Highlights:

- Emory University invested over $15 million in Grayscale’s Bitcoin Mini Trust, holding 2,678,906 shares.

- Bitcoin ETFs’ total net inflows surged to over $22 billion amid growing optimism.

- Grayscale’s Bitcoin Mini Trust launch sparked renewed enthusiasm for Bitcoin ETFs amid market fluctuations.

Atlanta-based private research institution Emory University reported that it has invested more than $15 million in the Grayscale Bitcoin (BTC) Mini Trust. As of September 30, the university held 2,678,906 shares valued at $15,082,241, according to an October 25 filing with the United States Securities and Exchange Commission (SEC).

Additionally, it was the first U.S. university to disclose its Bitcoin holdings. This highlights a growing trend of institutional investors embracing digital assets, especially crypto ETFs. The filing also reveals that Emory held 4,312 shares in Coinbase, valued at $768,269. Notably, Coinbase acts as the custodian for Grayscale’s Bitcoin holdings.

Emory University has invested more than $15 million in the Grayscale Bitcoin Mini ETF, becoming the first American university to publicly disclose its Bitcoin investment. According to SEC filings, as of September 30, the university held 2,678,906 shares with a total value of…

— Wu Blockchain (@WuBlockchain) October 26, 2024

Exploring the Launch of Grayscale’s Bitcoin Mini Trust

This renewed interest in Bitcoin ETFs stems from Grayscale’s Bitcoin Mini Trust (ticker BTC) launch on July 31, 2024. BTC is a derivative of the Grayscale Bitcoin Trust (GBTC), the company’s spot BTC ETF. Mini Trust offers passive exposure to Bitcoin’s price, with the trust’s value designed to mirror Bitcoin’s price movements. As a spin-off from GBTC, BTC provides investors with access to Bitcoin at a lower share price, enabling them to achieve more precise Bitcoin exposure, according to the fund’s website.

The new fund attracted $18 million on its launch day. It then saw a remarkable $191 million in inflows on its second trading day. This surge sparked enthusiasm for spot Bitcoin ETFs, which had been fading due to market fluctuations at that time. As institutional investment in Bitcoin grows, Emory University’s participation in Grayscale’s BTC Mini Trust marks a significant step toward mainstream acceptance of cryptocurrencies.

In May, the State of Wisconsin Investment Board announced it held nearly $100 million in BlackRock’s iShares Bitcoin Trust at the end of Q1 2024. This Board is a state agency responsible for managing investments for public retirement and other trust funds.

Pension fund buys almost $100m of BlackRock’s Bitcoin ETF

The U.S. state of Wisconsin invested nearly $100M in BlackRock's iShares #Bitcoin Trust during Q1, purchasing 94,562 shares.#BitcoinETFs #token

— token.com (@tokencom_) May 14, 2024

Moreover, in July, the mayor of Jersey City, Steven Fulop, announced that the city’s pension fund would invest in BTC ETFs. He shared on X that they are updating paperwork with the U.S. Securities and Exchange Commission, similar to the Wisconsin Pension Fund.

Not my normal subject matter in a post but I’ll share anyway – the question on whether Crypto/Bitcoin is here to stay is largely over + crypto/Bitcoin won. The #JerseyCity pension fund is in process of updating paperwork to the SEC to allocate % of the fund to Bitcoin ETFs… https://t.co/5iNEqRqHGM

— Steven Fulop (@StevenFulop) July 25, 2024

Growing Optimism in the Bitcoin ETF Market

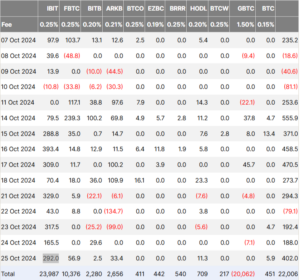

This news comes at a time of growing optimism in the spot Bitcoin ETF market. On Friday, October 25, spot Bitcoin ETFs saw strong interest, with total inflows reaching $402 million. The latest inflow brought Bitcoin ETFs to a total of $997.7 million in net weekly gains.

On Friday, BlackRock (IBIT) played a key role in Bitcoin’s impressive rise. The firm attracted around $292 million in cash inflows, allowing it to acquire over 4,300 Bitcoin. With this new purchase, BlackRock’s Bitcoin holdings surpassed 400,000.

Notably, three entities experienced gains exceeding $10 million. Fidelity Bitcoin ETF (FBTC) led with $56.9 million, followed by ARK 21Shares Bitcoin ETF (ARKB) with $33.4 million, and VanEck Bitcoin ETF (HODL) with $11.3 million. In addition to five ETFs with zero flows, two others had net inflows below $10 million: Grayscale Mini Bitcoin ETF gained about $5.92 million, and Bitwise Bitcoin ETF (BITB) saw an increase of $2.55 million.

Following the recent flow trend, Bitcoin ETFs’ total net inflows surged to around $22 billion. The total traded value jumped to approximately $2.9 billion, while total net assets reached $65.25 billion.