Highlights:

- Solana price has dropped 6% to $133 amid the Europe-US trade war.

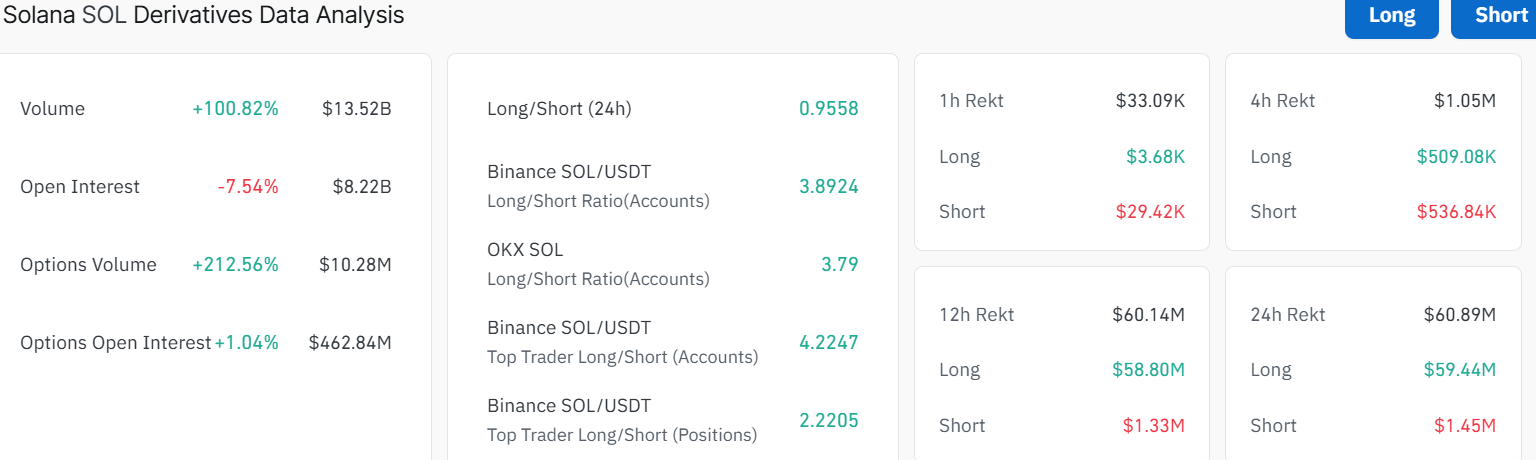

- The SOL derivatives data show weakening sentiment, with open interest slipping 7%.

- The technical outlook shows a potential downside to $126 if the support zone gives way.

The crypto market is in the red today, with Solana (SOL) down 6% to $133. The bearish grip in the market follows the ongoing US-Europe trade war. The data from derivatives markets suggests a downside bias, which aligns with the overall market pullback and anticipates a further decline in SOL.

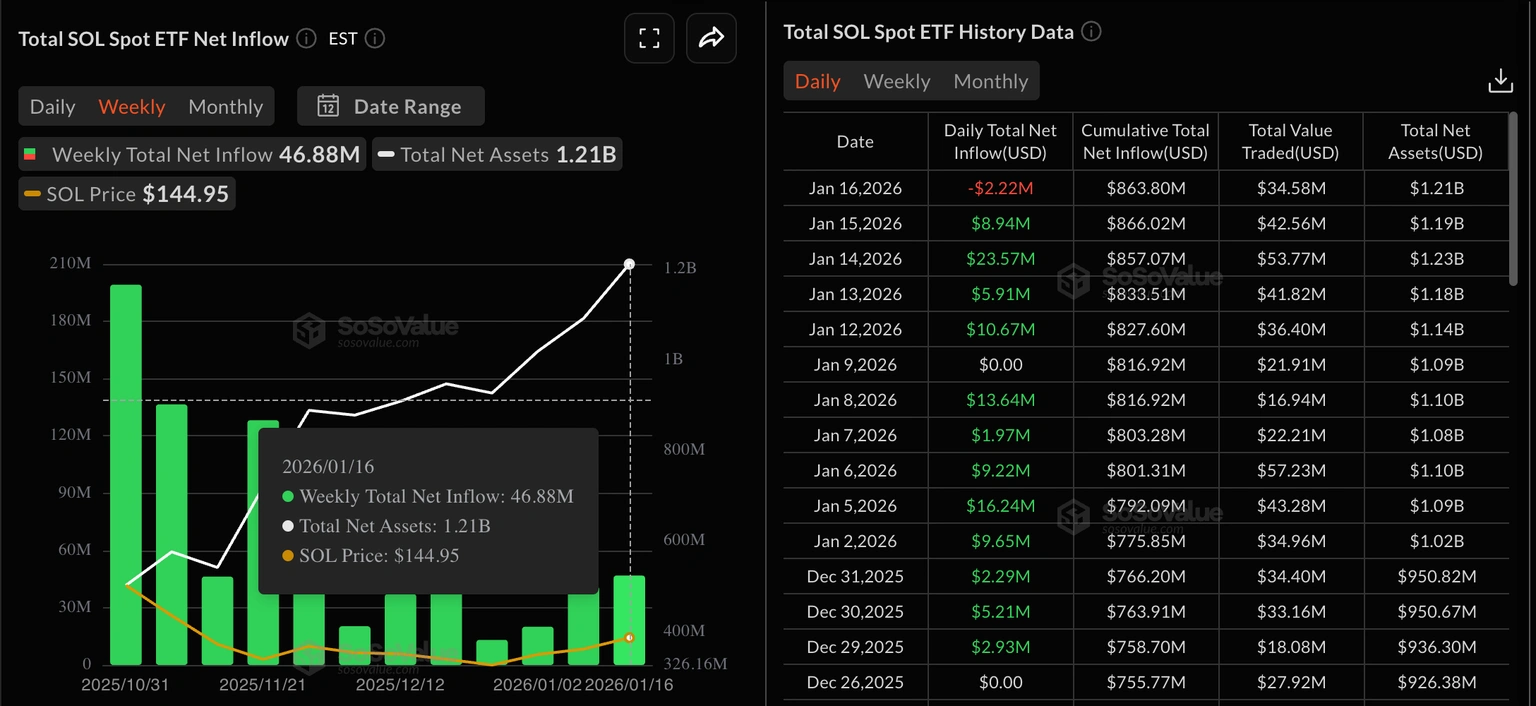

Meanwhile, the US spot SOL Exchange Traded funds (ETFs) have been receiving inflows of $46.88 million last week. The market dynamics may, however, adversely affect institutional confidence, as there is a threat of further sell-off pressure.

Solana derivatives have seen liquidations of $59.44 million over the past 24 hours, far exceeding short liquidations of $1.45 million, indicating a sell-side bias. The SOL futures Open Interest (OI) has also decreased by about 7% during the same period, to $8.22 billion, in line with the long liquidations. Such capital depletion at exposure in SOL derivatives indicates a lower risk appetite among traders.

SOL Price Holds Support at $132 Amid Bearish Market Sentiment

Solana is trading at $133, slightly above immediate support, after a sudden bearish move. On the daily timeframe, SOL remains within a consolidation channel, which may signal an accumulation phase. However, the recent outlook suggests a potential bullish reversal attempt if the $132 support zone holds. The SOL trading pair topped out near the $144 resistance zone, where strong selling pressure emerged. That rejection marked the start of a steady downtrend characterized by lower lows.

Currently, Solana is bouncing from the lower channel support, which also aligns with a key horizontal support level around $132. This confluence strengthens the area as an important demand zone. Historically, similar reactions from such confluence zones have led to short- to medium-term relief rallies.

Meanwhile, the SOL price is holding just above a critical support area, which often serves as a last line of defence for bulls during corrective phases. A sustained hold above this zone$132 increases the probability of a reversal rather than a continuation breakdown.

The RSI is currently around 46.95, which is below the neutral 50 level but above deep oversold conditions. This indicates bearish momentum is weakening rather than accelerating. However, the MACD has plunged below the signal line, indicating mounting selling pressure. This outlook warns traders of a potential downside if the bulls do not step into the market.

A bullish confirmation would require SOL to break and close above the channel’s upper boundary at $145. A successful breakout could open the door for a move toward $165-$172, where the long-term resistance sits. On the downside, failure for SOL to hold support at $132 would invalidate the bullish reversal setup and expose Solana’s price to deeper losses. In such a case, a drop toward $126 and potentially a $118 safety net may be imminent in the market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.