Highlights:

- Bitcoin leads Q3 2024, hitting its highest market share since 2021.

- Stablecoins reach record market cap, solidifying their role in the crypto space.

- AI-powered crypto projects recover, while DeFi and Layer-2 face challenges.

The Q3 2024 crypto market had a bit of growth and a fair share of challenges. According to CoinMarketCap, Bitcoin reached its highest level of dominance since 2021. Stablecoins also hit record highs, offering stability to investors. AI projects experienced renewed interest and recovery. Meanwhile, decentralized finance (DeFi) and Layer-2 solutions faced regulatory challenges. Despite these setbacks, experts predict a stronger performance in Q4.

Bitcoin Leads Q3 with Growing Dominance

Bitcoin was the primary player in the market. It accounted for more than 50% of the cryptocurrency market. The achievement highlights that investors have faith in its reliability as an asset. BTC stands out due to its stability, making it a secure, long-term investment option.

The report has revealed that Bitcoin might have deviated from its usual halving pattern. Typically, following a halving event, the price of Bitcoin tends to increase before dropping down. Yet, the present trend suggests that Bitcoin is moving from this trend, signaling a possible change in market dynamics.

Stablecoins Hit Record High in Q3

Stablecoins experienced a continuous increase in Q3 2024, reaching their highest market capitalization. Traders are increasingly relying on stablecoins as they are tied to fiat currencies. Their reliability offers protection against major price volatility. They are primarily used in trading pairs and act as security during market volatility.

Despite heightened regulatory scrutiny, stablecoins are experiencing continued growth. Governments are attempting to regulate the increasing market and demand for stablecoins. Some governments have taken a step further to create digital currencies issued by central banks (CBDCs). However, private stablecoins are still popular due to their utility and liquidity.

Artificial Intelligence Sees Recovery

Q3 experienced a rise in AI projects after a slow start earlier in the year. Investors have become increasingly interested in AI-powered tokens and applications. Many investors are recognizing the role of AI in reshaping industries. AI is becoming more crucial in blockchain analytics.

AI is assisting businesses in automating trading methods and improving the efficiency of decentralized apps (dApps). As a result, AI-driven crypto projects outperformed the overall market in Q3. Innovation in the AI field could change the trajectory of cryptocurrency.

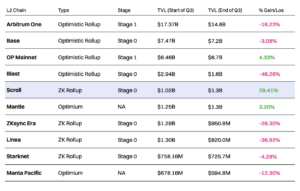

Challenges in DeFi and Layer-2 Solutions

DeFi and Layer-2 solutions have been struggling in the third quarter. DeFi has faced several challenges, including regulatory crackdowns and security vulnerabilities.

Security vulnerabilities and regular hacks have reduced consumer interest in DeFi. Several high-profile hacks have resulted in major losses for investors, making it difficult for DeFi to establish long-term trust. Furthermore, regulatory pressure is mounting as governments try to regulate the sector.

Many Layer-2 projects did not achieve the desired degree of adoption due to technological challenges. Despite their poor short-term results, their long-term potential is expected to be huge.

A Stronger Outlook for Q4

Q4 is expected to have a greater performance for the overall crypto market. Historically, the fourth quarter has been a period of recovery for cryptocurrencies. A bullish market is expected in Q4 due to several reasons such as the growing institutional interest and technological innovations.

Regulatory clarity of most pending cases is set to boost investor confidence. Clearer rules in major markets such as the United States and Europe may help reduce uncertainty among investors. The increased need for innovations such as stablecoins, AI-powered applications, and scalability will contribute to the next phase of growth.