Highlights:

- AAVE is trading at $170, and bulls aim to break the $174 resistance level.

- The funding percentage has also reversed, indicating that more traders are betting on AAVE’s price to soar.

- One crypto analyst believes seller liquidity has dried up and that AAVE will be forced into the $190-$205 supply range.

Aave (AAVE) is trading at approximately $170, with bulls targeting a break above $174 in the near future. Any upside disruption that exceeds this resistance will trigger a temporary spurt toward the buyer side of the market. Meanwhile, trading volume has increased by 7% to 331 million, indicating market growth. Note that the derivatives indicators indicate a positive market sentiment, supporting a bullish breakout in AAVE.

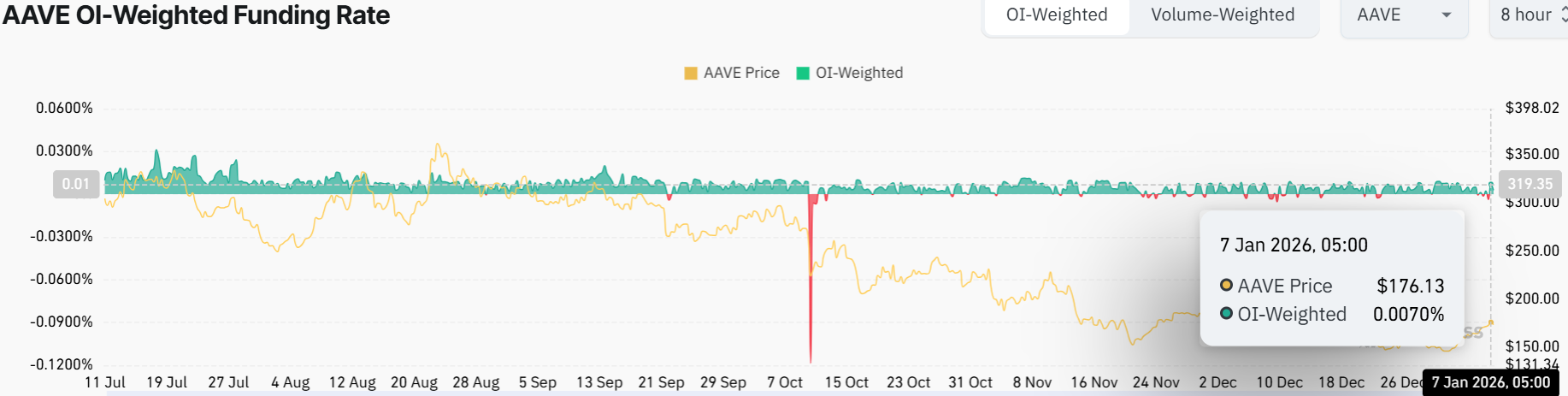

On the derivatives side, AAVE’s funding rate data indicate bullish sentiment. CoinGlass data on the OI-Weighted Funding Rate show that fewer traders have placed bets on the Aave price to drop.

On Wednesday, the metric reversed and turned positive by 0.0070%, indicating that longs are supporting shorts. The Aave price usually surges when fund rates turn positive. On the other hand, several cryptocurrency analysts are recording a bullish breakout. The sell-side’s liquidity has been depleted, according to Bullish Banter, which may bring Aave’s price into the $190-$205 supply range.

Sellside liquidity has been taken ✅

Market just printed a clean MSS and reacted from a bullish FVG

If price continues to respect this zone, a move back toward the $190–$205 supply area is very much on the table pic.twitter.com/ljHPIw3dzk

— BullishBanter (@bullishbanter01) January 7, 2026

AAVE Targets $174 Breakout as Bullish Momentum Builds

Since early October 2025, Aave has been in a gradual decline, currently trading at approximately $170. The bulls, however, formed a strong support level at around $145, which halted the downward movement. The token is currently in a short-term bearish move, supported by the 50-day SMA, which is above the price at $174.

The RSI stands at 52.44 (marginally above the neutral level), indicating a push-pull between bulls and bears. Nonetheless, it still has growth potential with the token remaining above the 50-level. Note that a bullish MACD crossover will further amplify bullish sentiment. This is evident when the MACD crosses above the orange signal line, indicating a bullish move. Traders may run behind the token, as AAVE targets $174 breakout.

In the near term, Aave’s price still remains bearish. The positive momentum indicators, however, suggest a potential relief rally. If the bulls gain momentum and break out above the falling channel, they could ignite a short-term rally in the market. The major resistance areas to watch are $174-$229, and the immediate support zones are $162-$145.

The traders are recommended to be careful because AAVE is currently within a bearish consolidation zone, and there is a potential for false breakouts. Before entering the market, traders are advised to closely monitor the RSI trend to determine whether the market is tired of the trend.

Taking a long-term outlook, AAVE is targeting a breakout above $174, which could push the token to the nearest resistance at $229. Thus, failure to hold above the $174 zone would in turn result in further downside to $162.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.