Highlights:

- BlackRock and MARA acquired 9,173 Bitcoin between December 5 and 6 after the BTC price dip.

- These companies now hold a substantial amount of Bitcoin, strengthening their positions.

- An unknown whale and companies like Semler Scientific increased Bitcoin holdings amid price dip.

The world’s largest asset manager, BlackRock, and Bitcoin mining firm Mara Holdings (MARA) seized the opportunity to buy more Bitcoin (BTC) as its price dropped from the all-time high of $104,000 to $92,957 on Dec. 5. According to data from Arkham, these Bitcoin-stacking firms bought a combined 9,173 Bitcoin between December 5 and 6.

MARA Acquires Additional 1,423 BTC, Reaching $2.17 Billion in Holdings

On Thursday, MARA, previously known as Marathon Digital, purchased 1,423 more Bitcoin. This follows the Bitcoin miner’s completion of an $850 million convertible note offering the day prior. MARA now holds 22,108 Bitcoin, valued at $2.17 billion. This marks a remarkable 162% increase in its holdings compared to last month.

On-chain data shows that Marathon Digital(@MARAHoldings) acquired another 1,423 $BTC($139.5M) in the past 6 hours!

This comes after #MARA announced yesterday the closing of its second $850M convertible note offering, primarily aimed at purchasing #Bitcoin and partially… pic.twitter.com/t2sjjzhDNW

— Lookonchain (@lookonchain) December 6, 2024

MARA’s updated treasury policy aligns with MicroStrategy’s strategy. It focuses on retaining all mined Bitcoin and using capital market instruments for further accumulation. In late November, MARA acquired 6,474 BTC, spending over $600 million.

BlackRock Acquires 7,750 Bitcoin as Its ETF Attracts More Buyers

At the same time, investment giant BlackRock acquired 7,750 Bitcoin. This was as its spot Bitcoin exchange-traded fund (ETF) continued to attract buyers.

The company’s total Bitcoin holdings now stand at $46.9 billion. According to SoSoValue, BlackRock’s iShares Bitcoin Trust (IBIT) has $51 billion in assets under management (AUM). Thomas Fahrer, the founder of Apollo, called it the “fastest-growing ETF EVER.” Last week, BlackRock’s BTC ETF surpassed the company’s Gold Trust in net assets, with Bitcoin’s ETF reaching over $32 billion.

🚨 Blackrock Buys 7750 #Bitcoin

They hold over $50 Billion in Assets.

Fastest growing ETF EVER! 🔥 pic.twitter.com/uJU9MLTlTb

— Thomas | heyapollo.com (@thomas_fahrer) December 6, 2024

Whale and Other Companies Take Advantage of Bitcoin Dip, Increasing Holdings

Like BlackRock and MARA, an unknown whale has also taken advantage of the BTC price dip. The whale acquired 600 more Bitcoin. This move likely cost the account nearly $58.9 million based on current prices. Unlike BlackRock and others, blockchain data shows this account only recently started accumulating Bitcoin. The first transaction reportedly occurred on November 24.

Other companies, like healthcare tech firm Semler Scientific, have adopted Bitcoin as part of their treasury strategy. Semler recently increased its Bitcoin holdings to 1,873. This came after the company purchased 303 Bitcoin on December 4. Institutional and corporate players are clearly paying more attention to Bitcoin. They now collectively hold 527,026 Bitcoin. This represents 2.66% of Bitcoin’s total supply.

Eric Semler, chairman of Semler Scientific, stated:

“We are very pleased to report BTC Yield of 78.7%. In addition, we have requested approval from the options exchanges to allow options trading in our stock as we believe we satisfy their eligibility requirements.”

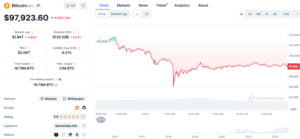

US spot BTC ETFs experienced strong momentum on December 5, with $747.8 million in inflows. BlackRock’s iShares BTC Trust led, contributing $751.6 million, while Grayscale’s BTC Trust saw $148.8 million in outflows. BTC surged to $104k, pushing its market dominance to 57%, challenging “altcoin season” expectations. Bitcoin’s rapid rise to six figures surprised the crypto market, reversing the previous trend. As of now, BTC is trading at $97,923, reflecting a 4.90% decrease in the past 24 hours.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.