Highlights:

- Bitcoin ETFs record their first loss of the week after forfeiting $394.68 million on January 16.

- Ethereum ETFs maintained their winning streak and ended the week with $479.04 million in net inflows.

- Solana and DOGE ETFs had neither inflows nor outflows, while XRP funds attracted $1.12 million.

After recording straight net inflows since the week began, Bitcoin (BTC) exchange-traded funds (ETFs) experienced net outflows on the last day of the week. SosoValue’s most recent statistics showed that the funds lost $394.68 million on January 16.

Despite yesterday’s outflows, Bitcoin ETFs ended the week with net inflows of approximately $1.42 billion. On the other hand, Ethereum ETFs recorded another net inflow to extend their winning streak to five consecutive days, with no net outflow during the week. Ethereum funds attracted $479.04 million in weekly net inflows.

Spot Solana (SOL) ETFs recorded net outflows worth $2.22 million, while XRP ETFs and Canary Litecoin ETF (LTCC) attracted $1.12 million and $2 million, respectively. Other cryptocurrency funds, including Dogecoin (DOGE) ETFs and Chainlink ETFs (LINK), recorded neither inflows nor outflows.

On January 16 (ET), U.S. spot Bitcoin ETFs recorded total net outflows of $395 million, with only BlackRock‘s IBIT posting net inflows. Spot Ethereum ETFs saw total net inflows of $4.64 million, marking five consecutive days of inflows. XRP spot ETFs recorded net inflows of $1.12… pic.twitter.com/u0TdDaLPjz

— Wu Blockchain (@WuBlockchain) January 17, 2026

BlackRock Continues to Dominate Bitcoin and Ethereum ETFs Inflows

Yesterday, five out of twelve Bitcoin ETFs were active. Four saw outflows, while BlackRock Bitcoin ETF (IBIT) had the only inflow, worth $15.09 million. Fidelity Bitcoin ETF (FBTC) had the highest outflow, valued at roughly $205.22 million.

Bitwise Bitcoin ETF (BITB) followed closely at $90.38 million. Ark & 21 Shares Bitcoin ETF (ARKB) and Grayscale Bitcoin ETF (GBTC) also recorded outflows. They lost $69.42 million and $90.38 million, respectively. Other ETFs, including Grayscale Mini Bitcoin ETF (BTC), VanEck Bitcoin ETF (HODL), and Invesco Bitcoin ETF (HODL), had neither inflows nor outflows.

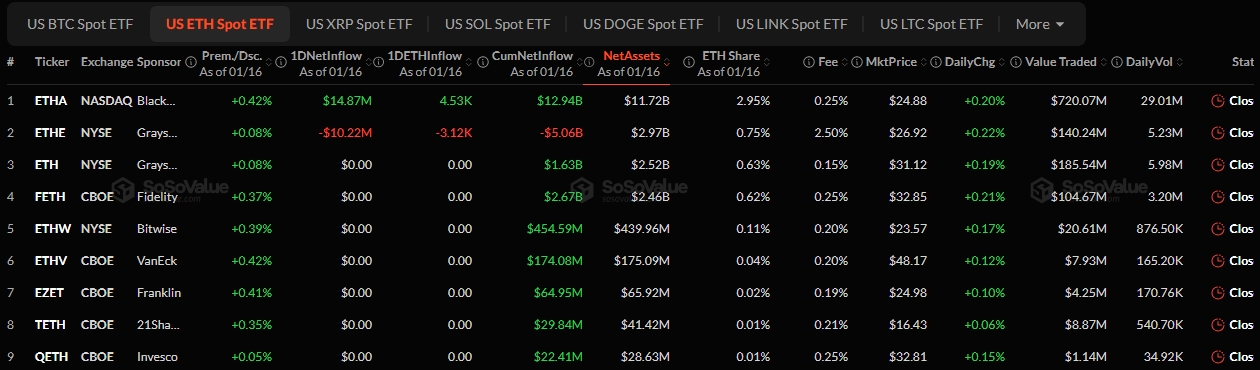

Like Bitcoin, BlackRock Ethereum ETF (ETHA) saw the only net inflows among the nine Ethereum funds. However, only two funds were active yesterday, as Grayscale Ethereum ETF (ETHE) recorded the only outflow, worth $10.22 million. Every other Ethereum fund, including Grayscale Mini Ethereum ETF (ETH), Fidelity Ethereum ETF (FETH), Bitwise Ethereum ETF (ETHW), and VanEck Ethereum ETF (ETHV), had zero flows.

Overall, Bitcoin ETFs’ cumulative net inflow has reached $57.82 billion, the total value traded is worth $3.06 billion, with a net assets valuation of approximately $124.56 billion. Ethereum ETFs’ cumulative net inflow is $12.91 billion with a net assets valuation of $20.42 billion, and a total traded valuation of $1.19 billion.

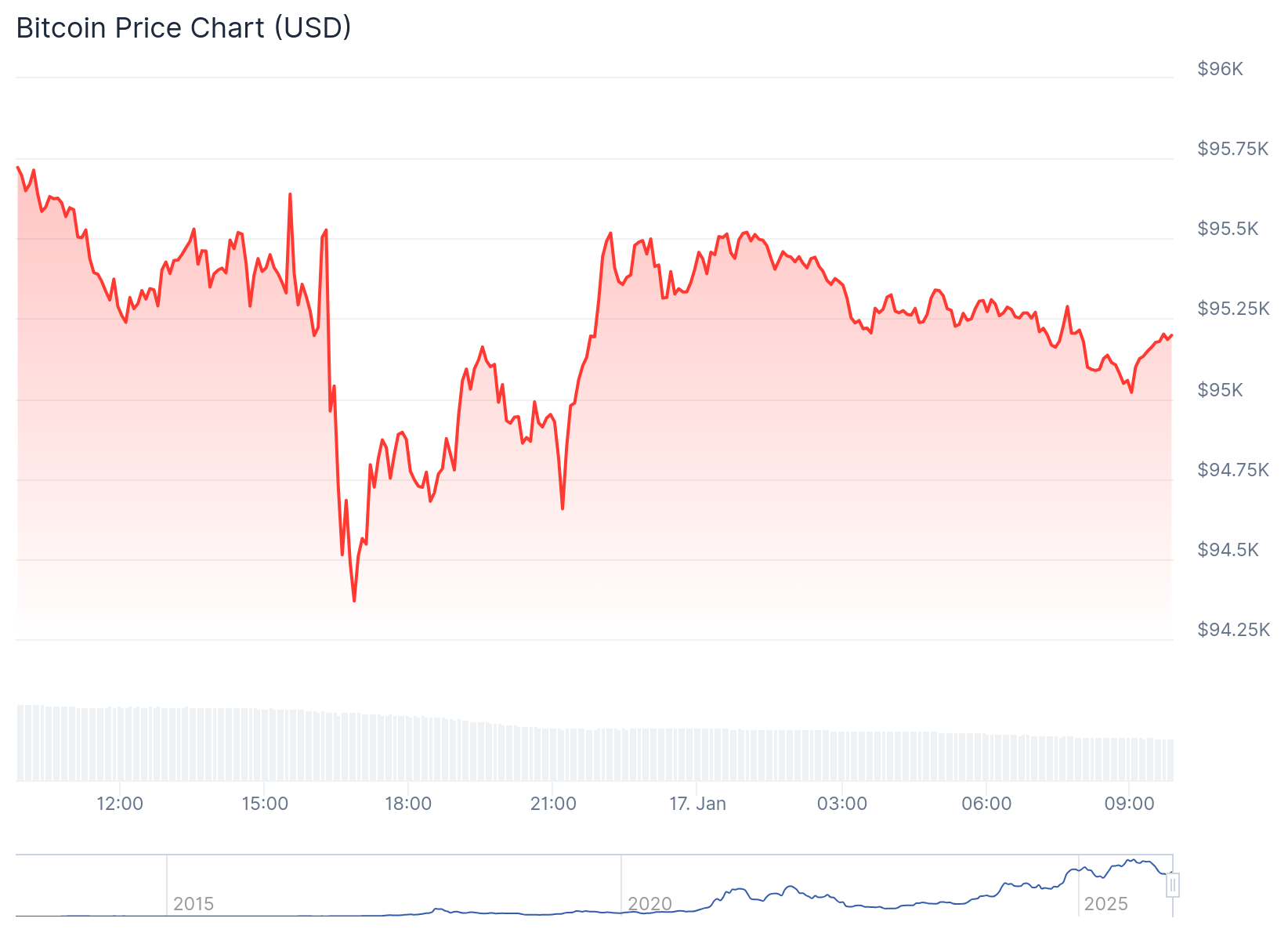

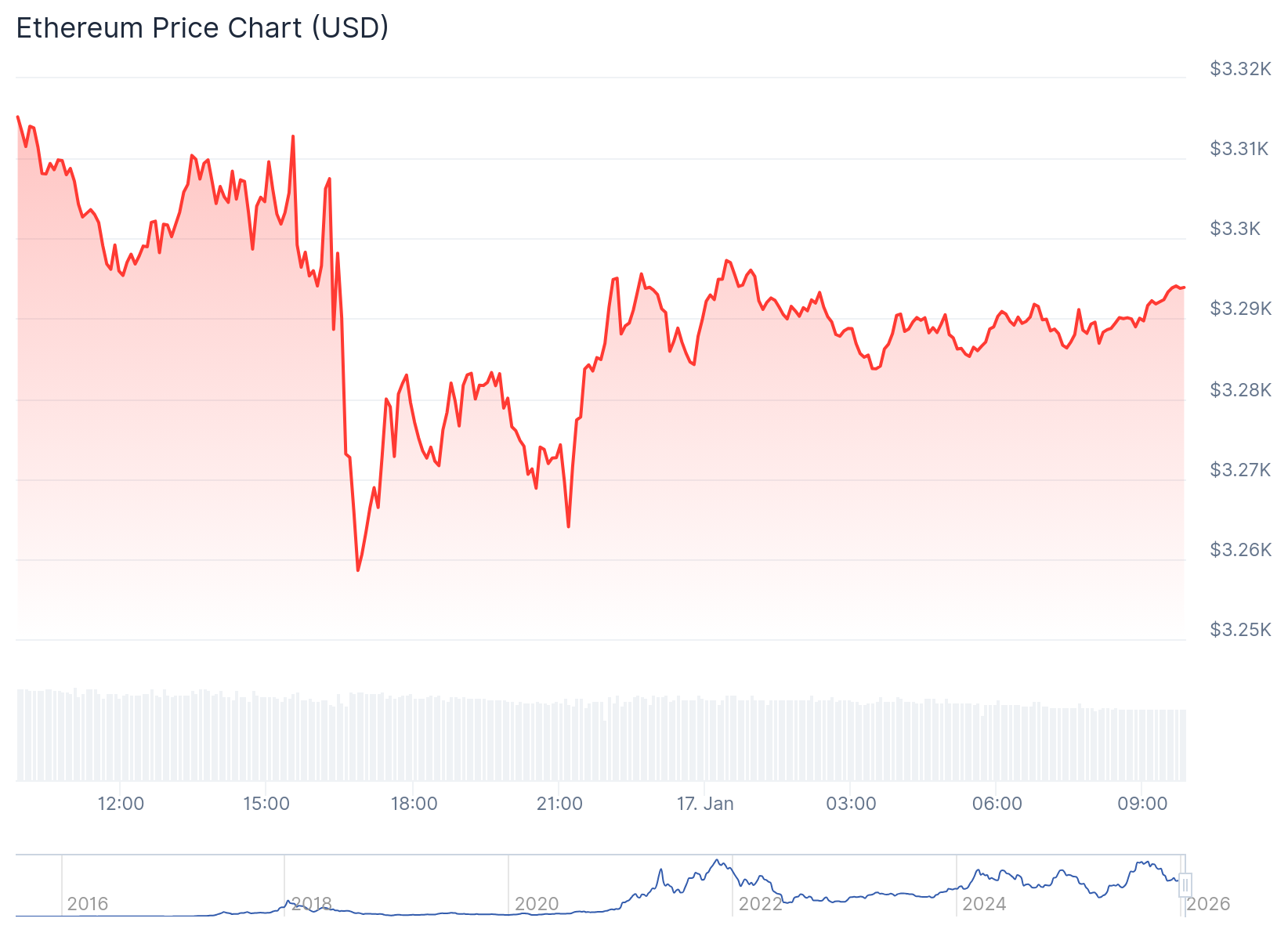

BTC and ETH Prices Exceed Key Levels as Bitcoin ETFs Lose Millions

At the time of writing, the cryptocurrency market is 0.4% down in the past 24 hours with a market cap of $3.11 trillion and a trading volume of $93.291 billion. Bitcoin dominance sits at 57.4%, while Ethereum contributes 12%. Like the broader market, BTC dropped 0.5% in the last 24 hours and is changing hands at $95,086. It has a trading volume of $30.84 billion and a market cap of $1.9 trillion.

Ethereum is also down 0.6% in the past 24 hours, trading at $3,289, with a market cap of $397.02 billion and a trading volume of $20.47 billion. ETH’s supply inflation is low at 0.17% with a medium volatility at 4.17%. Sentiment remains neutral, including the asset’s “Fear $ Greed index.” Coincodex’s risk assessment showed that Ethereum is trading near its cycle high, with 17 profitable days in the past month.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.