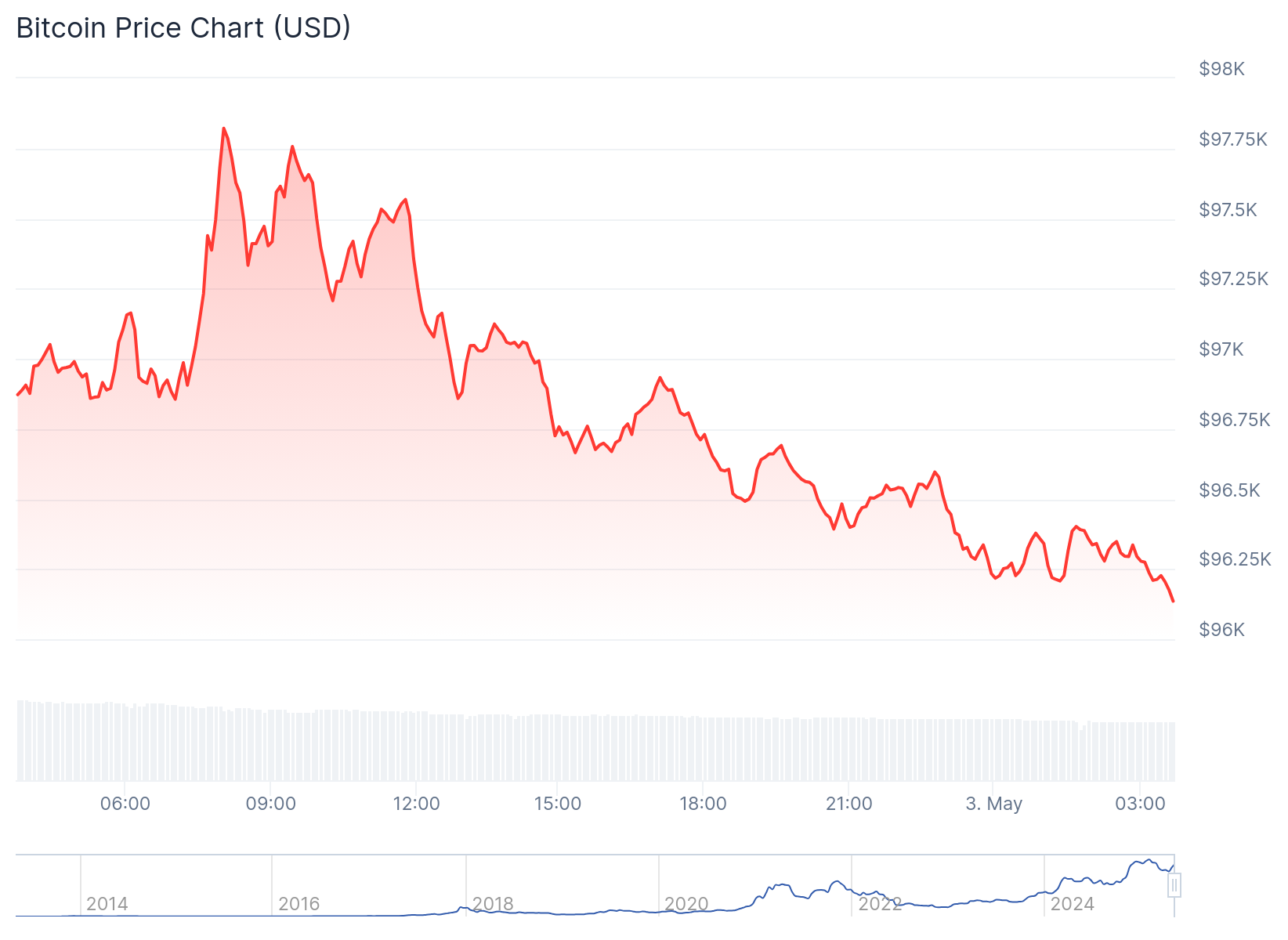

Bitcoin dropped 0.4% in the past 24 hours, reflecting a market value of approximately $96,335. Bitcoin’s market cap also depreciated slightly to about $1.91 trillion with a similar dilution volume.

Meanwhile, a 7-day-to-date price change data displayed a 2% spike, fluctuating between $92,972.12 and $97,715.58. This price range suggests that BTC is on the verge of reclaiming the $100,000 mark. Bitcoin’s 24-hour trading volume decreased by about 29.65% to its present $23.73 billion valuation.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.