Highlights:

- The World Liberty Financial price has increased by 22% to trade at $0.12 mark today.

- The derivatives market indicates a spike in open interest, as investor confidence builds.

- The bullish technical picture shows a potential spike towards $0.13.

World Liberty Financial (WLFI) price has increased by 22% in the past 24 hours, to exchange hands around the $0.12 mark today. WLFI is a family-owned crypto company of the US President Donald Trump and is among the top gainers today, boasting a bullish momentum.

The demand is skyrocketing ahead of the World Liberty Forum meeting. This is an event hosted at the exclusive Trump club in the Mar-a-Lago resort in Palm Beach, Florida. The U.S. senators and the world market leaders are set to attend.

World Liberty Financial has announced an invitation-only meeting. The event will take place on Wednesday, Feb 18. It will include the US Senators, Franklin Templeton, world investors, Nasdaq, Goldman Sachs, Donald Trump Jr, Coinbase, FIFA president, and co-founders of WLFI, and Eric Trump.

The stage is set. 🦅🇺🇸

The energy in the room at Mar-a-Lago is absolutely electric. World Liberty Forum 2026 is officially kicking off! pic.twitter.com/s1pG7r9AjA

— WLFI (@worldlibertyfi) February 18, 2026

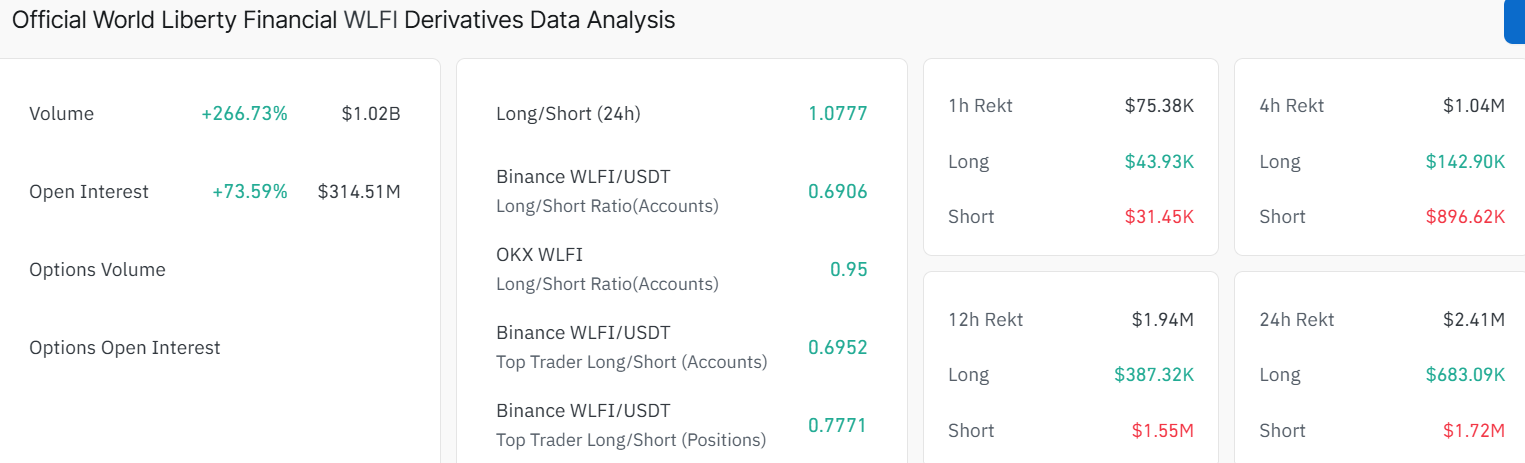

On the other hand, the derivatives market is showing heightened market activity. This is evident as the open interest has increased by 73% to $314 million. The recent rise in OI indicates a sudden growth in investor interest, which may further see the WLFI price increase. Notably, the volume is up by 266%, indicating intense trading activity in the World Liberty Financial market.

World Liberty Financial Price Eyes $0.13 Barrier

The recent price action shows that the World Liberty Financial price has ripped through resistance levels, trading at $0.1238. The 50-day Simple Moving Average (SMA) on the 4-hour chart sits at $0.1053, and the WLFI token price is above it. This suggests strong upward momentum, as bulls are gaining strength.

The recent candlestick action shows a building higher highs, hinting that the bulls are still in control. Looking at the Relative Strength Index at 78.64, sits just above overbought territory (70). This shows that there is an increased buying appetite in the WLFI market. However, with the overbought conditions, early profit-taking may resume, leading to a correction in the market.

Looking at the bigger picture, the chart shows a steady climb, as the bulls show no signs of stopping. The daily trading volume is up by over 200% increase, backing this the recent upward movement. However, with the overbought conditions, a slight pullback may be imminent soon, to allow bulls sweep liquidity. In such a case, a drop towards $0.10 support may come in handy. In the short term, traders might want to hold tight and set a stop-loss to reduce the impact of any sudden dumps.

On the other hand, if the current momentum holds, the WLFI bulls may target the immediate resistance around $0.13, which aligns with the 200-day SMA. A quick move above this zone may open the doors for more bullish momentum towards $0.16-$0.19.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.