Highlights:

- Institutional interest in spot Bitcoin ETFs grew significantly in Q2 2024.

- Investment advisors increased their share of Bitcoin ETF holdings.

- Hedge fund holdings in Bitcoin ETFs saw a noticeable decline.

Coinbase has reported that updated 2Q 2024 13-F filings show a significant increase in institutional inflows into US spot Bitcoin exchange-traded funds (ETFs). Meanwhile, the hedge fund holdings have seen a slight decline.

Coinbase analysts David Duong and David Han suggested that the ongoing inflows into spot Bitcoin ETFs, even during Bitcoin’s underperformance, “may be a promising indicator of sustained interest in crypto from the new pools of capital that the ETFs give access to.” ETFs have broadened access to crypto by trading like traditional equities on stock exchanges, allowing asset managers to gain exposure without directly purchasing Bitcoin.

Increased Inflows from Investment Advisors

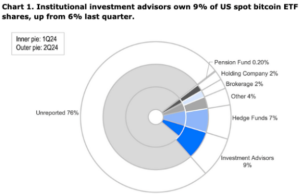

The exchange noted that this data only includes firms managing over $100 million in assets, as they are required to file the SEC’s 13F form. Analysts observed increased interest in spot Bitcoin ETFs in Q2 2024, compared to the initial launch of Bitcoin ETFs in the first quarter.

The proportion of ETF shares held by “investment advisors” increased from 29.8% to 36.6%. These advisors oversee substantial capital and make decisions on asset allocation, investment strategies, and specific securities purchases for their clients.

The analysts noted that several prominent new holders of Bitcoin emerged last quarter, including Goldman Sachs and Morgan Stanley, likely managing digital assets on behalf of their clients. Goldman Sachs held US spot Bitcoin ETF shares worth about $418 million as of June 30, according to its quarterly 13F filing with the SEC submitted on Tuesday. Despite Bitcoin’s price decline during the quarter, net inflows into spot Bitcoin ETFs totaled $2.4 billion.

Duong and Han said:

“The proportion of institutional holders categorized as ‘investment advisors’ increased from 29.8% to 36.6%, from 6% to 9% of total shares.”

However, the exchange noted that “large inflows” might be delayed due to the summer period in the United States, which can affect financial advisors’ ability to attract new clients promptly.

Coinbase reported:

“The ETF complex saw net inflows of $2.4B during this period, although the total AUM of spot bitcoin ETFs dropped from $59.3B to $51.8B (due to BTC dropping from $70,700 to $60,300).”

Hedge Fund Stakes Drop

The report indicated that the percentage of hedge fund BTC ETF holdings among institutions dropped from 37.7% to 30.5%. This decline could suggest that these firms are engaging in basis trading, an arbitrage strategy between spot and futures prices. Meanwhile, open interest in Bitcoin futures on the Chicago Mercantile Exchange (CME) rose by 15% to $2.75 billion in Q2.

Coinbase anticipates continued growth as more brokerage firms finalize their due diligence on Bitcoin ETFs, especially among registered investment advisors. However, the report also notes that short-term inflows might be affected by seasonal factors and current market volatility.

Bitcoin Struggles Despite ETF Inflows

Despite the influx of institutional capital into spot ETFs, BTC has struggled to break through the key $60,000 resistance level. On August 14, Bitcoin’s price fell below this significant threshold and has stayed under it since. Bitcoin’s price weakness can be linked to slow ETF inflows.

On August 16, there was a modest inflow of over $35.9 million, slightly up from $11.1 million the previous day. Historically, ETF inflows have been closely associated with Bitcoin price increases. As institutional adoption of Bitcoin ETFs grows, other market factors also impact Bitcoin’s price.