Highlights:

- A U.S. judge approved the DOJ’s request to sell 69,370 BTC, valued at $6.5 billion.

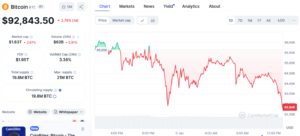

- Bitcoin briefly dropped to $92,800 after the DOJ ruling but slightly rebounded.

- El Salvador’s President sees the DOJ Bitcoin sale as an opportunity for investors to buy.

A U.S. federal judge has authorized the Department of Justice (DOJ) to sell approximately 69,370 Bitcoin, valued at around $6.5 billion, seized in connection with the Silk Road case, DB News reported Wednesday. This has raised concerns among investors about a potential BTC price drop below $90,000.

The ruling ended a prolonged legal dispute over the ownership of the Bitcoin stash. On December 30, a federal judge approved the DOJ’s request to sell the BTC. The decision followed the judge’s October dismissal of Battle Born Investments’ claims, which sought ownership through a bankruptcy estate and attempted to delay the sale.

The US Govt has been given the greenlight to liquidate 69,000 BTC ($6.5B) from Silk Road, an official confirmed to DB News today

Interesting situation less than 2 weeks away from the new admin who vowed to not sell https://t.co/HqD1KnhJK3 pic.twitter.com/xn8ATSEL7H

— db (@tier10k) January 9, 2025

Silk Road BTC Controversy Unfolds

The U.S. government seized 69,370 BTC from the operators of the Silk Road darknet marketplace. Active from 2011 to 2013, Silk Road facilitated illegal activities, including drug sales, with Bitcoin used as a discreet payment method. After a thorough investigation, an unidentified party, called ‘Individual X’ in the case, voluntarily handed over the full 69,370 Bitcoin to the government.

The government has been actively working to sell the seized Bitcoin, citing price volatility as a key reason for the sale. However, the process was delayed due to a lawsuit. Battle Born Investments claimed ownership of the seized BTC.

The company argued that it acquired rights through a bankruptcy estate linked to Raymond Ngan. It described itself as “an innocent owner of all the Defendant Property.” Battle Born also claimed that Ngan was “Individual X.” This unidentified hacker allegedly stole the Bitcoin from Silk Road. The hacker later surrendered the wallet to law enforcement, the firm claimed.

The group had filed a Freedom of Information Act (FOIA) request to reveal the identity of “Individual X.” However, their attempt was unsuccessful. Battle Born’s legal team criticized the DOJ’s actions, accusing the department of using “procedural trickery.” They claimed the DOJ used civil asset forfeiture to avoid public scrutiny. In October, the U.S. Supreme Court rejected Battle Born’s appeal over the ownership of the seized asset, clearing the way for the recent decision.

US SUPREME COURT TURNS DOWN CASE INVOLVING $4.4B IN SILK ROAD BITCOIN

The US Supreme Court just ghosted a case over 69,370 Bitcoin—around $4.4 billion—seized from Silk Road.

Battle Born Investments tried to snag the rights through a bankruptcy hustle, but the courts weren’t… pic.twitter.com/uUzJltjm2f

— Mario Nawfal’s Roundtable (@RoundtableSpace) October 8, 2024

DOJ’s Bitcoin Sale Approval Causes BTC Price Drop

The planned asset sale before Trump’s January 20 inauguration is unsettling crypto investors. Markets are already declining due to the FOMC meeting.

The DOJ’s approval to sell the seized Bitcoin further impacted the market, causing BTC to drop from around $95,000 to $92,800, according to CoinMarketCap. However, it has since slightly recovered to trade at approximately $92,843, reflecting a nearly 2.57% decline over the past 24 hours.

Bukele Sees Bitcoin Sale as an Opportunity for Investors

Reacting to the court’s decision, El Salvador’s President Nayib Bukele suggested it could offer investors a chance to buy Bitcoin at lower prices. This implies that Bukele anticipates a potential Bitcoin price drop during the sale.

Maybe we’ll all get the chance to buy Bitcoin at a discount! https://t.co/d16TnQ9SAl

— Nayib Bukele (@nayibbukele) January 9, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.