Highlights:

- Bitcoin and Ethereum whales show strength in market downtrends with massive token accumulations.

- The market is gradually recovering, which makes whale investors the biggest winners of the market slumps.

- Bitcoin and Ethereum displayed gradual recoveries, with increments in their 24-hour-to-date variables.

While most retailers were selling off their crypto holdings because of the generalized market slumps, whales showed resilience, evidenced by their market activities. Bitcoin (BTC) and Ethereum whale investors have amassed sumptuous token holdings during the declines, underscoring faith in crypto projects.

Bitcoin Whales Token Accumulations

In a new X post, IntoTheBlock has revealed that Bitcoin whales accumulated massively during the market downtrends. Disclosing the findings to its 58.9K followers, the analytical platform remarked, “Wallets holding between 1,000 and 10,000 BTC demonstrated confidence during the recent dip, consistently increasing their holdings as prices fell.”

As whales procured BTC, wallets holding less than 1 BTC had other plans. They panicked and eventually sold off most of their BTC stores, culminating in a substantial drop in Bitcoin holdings among retailers. Per IntoTheBlock, the sudden decline in BTC stores was more pronounced in yesterday’s blood bath, which saw BTC touch below $50,000.

Wallets holding between 1,000 and 10,000 BTC demonstrated confidence during the recent dip, consistently increasing their holdings as prices fell.

On the other hand, wallets with less than 1 BTC showed weak hands, with the most substantial decrease in holdings during yesterday's… pic.twitter.com/ib2bNv1YQJ

— IntoTheBlock (@intotheblock) August 6, 2024

Ethereum Whales Amassing ETH at Token’s Low

Aside from Bitcoin whales, Ethereum large spenders also amassed significant ETH stores in yesterday’s market slumps. According to Lookonchain, an entity with the pseudonym “7 Siblings” amassed sumptuous Ethereum holdings during the downtrend. Despite boasting about $1.57 billion in cryptocurrencies, the Ethereum whale procured 56,093 ETH in a buying spree that lasted approximately 12 hours.

The investor spent approximately $129 million to amass the above tokens, and he started accumulating when ETH plunged to $2,600. Interestingly, the Ethereum whale did not stop buying until ETH dropped to about $2,191. Based on the investor’s accumulation pattern, he spent an average of about $2,305 per token.

While you guys were panic selling due to the market crash, the entity"7 Siblings" with $1.57B assets quietly bought 56,093 $ETH($129M) at the bottom!

7 Siblings started buying when the price dropped to $2,600 and continued until the price dropped to $2,191, a total of 12 hours… pic.twitter.com/t5fsVu28gH

— Lookonchain (@lookonchain) August 6, 2024

Whales are Biggest Winners as Market Recovers Gradually

While yesterday birthed a spontaneous blood bath, the market seems to have recovered lately, with green charts across several variables. At the time of press, the global crypto market is up by about 4.3%, with about $2.089 trillion in market capitalization. Notedly, the global market year-to-date price change has appreciated from around 65% to over 70%, underscoring a marked improvement.

Despite the slight improvement, Bitcoin dominance remained unchanged at 56.92% and touched a day low of about 56.77%. BTC’s relatively stable dominance amid market recovery stemmed from altcoins’ underperformance. The poor performance implies that they still boast massive growth potential. On its part, Bitcoin will likely reach its peak soon, eventually paving the way for the altcoins boom.

Bitcoin Records Upswing in its 24-Hour Price Change

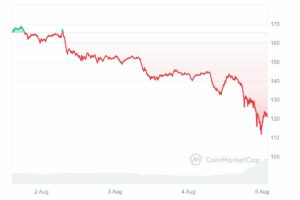

Bitcoin has staged a remarkable correction from yesterday’s downtrends. It is up by about 4% in the past 24 hours and selling for about $56,700. In the past week, Bitcoin fluctuated between minimum and maximum prices of about $52,633.00 and $56,957.25, respectively. Considering BTC’s current price, the 7-day-to-date price changes underscored a marked improvement, with BTC nearing a weekly peak price.

Ethereum Records Lesser Increment

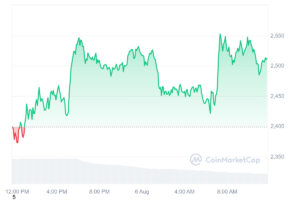

Like Bitcoin, ETH is also staging a gradual recovery. However, its increment has remained low relative to Bitcoin. The Ether-based token is changing hands at about $2,500, reflecting a 2 5% upswing from the previous day. Ethereum’s 24-hour-to-date and 7-day-to-date variables reflected minimum and maximum prices ranging between $2,367.59 – $2,547.45 and $2,197.15 – $3,338.82, respectively. Unlike Bitcoin, the 7-day price extremes signify that ETH is far from its weekly peak price.

Read More

- Next Cryptocurrency to Explode in August 2024

- Toncoin Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Pendle Price Prediction: PENDLE Poised for Potential Rally to $3 or Higher

- Canadian Crypto Platforms Face Regulatory Deadline