Highlights:

- Bitwise’s CEO reveals significant Bitcoin and Ethereum ETF Investments owned by a top RIA.

- Bitwise continues to display strength in the Bitcoin and Ethereum ETF markets with remarkable inflow data.

- Institutional interest in Bitcoin ETFs soared considerably in 2024’s Q2, according to Coinbase’s data.

Leading Exchange Traded Funds (ETFs) issuer Bitwise has revealed significant Bitcoin and Ethereum ETF Investments by a top Registered Investment Advisor (RIA). The disclosure implies growing adoption and capital Inflows in the commodities. Therefore, it underscores a good prognosis for the tokens involved and the general crypto market.

Bitwise CEO Reveals Significant Bitcoin and Ethereum ETF Investments

Taking to his verified X handle, Hunter Horsley Bitwise’s Chief Executive Officer (CEO) hinted that he received an email from a top RIA. Interestingly, the mail notified the CEO of the RIA’s massive investments in Bitwise’s offerings. The CEO’s tweet read thus, “Got an email from a large RIA today letting us know they own several million of BITB, ETHW, and BITW across client portfolios.”

For context, BITB represents Bitwise Bitcoin ETF, ETHW represents Bitwise Ethereum ETF, and BITW signifies Bitwise 10 Crypto Index ETFs. Therefore, it underscores a massive trust in Bitwise’s investment offerings by the RIA.

Bitwise Remains a Top Performer Among BTC and ETH ETFs

In the Ethereum and Bitcoin ETF markets, Bitwise has remained one of the top performers with consistent inflows. In the most recent EFTs flow statistics, Ethereum ETFs welcomed $5.7 million in losses. However, the outflows were fuelled by Grayscale Ethereum ETF (ETHE), with approximately $9.8 million in outflows. While VanEck Ethereum ETF (ETHV) led Ethereum ETF inflows with $2 million, ETHW followed closely with $1.4 million in profits.

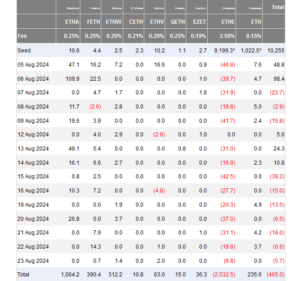

Meanwhile, according to Farside statistics, ETHW never recorded outflows between August 5 and August 23. Consequently, it has $312.2 million in cumulative net inflows. Only BlackRock Ethereum ETF (ETHA) and Fidelity Ethereum ETF (FETH) have registered more capital Inflows than ETHW. Notedly, ETHA has recorded over $1 billion in profits, while FETH has witnessed $390.4 million in inflows.

Among Bitcoin ETFs, the most recent data registered a whopping $252 million in net inflows despite Grayscale Bitcoin ETF’s (GBTC) $35.6 million outflows. In individual ETF cash inflow contributions, BITB was ranked fourth with $42.3 million in profits. BlackRock Bitcoin ETF (IBIT) witnessed the highest inflows at roughly $86.6 million. Fidelity Bitcoin ETF (FBTC) and Grayscale Mini Bitcoin ETF (BTC) followed closely in second and third places, respectively. They witnessed inflows of approximately $64 million and $50.8 million.

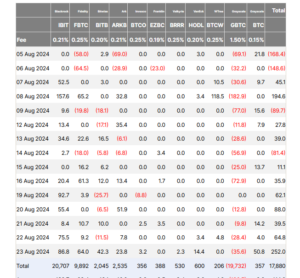

On Farside data, BITB only saw outflows six times between August 5 and August 23. However, its cumulative net inflows were positive, with about $2.045 billion. Like Ethereum ETFs, BlackRock. and Fidelity Bitcoin ETFs have the highest cumulative inflows, with about $20.7 billion and $9.89 billion, respectively.

Bitcoin ETFs Record Increased Institutional Interests in Q2

In the broader outlook, ETFs have been enjoying widespread adoption, evidenced by a recent Coinbase report. Per the American-based exchange, 2024’s Q2 13-F filings revealed a massive jump in Bitcoin ETFs’ institutional interests.

Commenting on the statistics, Coinbase analysts David Duong and David Han noted that the growing institutional interests, despite Bitcoin’s underperformance, signify good tidings for the crypto asset. Additionally, the analysts highlighted how ETFs have attracted investors in a unique style that circumvents the conventional tokens’ holding method.