There are growing signs that Bitcoin may soon be able to sustain its level above $70,000, driven by technical market data and predictions. U.S. Bitcoin ETFs continue to see strong inflows, collectively drawing over $2 billion last week.

Following a relatively quiet stretch since May, demand for Bitcoin is on the rise once again. As this trend unfolds, Bitcoin’s price movement could impact the broader market, potentially boosting altcoins. Investors are now focusing on top cryptocurrencies, highlighting opportunities as attention shifts to promising altcoins for investment.

Top Cryptocurrencies to Invest in Now

1. Bitcoin (BTC)

Bitcoin hit a three-month high of $69,733 on October 21, rising 0.85 percent. This marks its highest level since July, with the world’s largest cryptocurrency up 18 percent since October 10. The increase coincides with the approaching U.S. Presidential elections and is influenced by Donald Trump’s proposed tariff and tax policies.

Bitcoin also surged today due to a spike in inflows into its spot ETFs. Data revealed that U.S. spot Bitcoin ETFs experienced approximately $2.4 billion in net inflows in the six days leading up to October 18. This increase is partly driven by expectations that U.S. crypto regulations will become more favorable after the presidential election on November 5.

The SEC has approved Bitcoin ETF options for trading on the NYSE, providing more regulated access to Bitcoin, particularly for institutional investors. This decision allows cross-margining with assets like GLD and SPY, enhancing capital efficiency. The increased liquidity from ETF options may drive Bitcoin’s value higher, with analysts forecasting a potential rise beyond its current all-time high.

They approved same thing for Nasdaq recently so not a big surprise but still good news as SEC was big hurdle. We hearing good things about the rest of process altho exact timeline for listing date still unclear. https://t.co/N9squVSXfS

— Eric Balchunas (@EricBalchunas) October 18, 2024

2. Solana (SOL)

The creasing anticipation of a Trump victory has reignited excitement within the Solana (SOL), which has kicked off October on a strong note, maintaining a position above $135 despite a calm crypto market.

Historically, October has been favorable for Solana, with an average return of 14% over the past few years, suggesting further growth may be on the horizon. At the time of writing, SOL was trading at $169, reflecting a 6.04% increase in the past 24 hours.

Additionally, active users on the Solana network have increased by 15%, indicating a rising interest in the platform. Moreover, the excitement surrounding meme coins on Solana could boost activity and position it for a strong 2024.

If current trends persist, analysts project that SOL could experience a 15% price increase, potentially reaching $200. However, external factors such as geopolitical tensions and U.S. regulatory changes may affect its performance. Overall, Solana’s outlook remains promising as it continues to demonstrate strength.

Solana Could Surge 400% Under Trump Presidency, Standard Chartered Predicts https://t.co/6qpSm1SHGO

— Bitcoin.com News (@BTCTN) October 11, 2024

3. Ethereum (ETH)

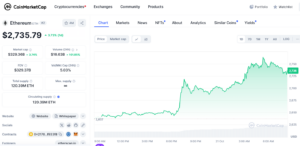

Ethereum, the second-largest cryptocurrency in the industry, has fallen behind Bitcoin in recent weeks. While Bitcoin has surged, ETH remains confined within a $2,200-$2,800 range, a trend that has persisted since August. However, technical indicators indicate that a breakout for ETH is increasingly probable.

If ETH can break into the $2,800 range, a surge back to yearly highs near the $4,000 mark could follow. As of this writing, ETH was trading at $2,735, reflecting a 3.73% increase over the last 24 hours. Traders seeking potentially undervalued coins should consider ETH, as it may be on the brink of a significant movement. This positions Ethereum as one of the top cryptocurrencies to buy right now.

Currently, just over $50 billion worth of Ether is locked in accumulation wallets, representing an increase of nearly 65% since the start of 2024, according to a crypto analyst. “By October 18, 2024, the total amount of Ethereum in accumulation addresses exceeded 19 million,” wrote CryptoQuant contributor Burakkesmeci in an analyst note on October 20.

Burakkesmeci stated that the total amount of ETH in these wallets is expected to “exceed 20 million” by the end of 2024. His reasoning is largely based on the anticipation surrounding the launch of spot Ether ETFs in July.

Ethereum $ETH held in accumulation wallets jumps 65% in 2024 pic.twitter.com/gJdEEaQ6D0

— Altcoin Daily (@AltcoinDailyio) October 20, 2024