Highlights:

- Bitcoin price has risen about 30% from April lows, breaking through $96K mark.

- Metaplanet has invested ¥3.6 billion in acquiring more Bitcoin, which could trigger prices in the near future.

- Glassnode data shows that short-term BTC holders are in profit.

The Bitcoin price has broken above the $95K level, boasting 1.18% gains at the $96, 671. Moreover, the Bitcoin market momentum is soaring, as the BTC price has rebounded about 30% from April lows of $74K. The recent upward movement demonstrates resilience despite the market volatility.

Notably, Metaplanet, a leading Japanese-based investment firm, decided to invest ¥3.6 billion in acquiring more Bitcoin. This is a step in the mainstream adoption of Bitcoin as an investment asset. Issuing these bonds also places Metaplanet among many institutional investors betting on Bitcoin’s long-term value proposition. At this time, Metaplanet’s move could have far-reaching implications for the cryptocurrency market as Bitcoin rockets in attention from investors around the globe.

*Metaplanet Issues 3.6 Billion JPY in 0% Ordinary Bonds to Purchase Additional $BTC* pic.twitter.com/e3UIEP7csr

— Metaplanet Inc. (@Metaplanet_JP) May 2, 2025

With rising institutional interest, the Bitcoin price could surge toward the $100k mark.

Bitcoin Price Outlook

The leading altcoin in the crypto realm, Bitcoin, has increased 3% in the past 7 days, to trade at $96K. The bullish momentum is quickly building up, as the altcoin holds above the 50-day and 200-day Moving averages. This shows a heightened bullish grip, as the bulls put their best feet forward, aiming for the $100K mark. If the support levels at $8,214 and $89,997 keep holding steady, the king coin could break through the $97K resistance soon. In such a bullish case, Bitcoin price could hit $100K.

The Bitcoin Relative Strength Index paints a bullish signal, thanks to its position at 69.58. This shows that the bulls are in full control of the market, as the RSI is yet to hit the 70-overbought region.

However, if the uptrend slows and early profiteering commences from investors, the Bitcoin price could drop. This may cause a plunge towards the $95,422 support area. Moreover, if the RSI hits the overbought region, it may call for further consolidation or a possible reversal. Increased selling may see Bitcoin price plunge toward the $93K and $92K.

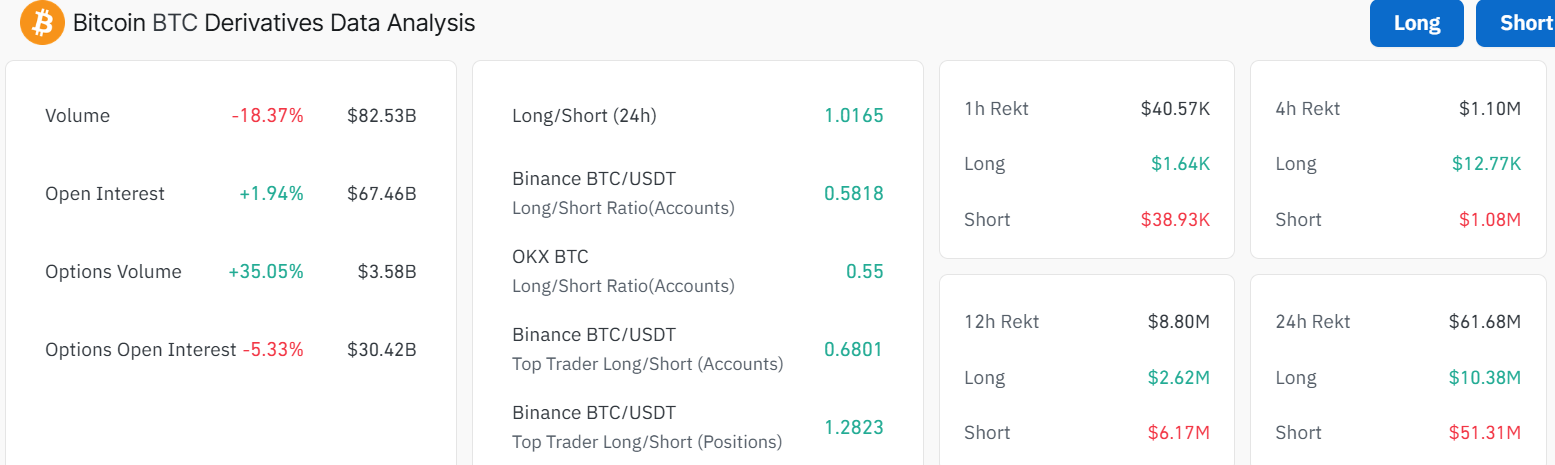

Bitcoin Derivatives Data

According to on-chain metrics, Bitcoin’s price dropped in volume by 18% to $82B, indicating reduced market activity. However, its open interest has risen by 1.94% to $67.46B. These mixed signals indicate weakening market momentum, which may pull BTC into consolidation.

However, a quick look at the liquidations in the BTC market shows that they have hit a whopping $61M in the past 24 hours. The long liquidations have acquired about $10M, while the short liquidations take the lion’s share of $51M. In other words, this paints a strong bullish picture in the market, with traders and investors expecting a strong rally soon. Meanwhile, the cost-basis ribbon for Short-Term Holders shows that investors holding BTC for over one month have returned to profit.

The cost basis ribbon for Short-Term Holders shows that investors holding $BTC for over 1 month have returned to profit. This shift eases sell pressure from older STHs and may signal early signs of positive market momentum if maintained. pic.twitter.com/e0mt0vCzXw

— glassnode (@glassnode) May 2, 2025

According to Glassnode data, this shift eases sell pressure from older STHs and, if maintained, may signal early signs of positive market momentum.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.