Highlights:

- Solana is trading at $127, down 11% over the past week.

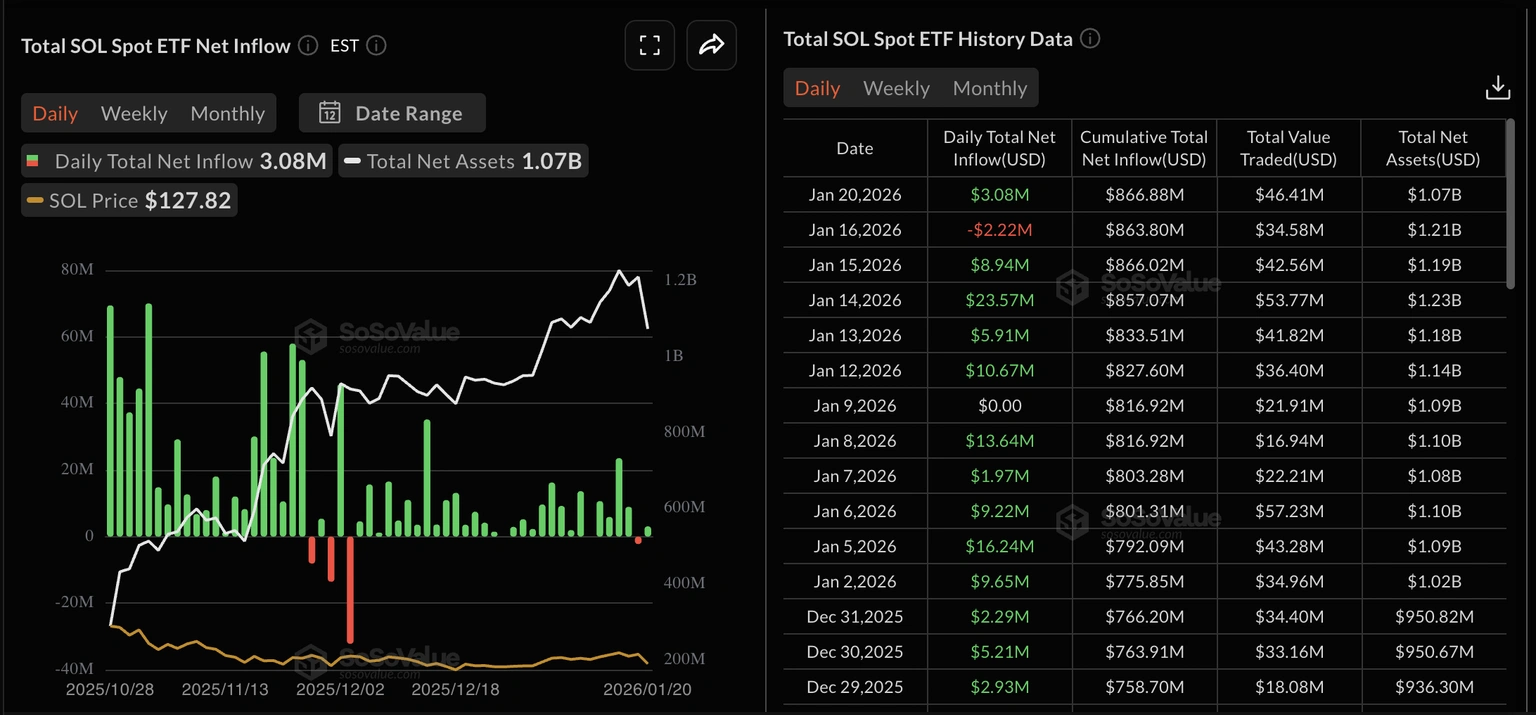

- The US Spot SOL ETF recorded net inflows of over $3 million on Tuesday, suggesting steady institutional interest.

- The technical outlook suggests a bearish grip as SOL risks further downside to $120.

Solana (SOL) price is exchanging hands around $127, marking an 11% drop over the past week. However, the daily trading volume has soared 16% to $4.66 billion, indicating growing market activity. The steady interest in Solana is reinforced by institutional inflows on Tuesday, while retail sentiment is deteriorating, as evidenced by decreased Open Interest and massive long liquidations. The technical outlook suggests accelerated selling pressure, and SOL risks further downside towards $120.

The US spot SOL Exchange Traded Funds (ETFs) on Tuesday saw inflows of $3.80 million, rebounding from the $2.22 million in outflows on Friday. Such a flow indicates institutional confidence in Solana despite the weakening of crypto and global financial markets.

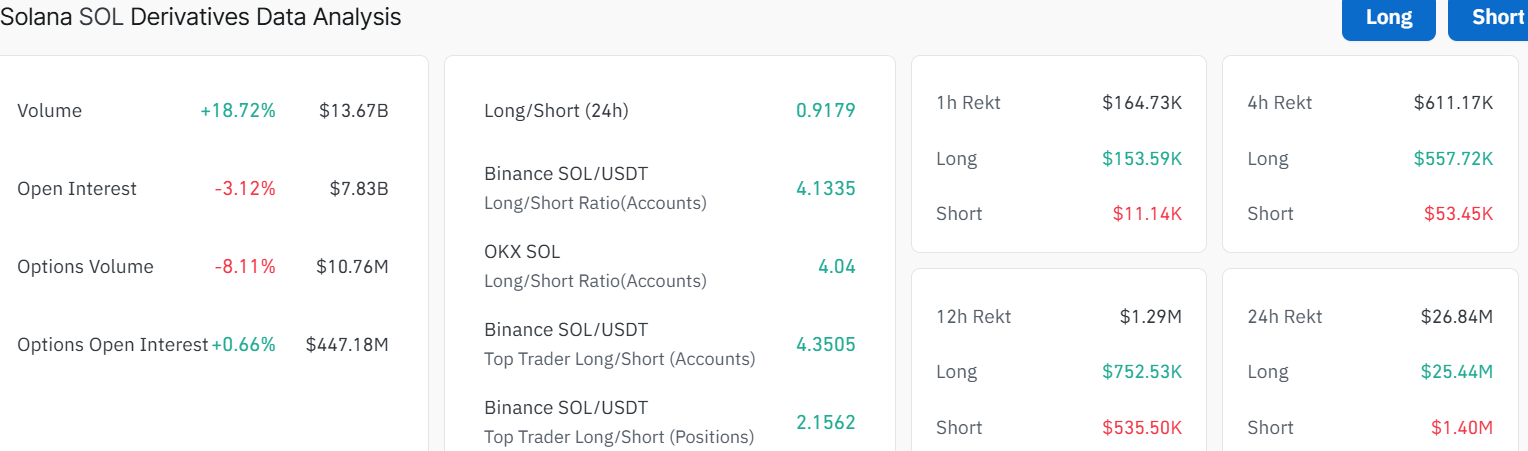

In the meantime, Solana Open Interest (OI) has decreased by 3.12% over the past 24 hours to $7.83 billion. This indicates a significant decline in the number of outstanding futures contracts, including leveraged positions. In accordance with diminished capital, long liquidations of $25.44 million in the same period surpassed short liquidations of $1.40 million, destroying widely bull-sided positions.

In the short term, institutional interest may keep Solana surging. However, a sustained decline in market sentiment would keep the risk of a severe correction.

SOL Risks Further Downside Towards $120

The Solana price chart shows the coin struggling to recover from a quick drop below key support zones. It is trading just around $127, with the 50-day Simple Moving Average (SMA) at $132 acting as overhead resistance, and the 200-day SMA at $172 now possibly a ceiling if the price tries to bounce.

Short-term support is near $120, but a stronger area sits around $116, where buyers last stepped in. The chart shows a major resistance band between $132 and $146. If the price climbs above the 50-day simple moving average, there is a chance of a move back towards $145 or even the $172 region, a key psychological level for traders.

Right now, technical indicators are bearish. The Relative Strength Index (RSI) reads 40.85, which is low and suggests the market is about to be oversold. This means a short-term rebound could happen if buyers return. However, sellers remain in control, and the MACD indicator is flat and negative, suggesting little momentum for an upward push.

Looking at the bigger picture, if SOL drops below current levels, a test of the $120 region is likely. Below $120, the next supports are much lower, near $116. Meanwhile, a popular crypto analyst, Ali Martinez, has reinforced his outlook, saying, ‘’SOL is approaching a key inflection point at $120.’’

Solana $SOL is approaching a key inflection point at $120. pic.twitter.com/Mkwh9GJ5dO

— Ali Charts (@alicharts) January 21, 2026

On the upside, clearing resistance at $132 and $145 could drive the coin’s price higher, especially if the momentum indicators flip positive and more institutions join the move. For now, the Solana price faces short-term headwinds, which may push it lower to the $120 support zone.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.