Highlights:

- The Bitcoin Cash price is steady above $565, marking a 2% gain today.

- CoinGlass data shows bullish signals in the market, as the open interest and volume soar, indicating growing optimism.

- The US President’s meeting with the Chinese President on Thursday may see the crypto market recover, as they had an ‘amazing’ meeting.

The Bitcoin Cash price is showing renewed momentum, steadying above $565 mark, marking 2% gains today. The daily trading volume has accompanied the price movement, soaring 22%, indicating growing trading activity. The on-chain data is showing some bullish signals in the market, meaning there is growing optimism among traders.

On Thursday, US President Donald Trump and Chinese President Xi Jinping ended the high-stakes trade summit on a positive note in South Korea. The main decisions that have been announced during the meeting are that China shall resume its exports of rare-earth on a one-year term, buy US soybeans, and negotiate with NVIDIA chips.

Further, the US has lowered tariffs to 47% compared to 57% for fentanyl tariffs. The two largest economies of the world are polishing the edges, and that may balance the financial markets globally and make cryptocurrencies traverse the recovery further.

💥BREAKING:

TRUMP & XI MEETING RESULTS!

1. Reduced Fentanyl Tariffs to 10%.

2. Overall tariffs on China reduced from 57% to 47%.

3. China to "discuss" chip restrictions with Nvidia.

4. "No more obstacles on rare earths"

5. China and US to collaborate on Ukraine. pic.twitter.com/HVCQZhp9hx

— Crypto Rover (@cryptorover) October 30, 2025

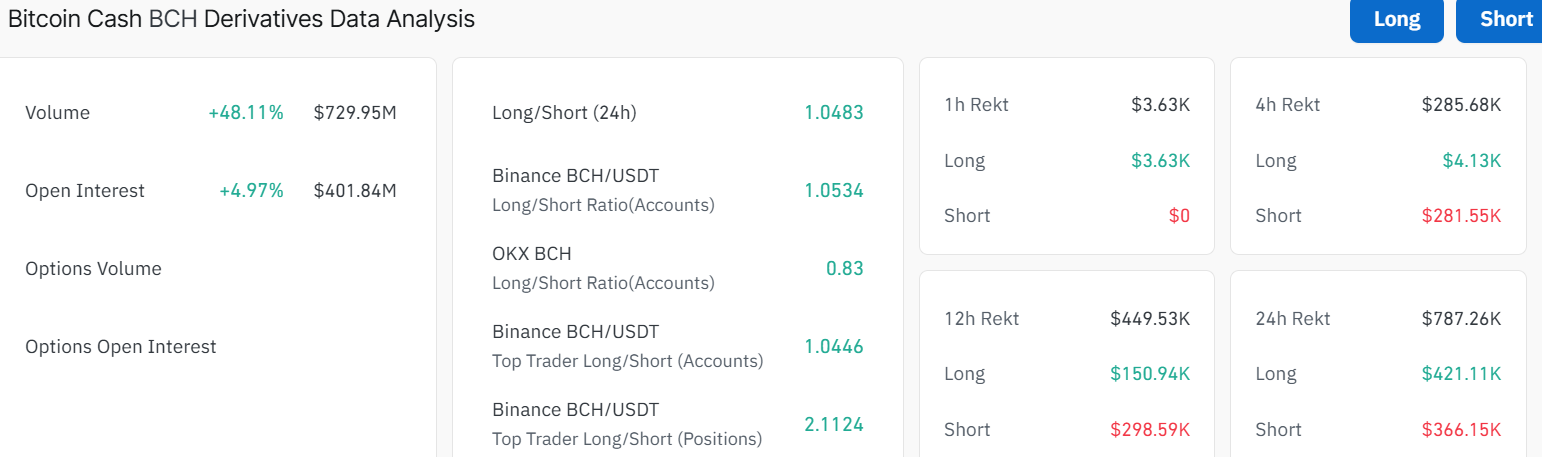

The future market of Bitcoin Cash price (BCH) has been on a steep upward trend, and the volume has increased by 48.11% to reach $729.95 million. Such development means a normal increase in market activity, with traders becoming more active on the price dynamics of BCH. There is also an impressive growth of the open interest by 4.97% to 401.84 million. This rise in open interest implies that a greater number of traders are holding positions, which, in addition to this, increases liquidity in the market.

BCH has a long/short ratio of 1.0483, indicating that the bullish grip is building in the Bitcoin Cash market. The ratio above 1 indicates that many traders are betting on the price to rally soon.

Bitcoin Cash Price Poised for a Breakout Amid Bullish Signals

The BCH/USD may be ready for a comeback after struggling to recover. Recent price movements and chart patterns suggest that the Bitcoin Cash price could be preparing for a breakout. The daily chart shows that BCH has been stuck in a downward trend inside a bearish channel. During this period, the price kept falling, but eventually, it flipped above both the 50-day ($554) and $200-day ($496), turning them into support zones.

This support zone has helped prevent further drops and created a possible launchpad for the next upward move. This shape on the chart often appears when buyers are gradually stepping in, building momentum for a bigger price move.

The Relative Strength Index (RSI), which measures price momentum, is currently at 60.05. This means buying interest is increasing, but the market is not yet overbought, leaving room for further growth. Looking ahead, the Bitcoin Cash price may need to stay above the support zones to confirm a true bullish reversal. However, if the price falls below current levels, it could revisit the major support zone at $554, delaying any hopes of a rally.

Meanwhile, with President Trump having an ‘’amazing’’ meeting with the Chinese president, the market may begin seeing a recovery. In such a case, the Bitcoin Cash price may rally towards $640 in the coming days, if the momentum holds.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.