Highlights:

- The Zcash price is down by 6% to trade at $361, as its trading volume decreases 24%.

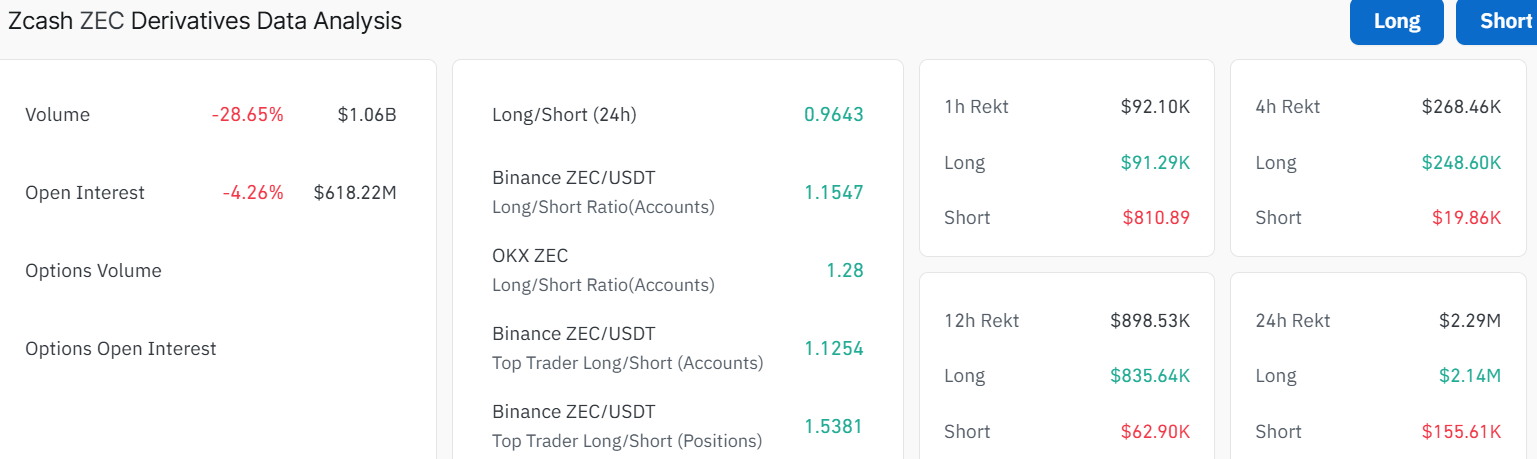

- The derivatives data show mixed signals, weak momentum, as the volume and open interest drop.

- The technical outlook shows mixed sentiment, as ZEC risks a drop to $332 before recovery.

Zcash (ZEC) price has remained in the red, currently exchanging hands at $361, marking a 6% drop today. Its daily trading volume is also down 24% to $425 million. The derivatives data show that traders have mixed feelings, which further restricts the possibility of a price recovery.

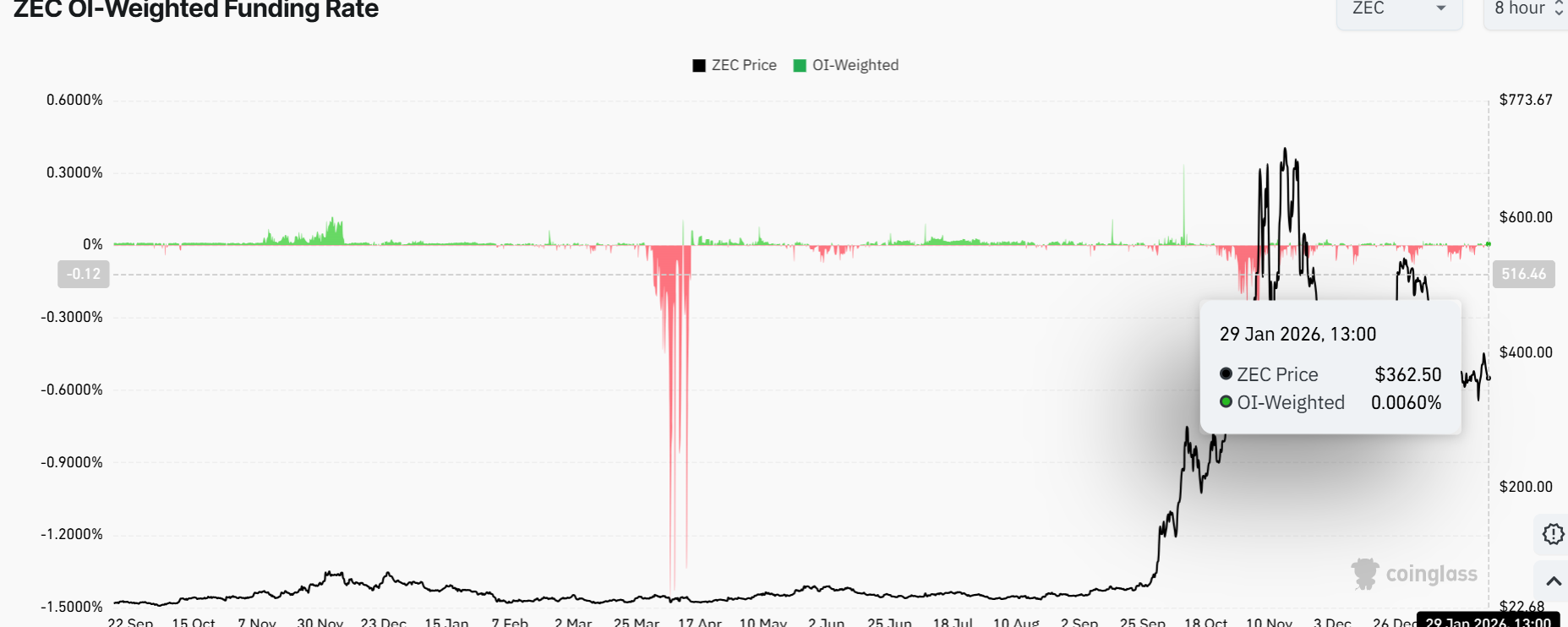

According to CoinGlass data, the funding rate of ZEC inverted its value into a positive value on Wednesday and stands at 0.0060% on Thursday. This means that long positions are paying short and are reflecting an optimistic mood.

On the other hand, the long-to-short ratio has fallen to 0.96, indicating an increase in short bets. This is a deviation, which underscores increased doubt on the derivative market itself and the lack of strength of bullish belief.

The open interest is also down 4% to $618 million, as the volume slips 28% to $1.06 billion. This indicates that money is flowing out of the market, and may see the ZEC price fall further, as the market activity slips.

ZEC Risks a Drop to $332 Amid Mixed Sentiment

ZEC is currently trading at $361, slightly down by 6%, as it trades within a falling parallel channel. The bulls have established a strong support zone around $260, aligning with the 200-day SMA.

The short-term trend appears bearish, as the Zcash price remains below the 50-day simple moving average (SMA). The 50-day SMA is at $428, below the 200-day SMA at $260, forming a subtle bearish crossover signal. This indicates that short-term momentum is weaker than long-term trends, and unless buyers step in aggressively, ZEC may continue to face selling pressure.

The Relative Strength Index (RSI) is at 43.27, below the neutral 50 level, signalling mild bearish momentum, although it is not yet in oversold territory. This implies that there is still room for further downside before any reversal signals may appear in the ZEC market. The MACD shows a slight positive divergence, with the MACD line positioned above the signal line, confirming weakening momentum and the potential of a bounce-back.

Looking ahead, a strong bounce from the current price levels could attract buyers and help stabilize the price. A decisive break towards $400 may open the way toward the immediate resistance zone at the $428 levels, which aligns with the 200-day SMA.

On the other hand, if the $428 resistance proves too strong, further downside could see Zcash price dwindle to $332 immediate support. A break below the level could see further downside towards the $260 major support zone. In the meantime, ZEC remains under pressure while testing a crucial support level. Indicators suggest weak momentum, so traders should exercise caution. Monitoring whether ZEC can hold support or break lower will be key for short-term trading decisions in the market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.